6 Types Of Bankruptcies Explained Self Credit Builder

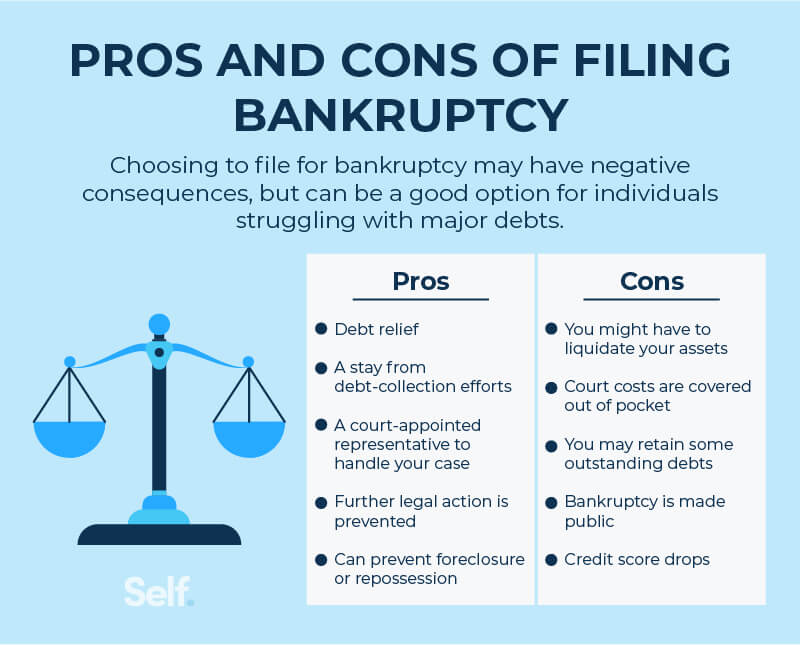

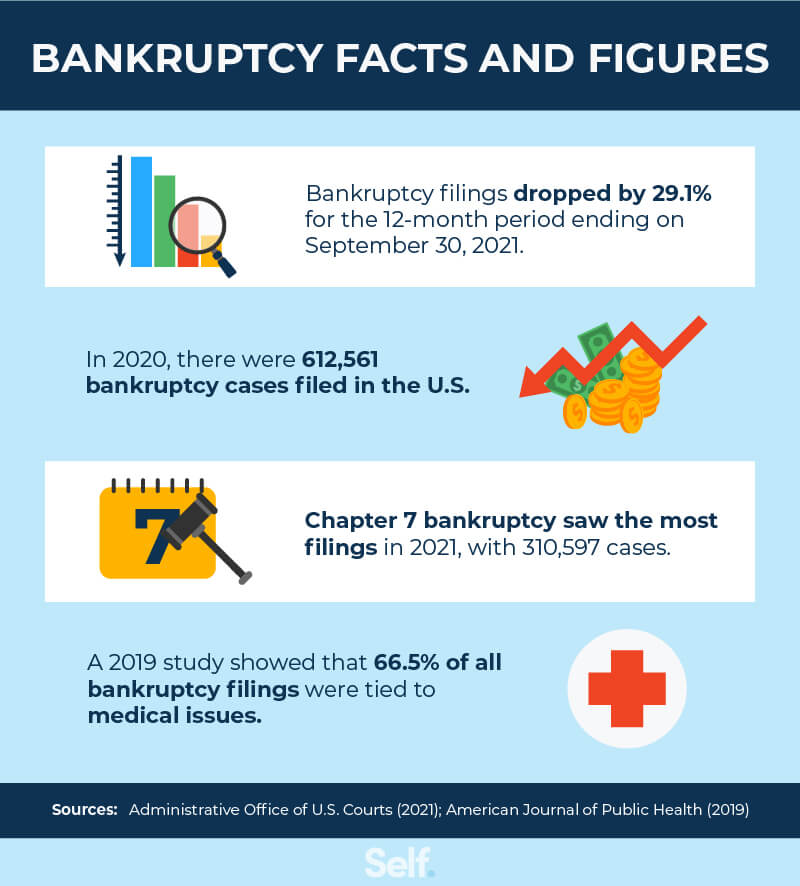

6 Types Of Bankruptcies Explained Self Credit Builder The bankruptcy process typically involves the liquidation of assets, repayment plans, or reorganization of debts and finances. while the most common types of bankruptcies are chapter 7 and chapter 13, there are actually six different types someone can file. here’s what you need to know about the six different types of bankruptcy before you. There are also alternatives you may want to consider; see more about those below. there are several types of bankruptcy — six, as a matter of fact. the two most common types of bankruptcy for.

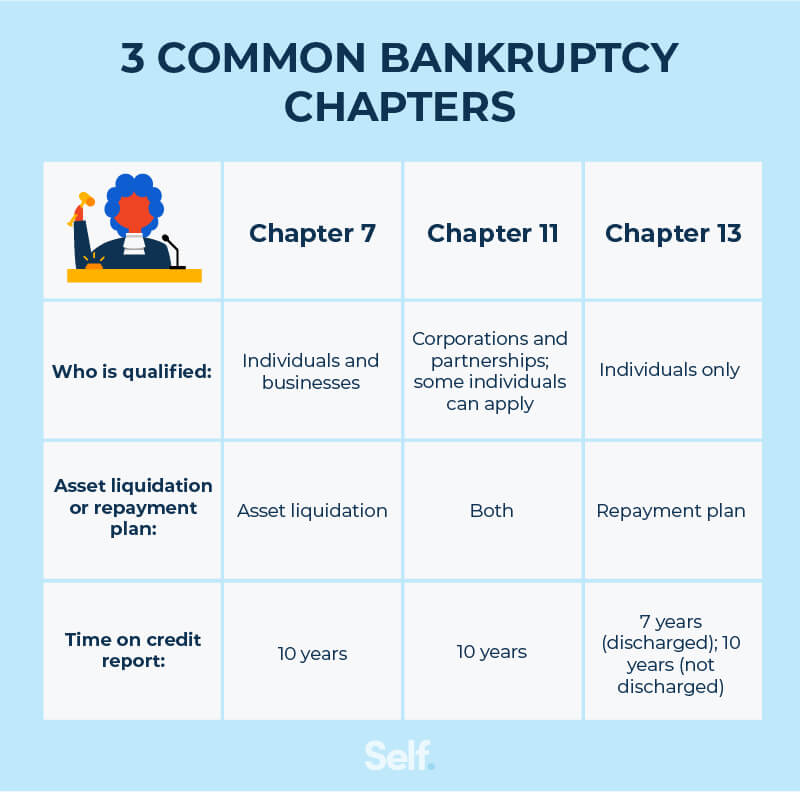

6 Types Of Bankruptcies Explained Self Credit Builder Chapter 13 bankruptcy is a plan that is eligible for those who have less than $2,750,000 starting the date of filing, according to uscourts.gov. it helps to repay debts over the course of three to five years, depending on how much income the person filing makes. once filed, this chapter pauses attempts from creditors to collect debts from you. For creditors, bankruptcy offers a way to collect on debts they may otherwise write off. the united states bankruptcy code provides six types of bankruptcy: chapter 7, 9, 11, 12, 13 and 15. There are six different types of bankruptcies under united states bankruptcy law. each serves either an individual or an entity like a business or local government. chapter 7 and chapter 13 are personal bankruptcies that serve individuals who have a lot of medical, credit card, or other consumer debt. chapters 9, 11, 12, and 15 are bankruptcies. In fact, there are six different types of bankruptcies: chapter 7: liquidation. chapter 13: repayment plan. chapter 11: large reorganization. chapter 12: family farmers. chapter 15: used in foreign cases. chapter 9: municipalities. you may have just taken one look at this list and zoned out for a second. that’s okay.

6 Types Of Bankruptcies Explained Self Credit Builder There are six different types of bankruptcies under united states bankruptcy law. each serves either an individual or an entity like a business or local government. chapter 7 and chapter 13 are personal bankruptcies that serve individuals who have a lot of medical, credit card, or other consumer debt. chapters 9, 11, 12, and 15 are bankruptcies. In fact, there are six different types of bankruptcies: chapter 7: liquidation. chapter 13: repayment plan. chapter 11: large reorganization. chapter 12: family farmers. chapter 15: used in foreign cases. chapter 9: municipalities. you may have just taken one look at this list and zoned out for a second. that’s okay. A bankruptcy will make it harder to get loans or credit in the future, and your rates will be higher if you do qualify. chapter 7 bankruptcy can stay on your credit reports for 10 years, while. In general, bankruptcies can be categorized into two types: liquidations (chapter 7) reorganizations (chapters 11, 12, and 13) among the different types of bankruptcies, chapter 7 and chapter 13 proceedings are the most common for individuals and businesses. chapter 7 bankruptcies normally fall in the liquidation category, meaning your property.

Comments are closed.