A Step By Step Guide Of The Cfpb S New Rule Regulation F Simplified

A Step By Step Guide Of The Cfpb S New Rule Regulation F Simplified 22 november 2021 sara m. costanzo david a. head james t. hart. a step by step guide of the cfpb's new rule: regulation f simplified. topics: consumer collections. many have been preparing for the effective date of regulation f, which is november 30 th. this new rule will undoubtedly change the world of debt collection. The cfpb regulation f ruling on digital communications for debt collections has paved the way for a new dimension to the receivables management industry by modernizing debt collection laws and making it simpler for both debt collectors and consumers to understand their rights. a robust compliance management system is critical for debt.

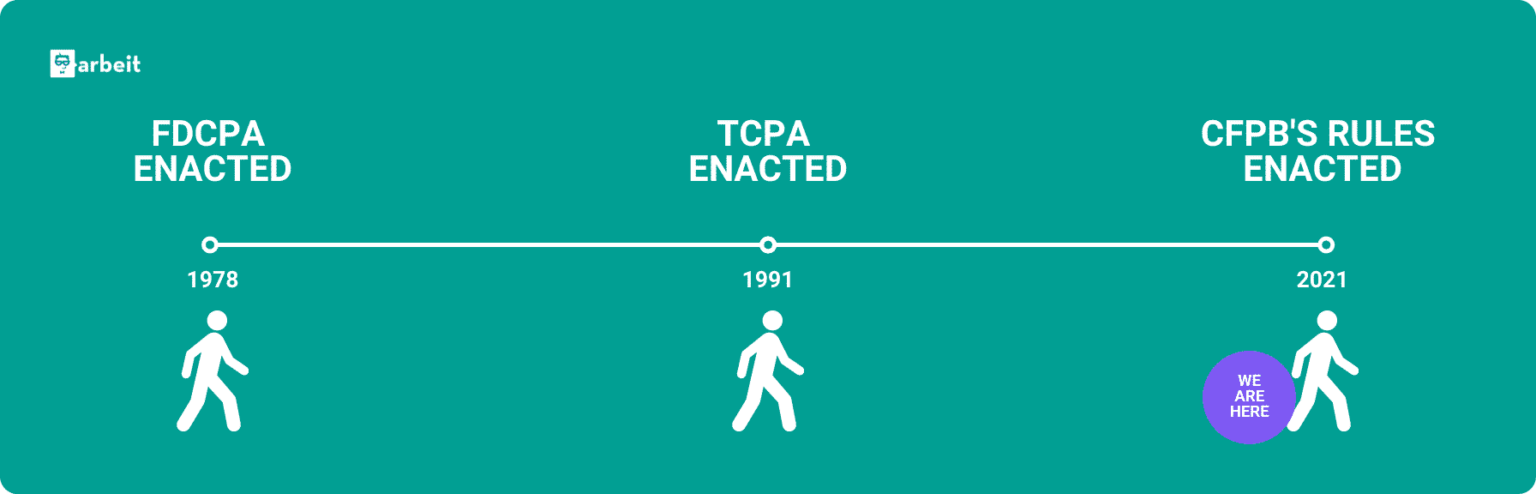

A Complete Guide To Reg F The Cfpb S Rules For Debt Collection (last month, the cfpb published faqs on the rule’s limited content message and call frequency provisions.) debt collection rule faqs update. debt collectors may use model form b 1 in appendix b to regulation f to comply with the validation information content and form requirements of § 1006.34(c) and (d)(1). This rule amends regulation f, 12 cfr part 1006, which implements the fair debt collection practices act (fdcpa), to prescribe federal rules governing certain activities of debt collectors, as that term is defined in the fdcpa. the final rule, among other things, clarifies the information that a debt collector must provide to a consumer at the. Get a free quote. the cfpb’s debt collection rules, or regulation f, is the new ruleset implemented under the cfpb to add clarity and guidelines in consumer communication for collection agencies. it went into effect on nov. 30, 2021. the rule gave clarity on topics like harassment, disclosures, and omnichannel communication. 2. capturing and managing opt ins opt outs. reg f requires specific opt in opt out processes prior to texting or emailing a customer. to start using omnichannel outreach, you need to first have.

Guide How To Address Cfpb Regulation F Compliance Firstsource Get a free quote. the cfpb’s debt collection rules, or regulation f, is the new ruleset implemented under the cfpb to add clarity and guidelines in consumer communication for collection agencies. it went into effect on nov. 30, 2021. the rule gave clarity on topics like harassment, disclosures, and omnichannel communication. 2. capturing and managing opt ins opt outs. reg f requires specific opt in opt out processes prior to texting or emailing a customer. to start using omnichannel outreach, you need to first have. Regulation f effectively brings changes to debt collections law. regulation f prevents excess contacting. regulation f outlines and clarifies precise parameters on what time and where consumers may be contacted. regulation f outlines a new model validation notice. regulation f clarifies the new 7 in 7 rule. Cfpb adds new debt collection rule faqs. last week, the cfpb published additional frequently asked questions on regulation f, its debt collection rule. the new faqs address third party communications, electronic communications, and unusual or inconvenient time and place provisions. prohibitions on third party communications.

Comments are closed.