A Complete Retirement Plan Build Step By Step Guide

Retirement Planning Guide Step By Step Guide Benefits Thank you for 100,000 subscribers!in this video we go through a full retirement plan build, which breaks down the fundamental pieces that any retirement plan. Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return.

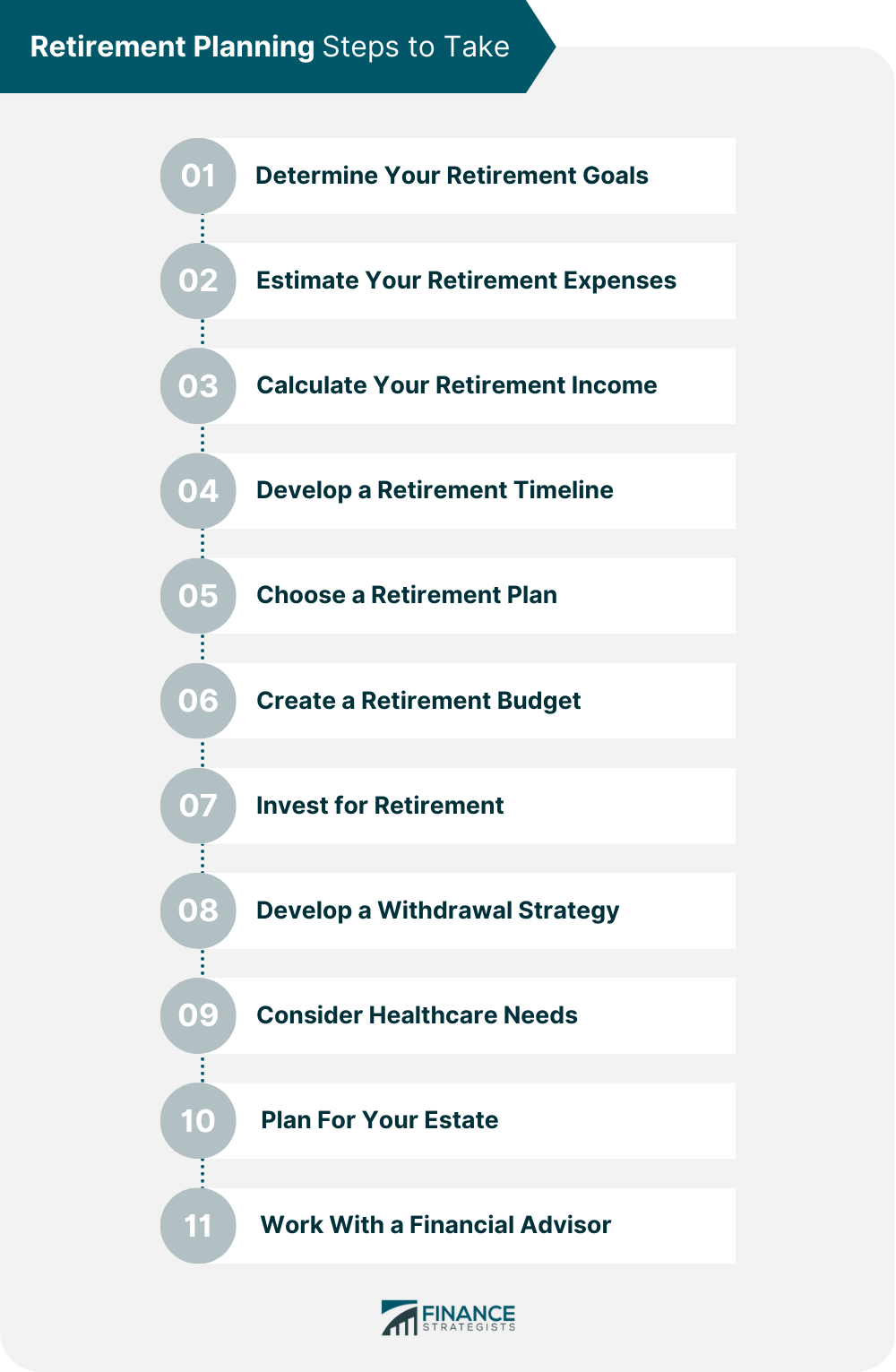

Your Guide To Retirement Planning The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. Having a road map helps. 2. estimate your expenses. once you know how you want to spend retirement, you can plan how to pay for it. this starts by determining your expenses. one rule of thumb says. Step 1: determine your retirement goals. the first step is to identify your retirement goals. your goals may include traveling, starting a business, or enjoying a comfortable retirement. consider your lifestyle, interests, and priorities to determine your retirement goals. in addition, consider your health, family, and other personal circumstances. Also, discuss how you plan to handle declining health as you each get older. the first step in being purposeful about the retirement process is defining what you want it to look like. put a dream meeting date with your spouse on your calendar, and start creating a vision together! 2. create a retirement spending plan.

Step By Step Guide To Efficient Retirement Planning Step 1: determine your retirement goals. the first step is to identify your retirement goals. your goals may include traveling, starting a business, or enjoying a comfortable retirement. consider your lifestyle, interests, and priorities to determine your retirement goals. in addition, consider your health, family, and other personal circumstances. Also, discuss how you plan to handle declining health as you each get older. the first step in being purposeful about the retirement process is defining what you want it to look like. put a dream meeting date with your spouse on your calendar, and start creating a vision together! 2. create a retirement spending plan. Take a deep breath and check out these simple steps you can take to get your plan rolling. step 1: set your retirement goals. step 2: save 15% of your income for retirement. step 3: contribute to your 401 (k). step 4: invest in a roth ira. step 5: pay off your mortgage early. step 6: study your social security options. Setting financial goals. one of the most important components of retirement planning is setting financial goals. it’s impossible to create an in depth retirement plan if you don’t know exactly what you’re planning for. when you’re setting goals, make sure they’re smart: specific, measurable, achievable, relevant, and time bound.

How To Do Retirement Planning Step By Step Guide Infographic Take a deep breath and check out these simple steps you can take to get your plan rolling. step 1: set your retirement goals. step 2: save 15% of your income for retirement. step 3: contribute to your 401 (k). step 4: invest in a roth ira. step 5: pay off your mortgage early. step 6: study your social security options. Setting financial goals. one of the most important components of retirement planning is setting financial goals. it’s impossible to create an in depth retirement plan if you don’t know exactly what you’re planning for. when you’re setting goals, make sure they’re smart: specific, measurable, achievable, relevant, and time bound.

5 Simple Steps To Retirement Planning The Economic Times

Retirement Planning Step By Step First Point Wealth Management

Comments are closed.