5 Of The Most Common Risks To Retirement How To Plan To Avoid Them

Retirement Risks Powerpoint And Google Slides Template Ppt Slides The decisions made in the pre retirement phase can have serious and lasting effects, here are some of the most common mistakes to avoid before retirement. 1. not adjusting your portfolio for risk. Here are five common retirement planning mistakes many people make that can lead to a low rpm, along with steps you can take to improve your retirement readiness. 1. not having a plan. start.

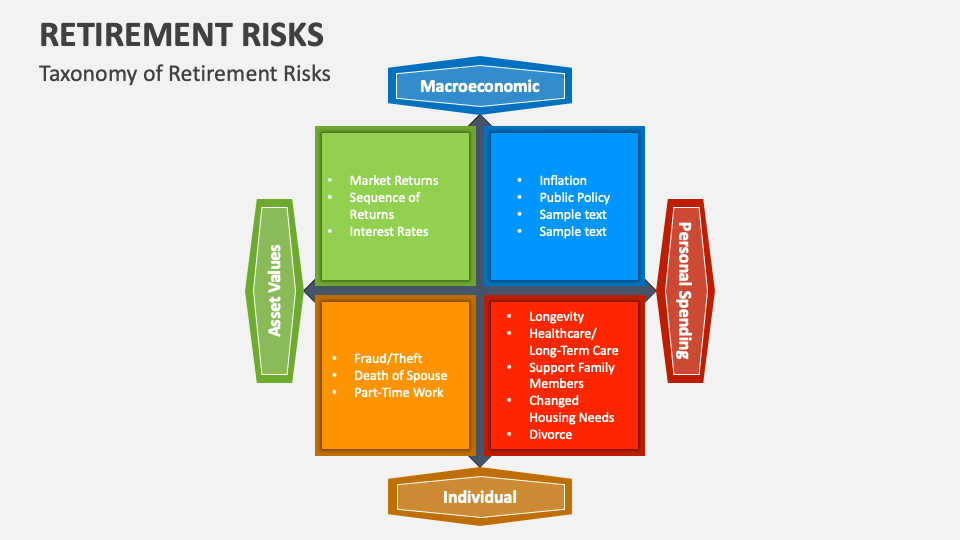

Retirement Risks Powerpoint And Google Slides Template Ppt Slides But there are always risks and, according to the center for retirement research at boston college, here are the five largest risks we face in retirement, as described by the center in order of how it views the greatest risks. longevity risk: living longer than expected and exhausting one’s resources. market risk: since most people now save. Mistake #1: having a distorted view of wealth. i have come to the opinion that the status quo paradigm about wealth is distorted. the idea of having a high salary or a large investment account as. Here are the seven biggest risks retirees should avoid at all costs, along with tips to address them. 1. longevity risk. average life expectancy has increased from 68.14 years in 1950 to 76.4. Blunder no. 2: ignoring sequence of returns risk. if you plan to use money invested in the market as a source of retirement income, this is the monster in the closet. most people i talk to have.

Understanding Five Common Retirement Risk Factors Here are the seven biggest risks retirees should avoid at all costs, along with tips to address them. 1. longevity risk. average life expectancy has increased from 68.14 years in 1950 to 76.4. Blunder no. 2: ignoring sequence of returns risk. if you plan to use money invested in the market as a source of retirement income, this is the monster in the closet. most people i talk to have. 2. higher than expected medical costs. health care expenses are a major financial risk to retirees, and it’s one they often miscalculate, according to hou. recent research from fidelity investments shows that the average 65 year old retired couple can now expect to pay $315,000 on medical expenses in retirement. Individuals 50 and over can deposit a catch up contribution of $1,000 for a total of $8,500 per year (up from $8,000 in 2023). 3. not having a financial plan. to avoid sabotaging your retirement.

Comments are closed.