6 Small Business Loan Requirements That You Need To Know

6 Small Business Loan Requirements That You Need To Know 1. personal and business credit scores. you’ll likely need good personal credit (typically a score of 690 or higher) or excellent business credit to qualify for a government backed sba loan or. To help you qualify for a small business loan, we’ve identified eight common requirements for a business loan. 1. annual revenue requirement. while revenue requirements vary by lenders, most.

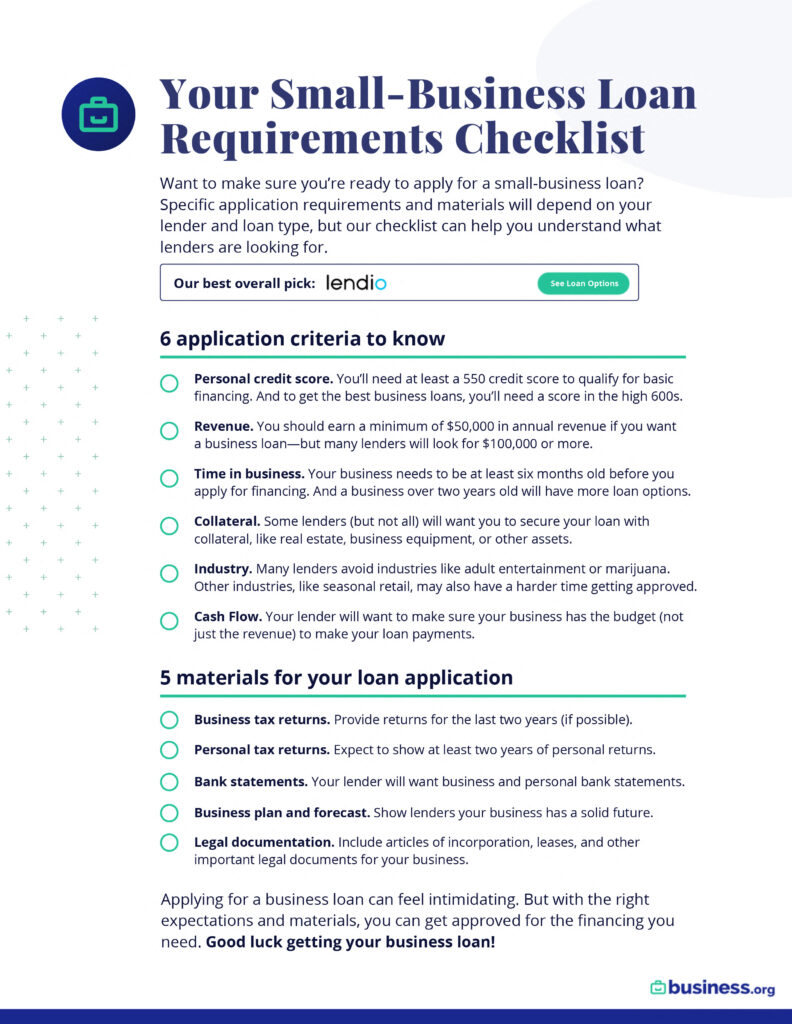

Your Small Business Loan Requirements Checklist Business Org Recently obtained debt not yet being reported to your credit reports. 3. income. requirements surrounding a company’s income can involve a minimum revenue figure for a given time frame, an analysis of the income trending over the past one to two years, and the amount of income earned in relation to the company’s debts. The sba requires that any real estate you purchase with this financing is 51% owner occupied — and 60% owner occupied for new construction. to qualify for an sba 504 loan, your business must. Business loans can help you survive difficult times, improve cash flow or grow your business. here are eight common small business loan requirements you should know. Baseline small business loan requirements typically include a good credit rating and an annual income of at least $20,000 (if you’re new in the business, some lenders will go as low as $10,000). however, since exact requirements vary from lender to lender, we’ve reviewed an assortment of lenders who can work around your unique needs.

Small Business Loan Requirements Everything You Need To Know Business loans can help you survive difficult times, improve cash flow or grow your business. here are eight common small business loan requirements you should know. Baseline small business loan requirements typically include a good credit rating and an annual income of at least $20,000 (if you’re new in the business, some lenders will go as low as $10,000). however, since exact requirements vary from lender to lender, we’ve reviewed an assortment of lenders who can work around your unique needs. Yes, business loan lenders evaluate your personal credit score —the same score you use to buy a car or get a personal loan. most small business lenders ask for a score of at least 620; if you have a lower score, expect to have limited choices. as a general rule, as your credit score increases, so do your credit options. These loans, which include both traditional loans and equipment loans, can be funded within a day in some cases. 2. check your eligibility. although business loan requirements vary, here are four.

Comments are closed.