A Step By Step Guide To Filing Taxes In The U S For The First Time

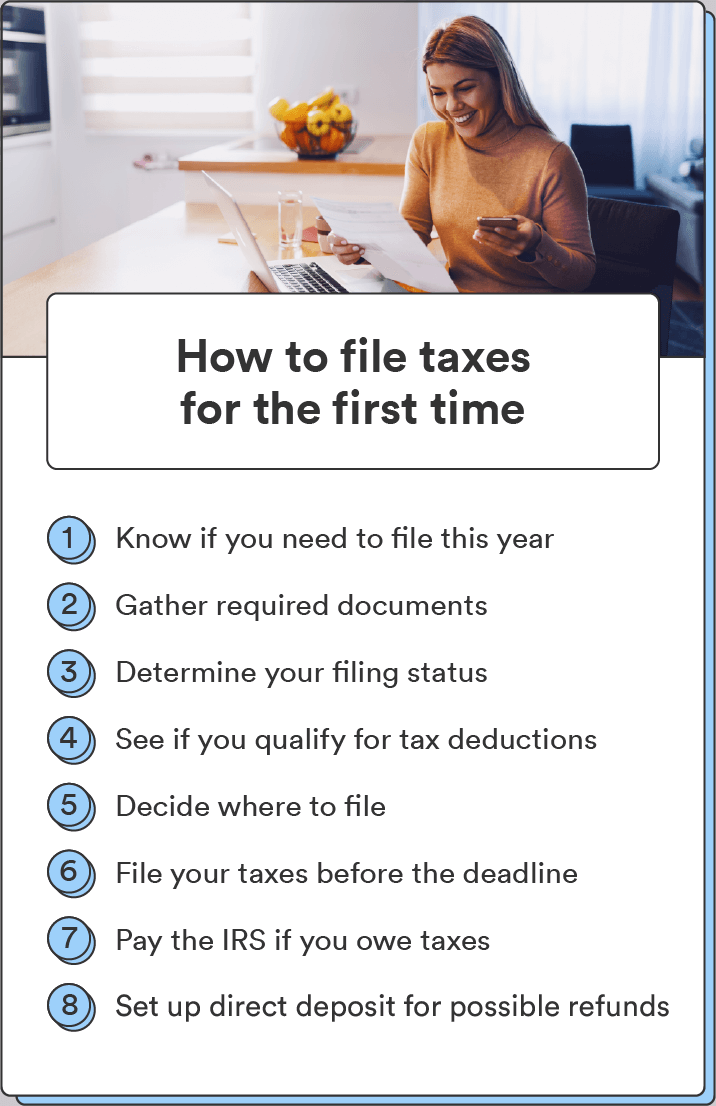

A Step By Step Guide To Filing Taxes In The U S For The First Time Steps to file. use these steps and resources to make filing your form 1040 easier. even if you don't have to file a tax return, you may want to file. you may get money back: if you qualify for a refundable tax credit . if your employer withheld more taxes than you owe. if you owe tax, it's important to file and pay on time to avoid penalties. The filing season is usually in april. you normally have to file a tax return and pay any taxes owed by april following a tax year. in 2024, the deadline for filing a return and paying taxes for the prior year is april 15. don’t miss the tax season. mark the date on your calendar.

How To File Taxes For The First Time Step By Step Chime The value of a deduction is determined by your tax rate because your savings come from not having to pay taxes on the deductible amount. so, if you were in the 22% tax bracket, a $1,000 deduction. Step 5: file your taxes. as you plan to file your taxes, you may want to check which tax brackets you fall into and use that information to estimate how much you’ll owe. the filing deadline for individual federal income taxes is april 15. while most people file online nowadays, you can also file by mail. Let’s go step by step for your first time filing taxes. file with h&r block to get your max refund. file online. file with a tax pro. 1 – know if you’ll need to file. if you can be claimed as a dependent on another taxpayer’s return and you’ve had a job — even a part time one — and earned more than $13,850 in the tax year—you. Turbotax is developed with first time filers in mind. we guide you step by step with simple, plain english questions and apply the appropriate tax laws in the background. we also do the math and fill in all the right tax forms. turbotax will even recommend the best choices for you when it comes to filing status, deductions and credits, and.

How To File Your Taxes In The U S For The First Time Let’s go step by step for your first time filing taxes. file with h&r block to get your max refund. file online. file with a tax pro. 1 – know if you’ll need to file. if you can be claimed as a dependent on another taxpayer’s return and you’ve had a job — even a part time one — and earned more than $13,850 in the tax year—you. Turbotax is developed with first time filers in mind. we guide you step by step with simple, plain english questions and apply the appropriate tax laws in the background. we also do the math and fill in all the right tax forms. turbotax will even recommend the best choices for you when it comes to filing status, deductions and credits, and. To help you cruise through the process, here are some quick tips for how to file taxes on your own for the first time. 1. gather all of your tax documents. if you're expecting a refund, you might be eager to file your tax return as soon as you can. throughout january, february and even march, you can still receive important tax documents in. Try nerdwallet’s free tax calculator. 4. decide how to file your taxes. there are three main ways to file taxes: fill out irs form 1040 by hand and mail it (not recommended), file taxes online.

Comments are closed.