5 Key Factors You Need For An Early Retirement Retirement Strategies

5 Key Factors You Need For An Early Retirement Retirement Strategies You may also reach out to a health insurance broker for estimates. 3. plan out your early retirement housing. “most pre retirees focus on getting their investments ready for retirement, but. How to retire early in 5 steps. 1. make adjustments to your current budget. here’s where that work comes in: no matter how you want to slice it, retiring early means making some changes to how.

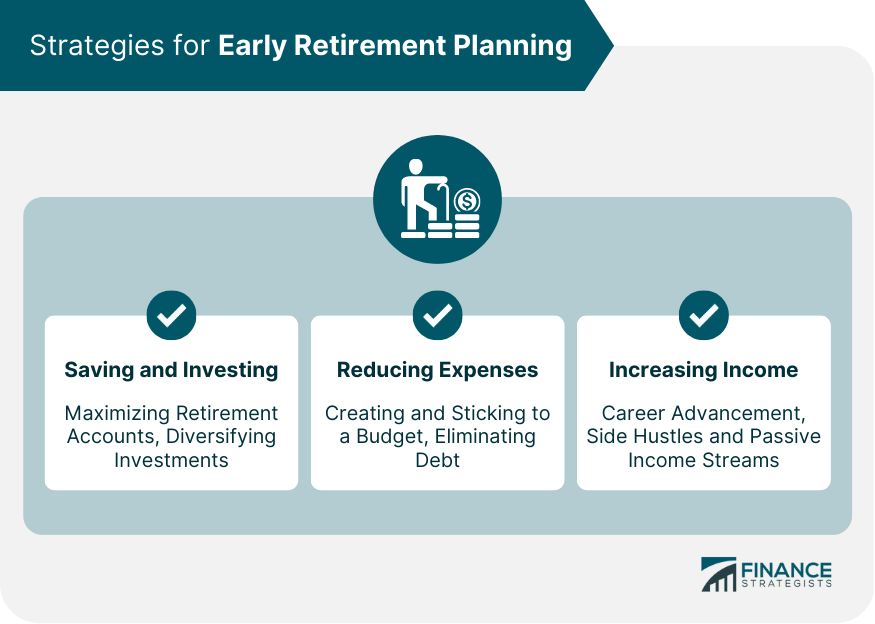

Retirement Income Planning Strategies Finance Strategists Start with your monthly expenses and multiply by 12 to obtain an annual estimate. next, find your "target" range. here's an example. assume your monthly expenses will be $5,000—or $60,000 per. Early retirement refers to leaving the workforce before the traditional retirement age, typically around 65. many people aspire to retire early, seeking the freedom and flexibility to pursue their passions, hobbies, and personal interests. the benefits of early retirement can include increased leisure time, the opportunity to travel, and the. If you know you want to retire early, your retirement planning may look slightly different than that of someone who plans to retire at the full retirement age (fra). of course, building a substantial retirement nest egg and maximizing tax efficient withdrawal strategies is essential, but you may have additional factors you’ll need to consider. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before.

Early Retirement Considerations Strategies And Challenges If you know you want to retire early, your retirement planning may look slightly different than that of someone who plans to retire at the full retirement age (fra). of course, building a substantial retirement nest egg and maximizing tax efficient withdrawal strategies is essential, but you may have additional factors you’ll need to consider. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. The 4% rule has long been the baseline for determining your withdrawal rate from retirement savings. this rule dictates that you withdraw 4% the first year in retirement, then withdraw the same. If, for example, you have a retirement portfolio worth $400,000 and income needs of $50,000, assuming no taxes and the preservation of the portfolio balance, you are relying on an excessive 12.5%.

How To Retire Early Steps Strategies Savings The Motley Fool The 4% rule has long been the baseline for determining your withdrawal rate from retirement savings. this rule dictates that you withdraw 4% the first year in retirement, then withdraw the same. If, for example, you have a retirement portfolio worth $400,000 and income needs of $50,000, assuming no taxes and the preservation of the portfolio balance, you are relying on an excessive 12.5%.

Early Retirement Planning Definition Strategies Considerations

Comments are closed.