A Complete Review Of The Major Credit Reporting Agencies And Credit

A Complete Review Of The Major Credit Reporting Agencies And Credit Monitor progress: regularly checking your reports lets you track your credit building efforts and see how changes, like paying down debt, affect your score. fixing mistakes on your credit reports. mistakes can occur on any credit report, and they can negatively impact your credit score. if you find an error, follow these steps to dispute it:. The three major credit bureaus also have their own scoring models. equifax has the “equifax credit score”, experian has the “plus score”, and transunion has the “transrisk new account score.”. according to the cfpb, these credit scores are not typically used by creditors and are only meant for educational purposes.

A Complete Review Of The Major Credit Reporting Agencies And Credit The three major credit bureaus are equifax, experian and transunion. they collect financial information from creditors and then sell credit reports to various entities, such as lenders, insurance. How to get a copy of your credit report. by law, you can get a free credit report each year from the three credit reporting agencies (cras). these agencies include equifax, experian, and transunion. annualcreditreport is the only website authorized by the federal government to issue free, annual credit reports from the three cras. You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—equifax, transunion, and experian. you can request a copy through annualcreditreport . as a result of a 2019 settlement, all u.s. consumers may also request up to six free copies of their equifax credit report. The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in.

Understanding Credit Reporting Agencies You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—equifax, transunion, and experian. you can request a copy through annualcreditreport . as a result of a 2019 settlement, all u.s. consumers may also request up to six free copies of their equifax credit report. The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in. The three major credit bureaus are equifax, experian and transunion. credit bureaus gather and maintain data on consumers' credit use, which means that if you have a credit card or a loan, you. Home > credit > understanding credit reports > 3 major credit reporting agencies. to many american consumers, the three major credit bureaus — experian, equifax and transunion — must seem like confusing and unexplainable financial force. the “big three” credit reporting bureaus gather data on our spending and payment habits, toss it.

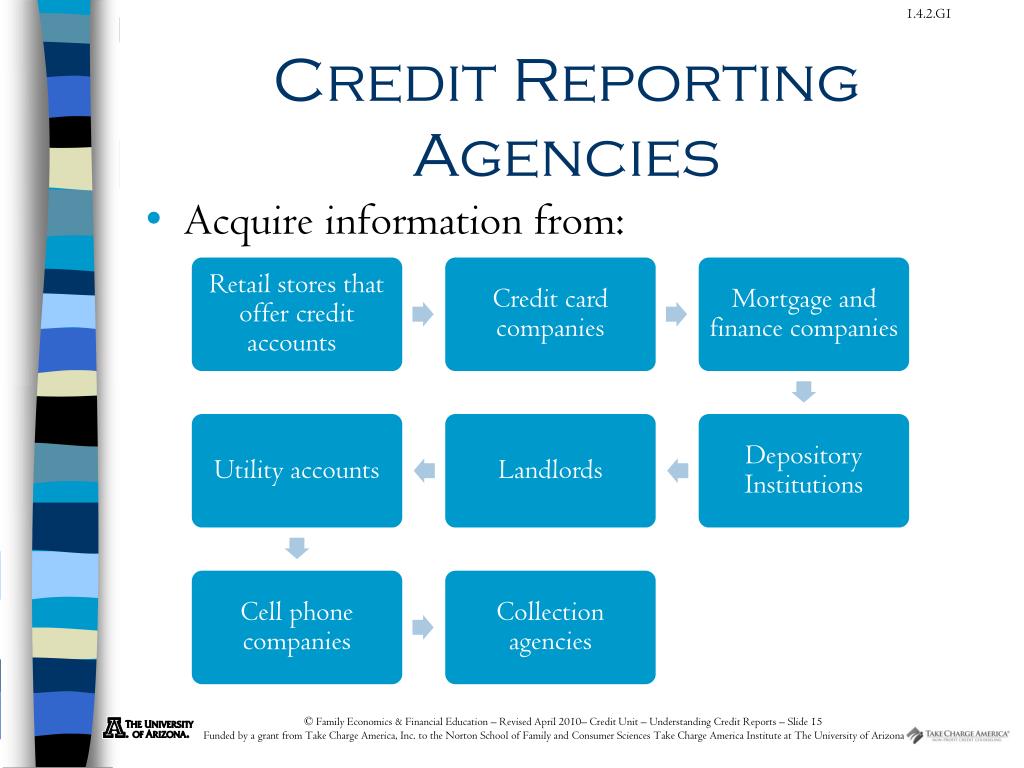

Ppt Understanding Credit Powerpoint Presentation Free Download Id The three major credit bureaus are equifax, experian and transunion. credit bureaus gather and maintain data on consumers' credit use, which means that if you have a credit card or a loan, you. Home > credit > understanding credit reports > 3 major credit reporting agencies. to many american consumers, the three major credit bureaus — experian, equifax and transunion — must seem like confusing and unexplainable financial force. the “big three” credit reporting bureaus gather data on our spending and payment habits, toss it.

Who Are The Major Credit Reporting Agencies Credit Reports

Comments are closed.