7 Factors To Consider Choosing The Best Retirement Saving Plan

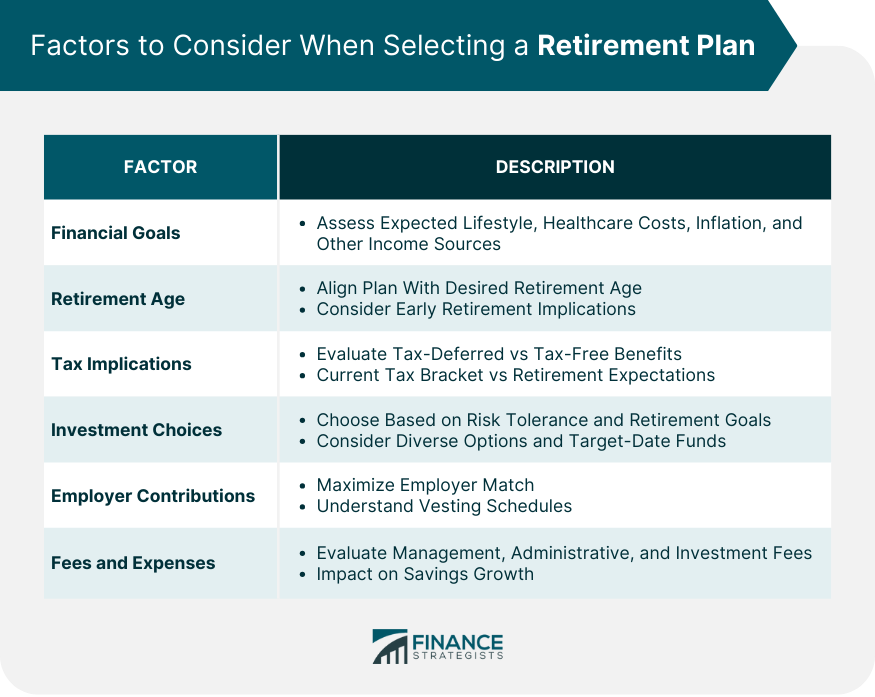

7 Factors To Consider Choosing The Best Retirement Saving Plan Understanding the various options, including traditional and roth iras, 401 (k) plans, pensions, sep iras, and simple iras, is essential. each plan offers unique benefits, tax advantages, and contribution limits, catering to different financial situations and goals. when choosing a retirement plan, consider factors such as your financial goals. In 2023, you can contribute up to $22,500 per year or 100% of your compensation, whichever is less. employees aged 50 and older may make additional catchup contributions of $7,500. for 2024, the.

10 Best Factors For Retirement Planning To Take Into Consideration The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. 7 factors to consider while choosing the best retirement saving schemes. with an improvement in the escalating expense of living, healthcare, and life expectancy, planning for retirement has become a must and should be worked upon on priority. here are a few ways in which you can choose the most suitable retirement saving schemes. 1. Employees with 15 years of service might qualify for $3,000 in catch up contributions each year for 5 years. 457 (b) if employer offers a 403 (b) or 401 (k) in addition to the 457, workers might. 401 (k)s are popular retirement savings plans offered by for profit companies. employees can open a traditional 401 (k) or a roth 401 (k). traditional 401 (k)s grow with pre tax dollars, but roth.

Best Retirement Plans Options And Factors To Consider Employees with 15 years of service might qualify for $3,000 in catch up contributions each year for 5 years. 457 (b) if employer offers a 403 (b) or 401 (k) in addition to the 457, workers might. 401 (k)s are popular retirement savings plans offered by for profit companies. employees can open a traditional 401 (k) or a roth 401 (k). traditional 401 (k)s grow with pre tax dollars, but roth. Key takeaways. tax advantaged savings accounts like traditional or roth ira and 401 (k)s are among the best retirement plans to build your nest egg. roth and traditional retirement accounts have. 2. ira plans. an ira is a valuable retirement plan created by the u.s. government to help workers save for retirement. individuals can contribute up to $7,000 to an account in 2024, and workers.

Comments are closed.