9 Steps To Execute A Successful 1031 Exchange 2024

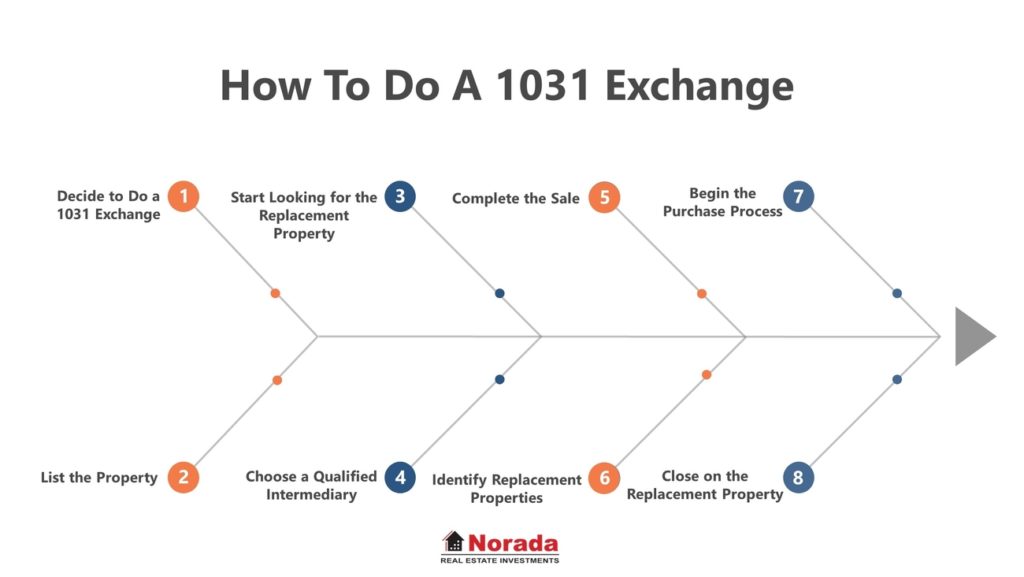

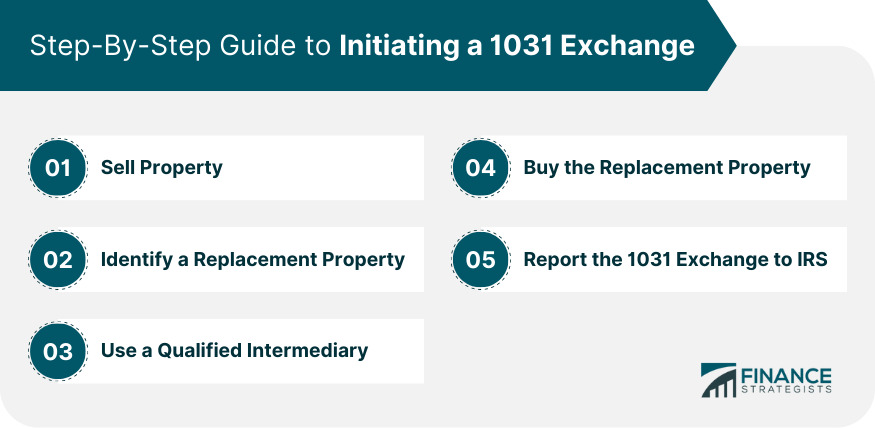

1031 Exchange Timeline 2024 Heddi Paloma A 1031 exchange, also known as a like kind exchange, is a tax deferred transaction that allows real estate investors to sell an investment property and acquire a replacement property of equal or greater value, without immediately paying capital gains taxes on the sale. this powerful tax strategy provides investors with the opportunity to defer. Step by step guide to planning a 1031 exchange. now that you have a solid foundation of the basics and benefits of a 1031 exchange, let's dive into the step by step process of planning and executing a successful 1031 exchange. step 1: consult with a qualified intermediary.

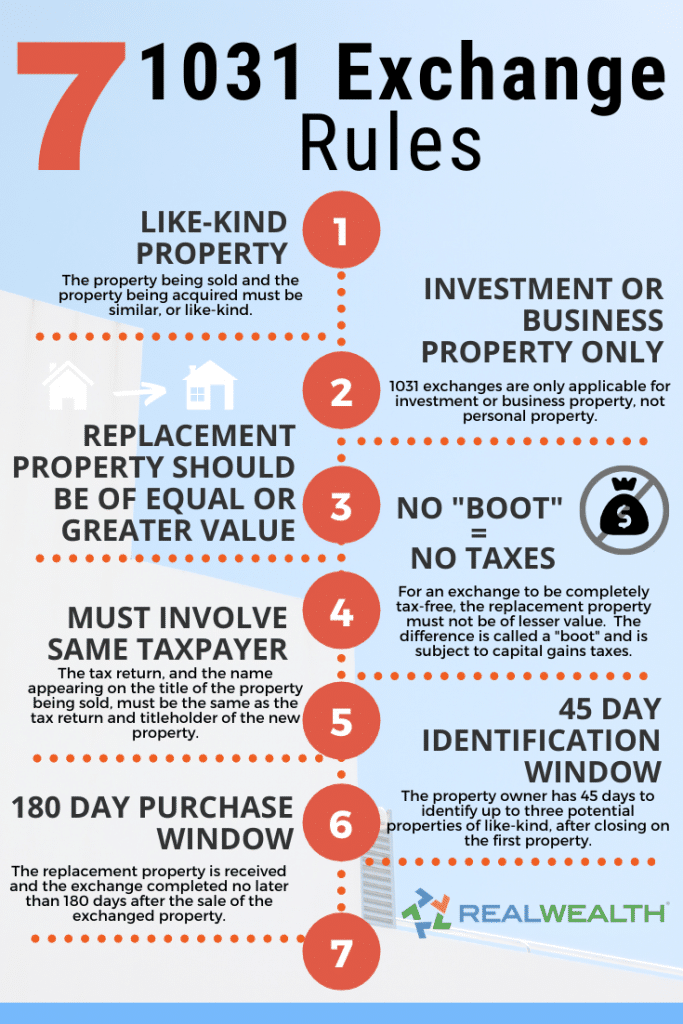

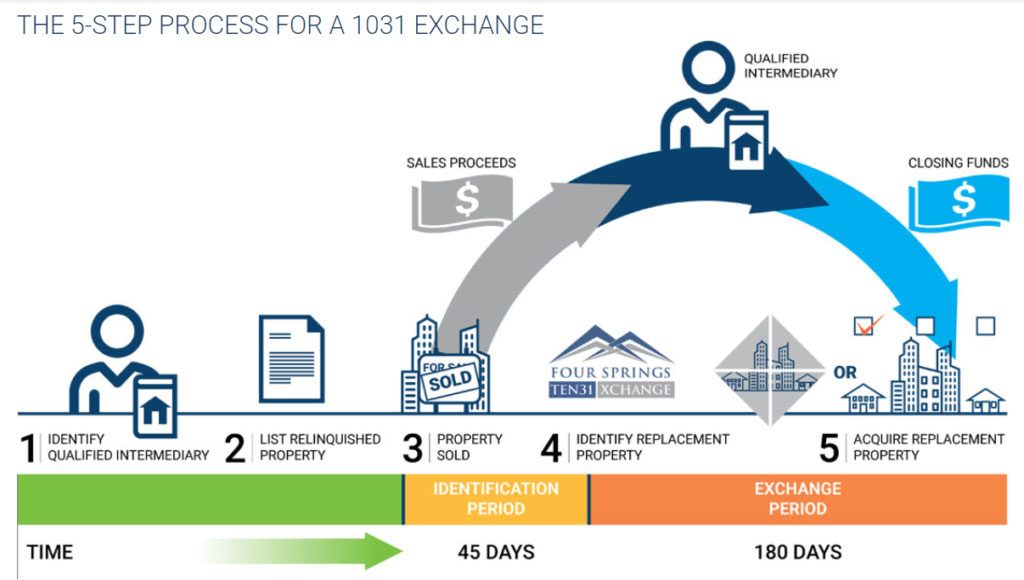

1031 Exchange Rules 2024 How To Do A 1031 Exchange The 1031 exchange allows you (as an investor) to postpone paying capital gains taxes on the sale of investment property. taxes on capital gains might be as high as 20 30% in a typical sale. those taxes, however, can be avoided if the proceeds of the sale are reinvested according to the rules outlined in irc 1031. Step by step guide to execute the 1031 exchange process. a 1031 exchange presents a strategic opportunity for real estate investors to defer capital gains taxes while repositioning their investment assets. the below steps designed to simplify the 1031 exchange process with precision, offering you a structured pathway through its complexities: 1. The second part of the 1031 exchange timeline lies within 180 days after the property sale. here, you must close in on at least one property you’ve got your eyes on. notably, this period includes the above 45 day period. this is when you’ll need to secure quick money, such as hard money loans. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest.

1031 Exchange For Dummies Overview Requirements Steps The second part of the 1031 exchange timeline lies within 180 days after the property sale. here, you must close in on at least one property you’ve got your eyes on. notably, this period includes the above 45 day period. this is when you’ll need to secure quick money, such as hard money loans. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. 1031 exchange: the rules and costs explained (2024 update) by steve nicastro updated july 9, 2024. a 1031 exchange allows property owners to "swap" one investment or business property for another of equal or greater value while deferring capital gains tax and avoiding depreciation recapture. this tax break lets you upgrade to a higher priced. The 180 day deadline in a 1031 exchange is a crucial benchmark. it establishes the maximum time frame of 180 calendar days from the sale of the relinquished property for the taxpayer to acquire the replacement property. keeping to this deadline is essential to upholding the property exchange’s tax deferred status.

1031 Exchange Rules Success Stories For Real Estate Investors 2022 1031 exchange: the rules and costs explained (2024 update) by steve nicastro updated july 9, 2024. a 1031 exchange allows property owners to "swap" one investment or business property for another of equal or greater value while deferring capital gains tax and avoiding depreciation recapture. this tax break lets you upgrade to a higher priced. The 180 day deadline in a 1031 exchange is a crucial benchmark. it establishes the maximum time frame of 180 calendar days from the sale of the relinquished property for the taxpayer to acquire the replacement property. keeping to this deadline is essential to upholding the property exchange’s tax deferred status.

The 1031 Exchange A Powerful Wealth Building Tool Debt Free Doctor

1031 Exchange Advisors Real Estate Transition Solutions

Comments are closed.