403 B Plans The Basics Austin Asset

403 B Plans The Basics Austin Asset This is the second article in a three part series about the basics of 401k, 403b, and defined benefit plans. retirement plans established under section 403(b) of the internal revenue code, commonly referred to as 403(b) plans or “tax sheltered annuities,” have become a popular type of employer sponsored retirement plan. what is a 403(b) plan?. Once you’re comfortable understanding 401k plans, come back to learn the basics of 403(b) plans and the unique planning opportunities they present. at austin asset, we are fee only financial advisors. we seek to bring clarity and purpose to wealth through authentic and enduring relationships. for life.

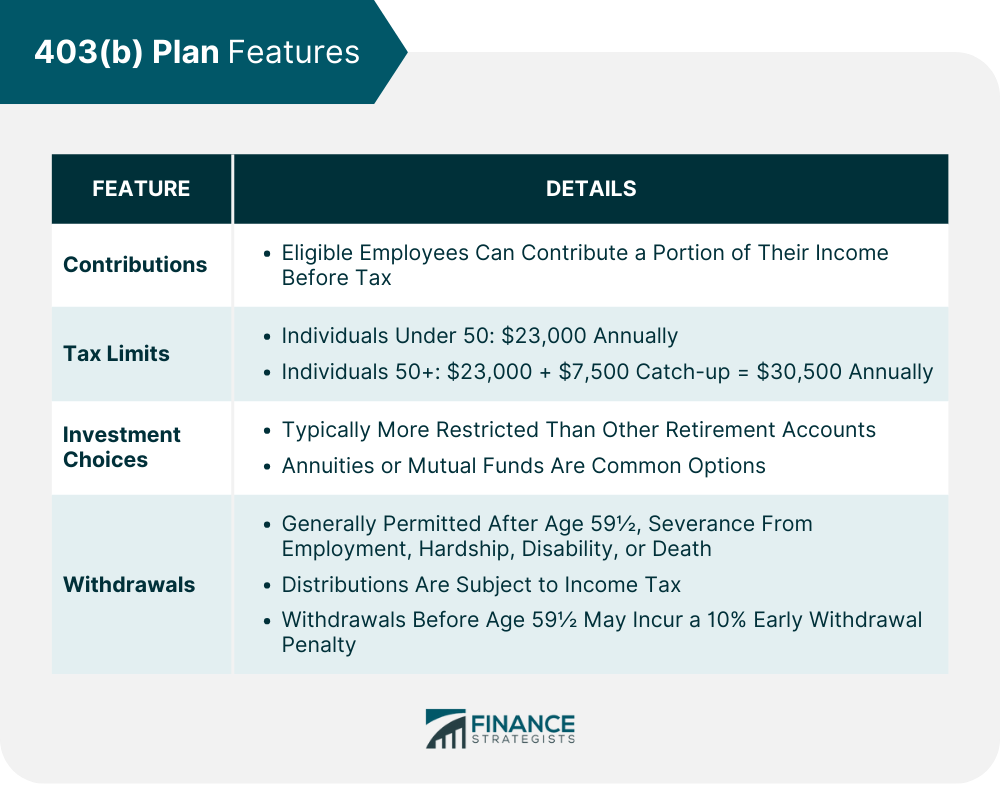

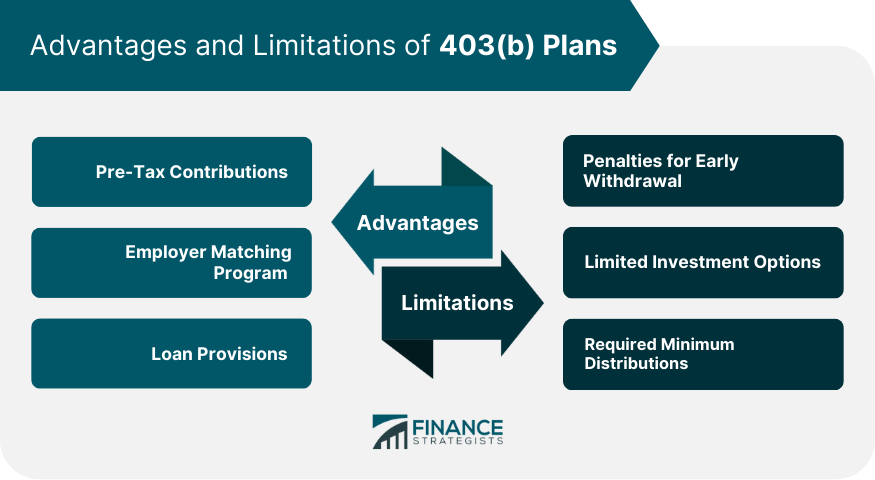

Understanding 403 B Retirement Plans The Benefits And Drawbacks Retirement plans established under section 403(b) of the internal revenue code, commonly referred to as 403(b) plans or “tax sheltered annuities,” have become a popular type of employer. 403 (b) contribution limits. you may contribute up to $22,500 yearly to a 403 (b) in 2023, or $23,000 in 2024. the contribution limits rise to $30,000 (2023) and $30,500 (2024) if you're 50 or. If an employee over age 50 has already made the maximum allowed qecs (equal to the basic limit) to 401(k) and 403(b) plans, the plans may nevertheless allow the employee to make additional qecs that are catch up contributions. 17 catch up contributions to the plans for a tax year are limited in the aggregate to the lesser of (1) an inflation. A 403(b) is a tax advantaged retirement plan designed for non profit organizations and certain government entities. the 403(b) works a lot like its better known counterpart, the 401(k), although.

The Beginners Guide To Understand 403 B Plan Overview Cc If an employee over age 50 has already made the maximum allowed qecs (equal to the basic limit) to 401(k) and 403(b) plans, the plans may nevertheless allow the employee to make additional qecs that are catch up contributions. 17 catch up contributions to the plans for a tax year are limited in the aggregate to the lesser of (1) an inflation. A 403(b) is a tax advantaged retirement plan designed for non profit organizations and certain government entities. the 403(b) works a lot like its better known counterpart, the 401(k), although. A 403 (b) is a tax advantaged retirement plan similar to a 401 (k) plan, but designed for employees of school systems, nonprofit hospitals, religious organizations and other tax exempt employers, known as 501 (c) (3) organizations. here are the basics of 403 (b) plans, although plan rules may vary:. For 2024, the total contribution limit for a 403 (b) is $23,000. but if you’re age 50 or older and need to catch up, you can put up to $30,500 into your account. 1. and folks with a 403 (b) have a nice advantage over their friends with a 401 (k). according to the 15 year rule, employees with at least 15 years of service can add an extra.

403 B Plan Information How It Works Eligibility And Steps A 403 (b) is a tax advantaged retirement plan similar to a 401 (k) plan, but designed for employees of school systems, nonprofit hospitals, religious organizations and other tax exempt employers, known as 501 (c) (3) organizations. here are the basics of 403 (b) plans, although plan rules may vary:. For 2024, the total contribution limit for a 403 (b) is $23,000. but if you’re age 50 or older and need to catch up, you can put up to $30,500 into your account. 1. and folks with a 403 (b) have a nice advantage over their friends with a 401 (k). according to the 15 year rule, employees with at least 15 years of service can add an extra.

The Basics Of A 403 B Plan And All You Need To Know Fundevity

403 B Plan Information How It Works Eligibility And Steps

Comments are closed.