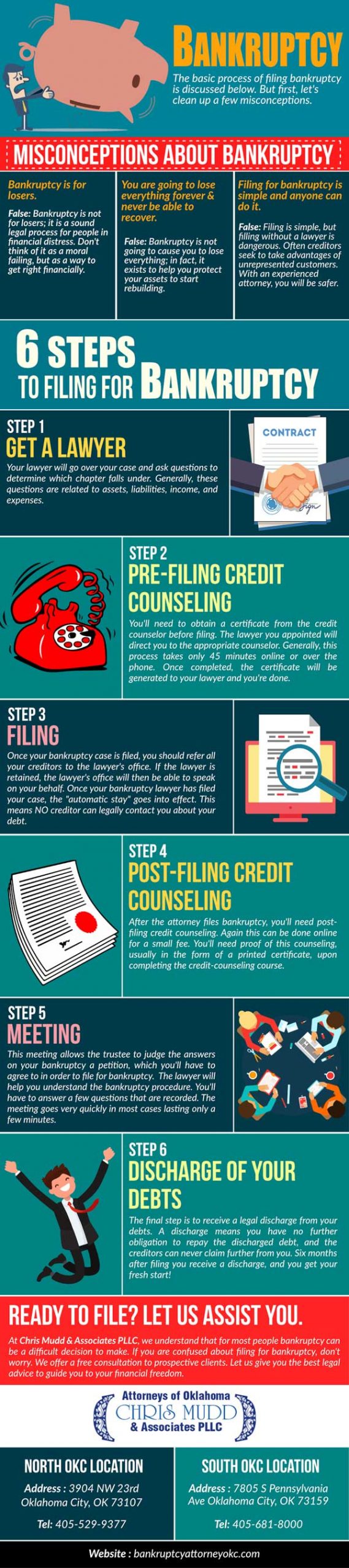

6 Steps To Filing For Bankruptcy

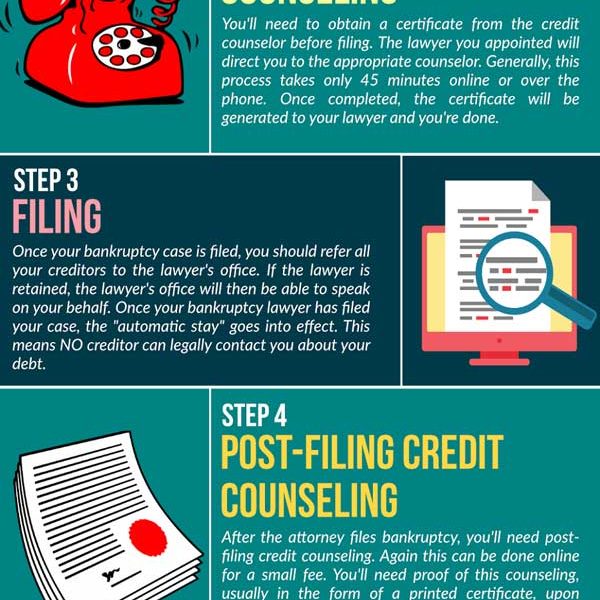

6 Steps To Filing For Bankruptcy Best Infographics Gather your latest tax return, recent loan and credit card statements, current bank statements and pay stubs. you’ll need this to evaluate the filing decision and you’ll need them again if you. Go to your state's bankruptcy article for specifics on where and how to file. the court will issue an automatic stay that will prevent most creditors from continuing to collect from you. even court cases and trials related to debt collection will have to stop. keep in mind that bankruptcy won't stop all lawsuits.

6 Steps To Filing For Bankruptcy In 2020 Debt Help Bankruptcy You must have sufficient income to make the monthly debt payments outlined in your bankruptcy plan. your unsecured debts (such as credit cards and medical bills) must be less than $419,275, and your secured debts (like mortgage and car payments) must be less than $1,257,850. these dollar amounts are in effect until april 2022. Here are the 10 steps to file your case successfully: 1. collect your documents 2. take the required credit counseling course 3. complete the required bankruptcy forms 4. get your filing fee ready or fill out a fee waiver request 5. print your completed bankruptcy forms 6. go to the court to file your forms 7. mail required documents to your. Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court. 6. make sure you have your filing fee. bankruptcy isn’t cheap. on top of attorney fees, you also have to pay a fee just to file for bankruptcy. the total filing fee for a chapter 7 bankruptcy is $335, and for a chapter 13 bankruptcy it’s $310. 2, 3 you’ll have to pay this amount in exact change to the court in person.

6 Steps To Filing For Bankruptcy Best Infographics Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court. 6. make sure you have your filing fee. bankruptcy isn’t cheap. on top of attorney fees, you also have to pay a fee just to file for bankruptcy. the total filing fee for a chapter 7 bankruptcy is $335, and for a chapter 13 bankruptcy it’s $310. 2, 3 you’ll have to pay this amount in exact change to the court in person. Much of the bankruptcy process is administrative, however, and is conducted away from the courthouse. in cases under chapters 7, 12, or 13, and sometimes in chapter 11 cases, this administrative process is carried out by a trustee who is appointed to oversee the case. a debtor's involvement with the bankruptcy judge is usually very limited. Bankruptcy basics provides basic information to debtors, creditors, court personnel, the media, and the general public on different aspects of federal bankruptcy law. it also provides individuals who may be considering filing a bankruptcy petition with a basic explanation of the different chapters under which a bankruptcy case may be filed and.

6 Steps To Filing For Bankruptcy Much of the bankruptcy process is administrative, however, and is conducted away from the courthouse. in cases under chapters 7, 12, or 13, and sometimes in chapter 11 cases, this administrative process is carried out by a trustee who is appointed to oversee the case. a debtor's involvement with the bankruptcy judge is usually very limited. Bankruptcy basics provides basic information to debtors, creditors, court personnel, the media, and the general public on different aspects of federal bankruptcy law. it also provides individuals who may be considering filing a bankruptcy petition with a basic explanation of the different chapters under which a bankruptcy case may be filed and.

6 Easy Steps To Filing For Bankruptcy Infographics Submission Hub

Comments are closed.