5 Quick Facts About Va Loans

5 Quick Facts About Va Loans When using the benefit for the first time, veterans pay 2.15% of the loan amount on a purchase or cash out refinance. for all subsequent uses, the fee rises to 3.3% of the loan amount. the funding fee for a va streamline refinance is 0.5%. buyers can lower their funding fee exposure by making a down payment. The va sends an appraiser to the property to assess value. generally, say this home appraises for $205,000. you could look to extract $30,000 in cash, which is the difference between what you owe and what the home is worth. you would essentially get a brand new mortgage and pocket the difference.

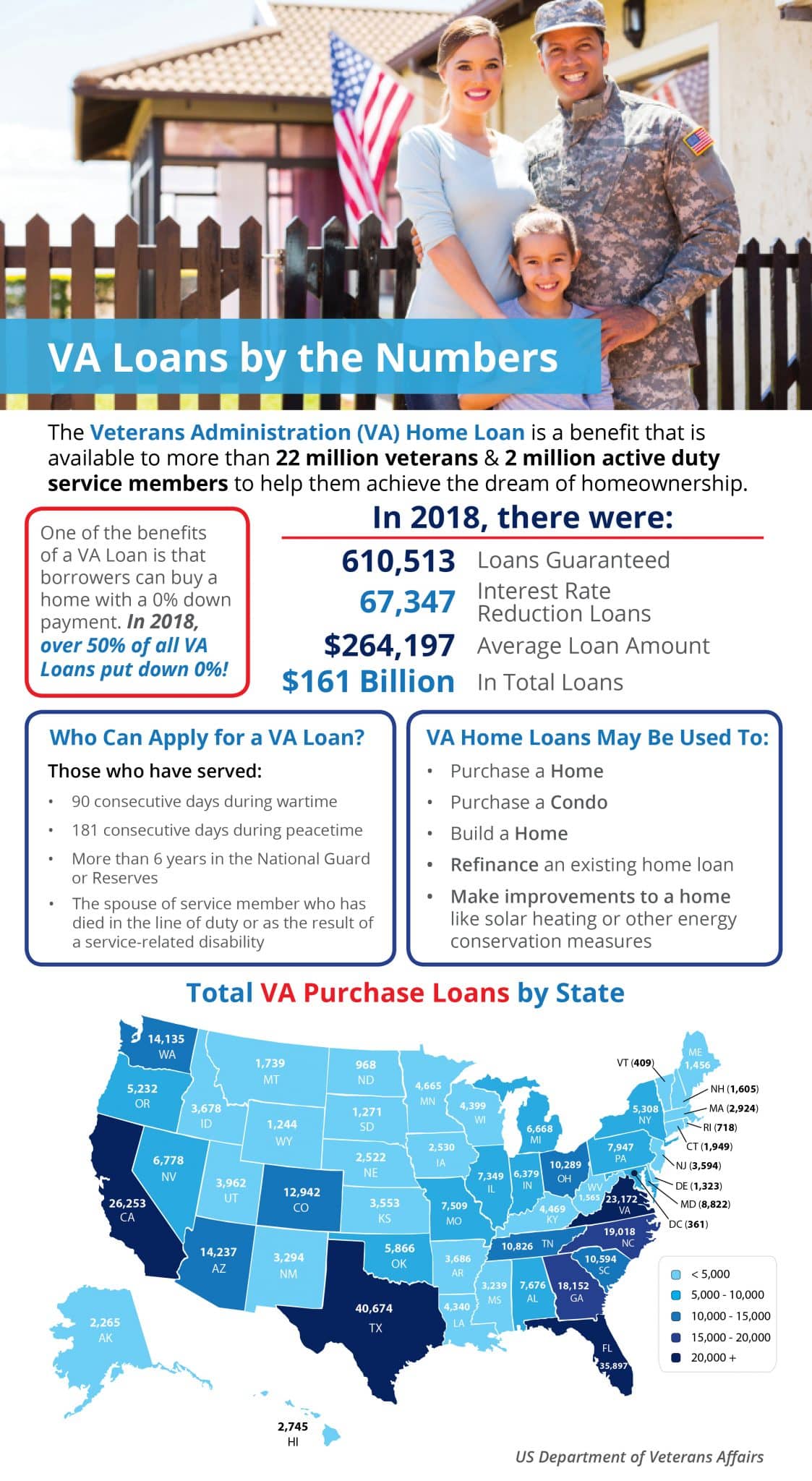

Va Loans Infographic Here’s a look at eight must know facts about va home loans: 1. 75% of buyers purchase with $0 down about 75% of va buyers bought a home last year without making a down payment. In 2024, the standard va loan limit is $766,550 for a single family home in a typical u.s. county, but it can run as high as $1,149,825 in high cost areas. it’s possible to get a va loan even if. Funding fee. most people who get a va loan are required to pay a funding fee, which covers the cost to taxpayers. the va funding fee normally ranges from 1.25% to 3.3% of your loan amount. if you previously had a va loan and you’re doing a va streamline, the funding fee is 0.5%. 1. no down payment. one of the most well known benefits of va loans is the ability to purchase a new home without needing a down payment. rather than paying 5%, 10%, 20% or more of the home’s.

Quick Facts Va Home Loans Infographic Denver Realtor Funding fee. most people who get a va loan are required to pay a funding fee, which covers the cost to taxpayers. the va funding fee normally ranges from 1.25% to 3.3% of your loan amount. if you previously had a va loan and you’re doing a va streamline, the funding fee is 0.5%. 1. no down payment. one of the most well known benefits of va loans is the ability to purchase a new home without needing a down payment. rather than paying 5%, 10%, 20% or more of the home’s. 1. no down payment. by far, the single largest benefit of the va loan is that qualified veterans can purchase without a down payment. this huge advantage allows veterans and service members to buy homes without having to spend years saving for that typical lump sum payment. check your eligibility for a $0 down va loan. Facts about va loans. a va home loan is one of the most widely used benefits available to veterans and active duty service members. in fact, more than 20 million loans have been guaranteed by the.

5 Things To Know About Va Loans 1. no down payment. by far, the single largest benefit of the va loan is that qualified veterans can purchase without a down payment. this huge advantage allows veterans and service members to buy homes without having to spend years saving for that typical lump sum payment. check your eligibility for a $0 down va loan. Facts about va loans. a va home loan is one of the most widely used benefits available to veterans and active duty service members. in fact, more than 20 million loans have been guaranteed by the.

Va Loans Everything You Need To Know Jvm Lending

Comments are closed.