Accounting 201 First Exam Study Guide Fall 2021 Topics Course Hero

Accounting 201 First Exam Study Guide Fall 2021 Topics Course Hero It emphasizes understanding transactions and recording methods. accounting 201: first exam study guide, fall 2021 prof. schiff [email protected] here are the topics that we have covered so far this semester and which you should review to prepare for the first exam. there will be about 50 60 multiple choice and true false questions, which. Acct201 firstexamstudyguide f21.docx. accounting 201: first exam study guide, fall 2021 prof. schiff [email protected] here are the topics that we have covered so far this semester and which you should review to prepare for the first exam. there will be about 50 60 multiple choice and tr.

Accounting 201 Exam 1 Pdf Practice Exam 1 Accounting 201 U2022 Accounting 201: first exam study guide, fall 2023 prof. schiff aschiff@towson here are the topics that we have covered so far this semester and which you should review to prepare for the first exam. there will be about 50 60 multiple choice and true false questions,. 2.fair value principle records assets and liabs at fair value. 3.full disclosure disclose all info that may affect a financial statement user's decision. constraints in accounting. 1.materiality companies do not have to follow gaap for a small amounts that would not affect user's decision. General ledger. study with quizlet and memorize flashcards containing terms like accounting equation, all of the financial statements are for a period of time except the: balance sheet income statement retained earnings statement statement of cash flows, expenses that result from operating the business are in stockholder's equity and more. Terms in this set (20) economic entity assumption. a basic assumption of accounting that requires activities of an entity be kept separate from the activities of its owner is referre to as the. cost. the cost principle requires that when assets are acquired, they be recored at. of an entity be kept separate from the activities of its owner.

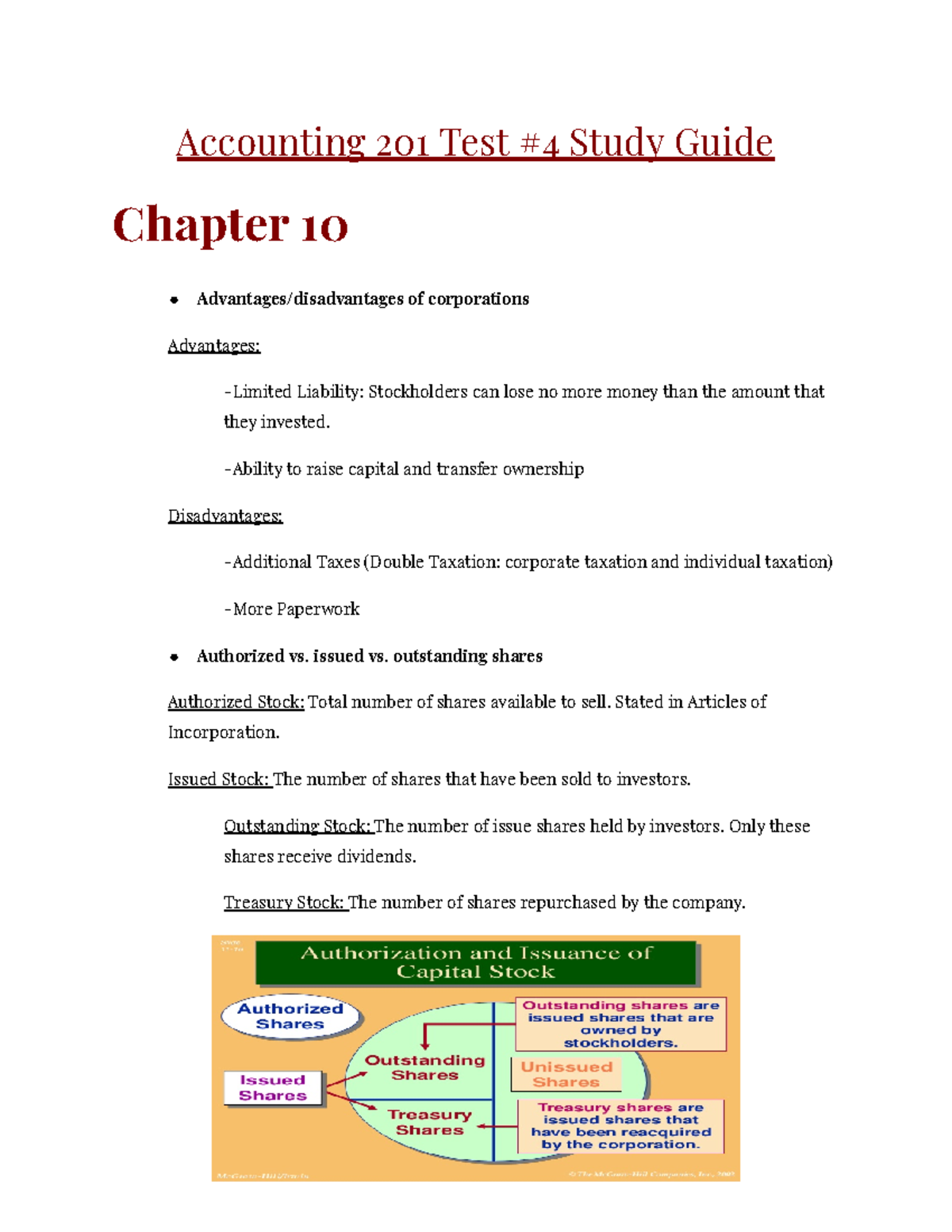

Accounting 201 Final Study Guide Google Docs Accounting 201 Test 4 General ledger. study with quizlet and memorize flashcards containing terms like accounting equation, all of the financial statements are for a period of time except the: balance sheet income statement retained earnings statement statement of cash flows, expenses that result from operating the business are in stockholder's equity and more. Terms in this set (20) economic entity assumption. a basic assumption of accounting that requires activities of an entity be kept separate from the activities of its owner is referre to as the. cost. the cost principle requires that when assets are acquired, they be recored at. of an entity be kept separate from the activities of its owner. Accounting 201 exam 1 fall 2017 study guide. chapter 1 role of accounting in business: o used to measure a company’s operating performance for a specific period o measure their financial position at a specific time users of accounting data o internal users: individuals inside the company managers o external users: individuals not employed by the company investors, creditors, customers, tax. Accounting final exam study guide, expanded chapter 1 accounting is the “language of business” financial accounting provides external users with info to make decisions a = l e ^^^ a (stuff we own) = l (stuff we owe) e (leftovers owner’s claims) financial statements: 1. income statement = revenues – expenses = ni 2.

Accounting Exam 1 Study Guide Docx Accounting Exam 1 Study Guide 1 Accounting 201 exam 1 fall 2017 study guide. chapter 1 role of accounting in business: o used to measure a company’s operating performance for a specific period o measure their financial position at a specific time users of accounting data o internal users: individuals inside the company managers o external users: individuals not employed by the company investors, creditors, customers, tax. Accounting final exam study guide, expanded chapter 1 accounting is the “language of business” financial accounting provides external users with info to make decisions a = l e ^^^ a (stuff we own) = l (stuff we owe) e (leftovers owner’s claims) financial statements: 1. income statement = revenues – expenses = ni 2.

Comments are closed.