401k Contribution Limits And Income Limits Annual Guide

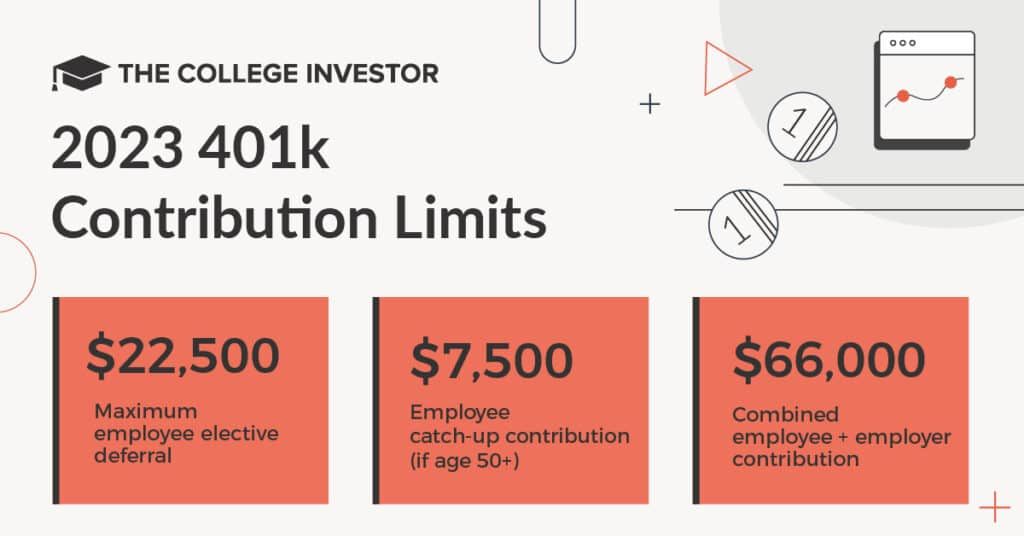

401k Contribution Limits And Income Limits Annual Guide The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. The 2024 limit on 401 (k) contributions is $23,000, or $30,500 for people 50 and older. employers can only use the first $345,000 of compensation to determine your 401 (k) match. 401 (k)s don't.

Irs Annual 401k Contribution Limit 2024 Hanni Kirsten Here are the 2023 401k contribution limits. these were announced by the irs on october 21, 2022. the employee deferral limit increased by $2,000 and the total combined contribution limit increased. The limit on annual contributions to an ira remains $7,000. the ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2025. The 2024 contribution limit for 401(k) plans is $23,000. in 2025, that limit rises to $23,500. loans guide ; getting a personal loan ; annual income. starting balance. The internal revenue service boosted the annual contribution limit for 401(k)s, 403(b)s, governmental 457 plans and the federal government’s thrift savings plan to $23,500, up from $23,000 in 2024.

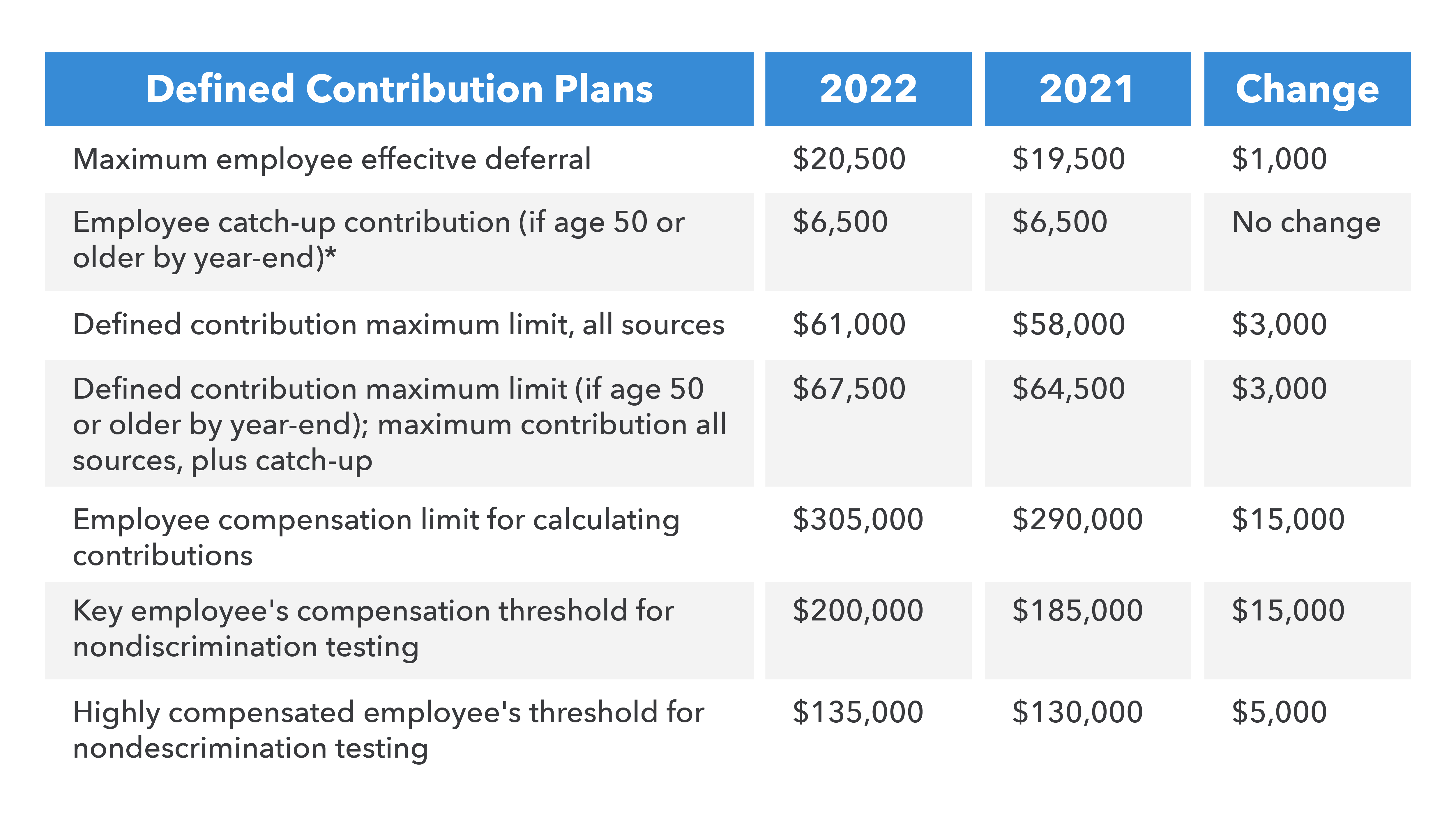

What S The Maximum 401k Contribution Limit In 2022 Mintlife Blog The 2024 contribution limit for 401(k) plans is $23,000. in 2025, that limit rises to $23,500. loans guide ; getting a personal loan ; annual income. starting balance. The internal revenue service boosted the annual contribution limit for 401(k)s, 403(b)s, governmental 457 plans and the federal government’s thrift savings plan to $23,500, up from $23,000 in 2024. For 2025, the 401 (k) limit for employee salary deferrals is $23,500, which is above the 2024 401 (k) limit of $23,000. employer matches don’t count toward this limit and can be quite generous. The chart below provides a breakdown of how the rules and limits for defined contribution plans (401(k), 403(b), and most 457 plans) changed for 2024 vs. 2025. defined contribution plan limits 2024.

Infographics Irs Announces Revised Contribution Limits For 401 K For 2025, the 401 (k) limit for employee salary deferrals is $23,500, which is above the 2024 401 (k) limit of $23,000. employer matches don’t count toward this limit and can be quite generous. The chart below provides a breakdown of how the rules and limits for defined contribution plans (401(k), 403(b), and most 457 plans) changed for 2024 vs. 2025. defined contribution plan limits 2024.

Comments are closed.