401k Calculator With Catch Up Contributions

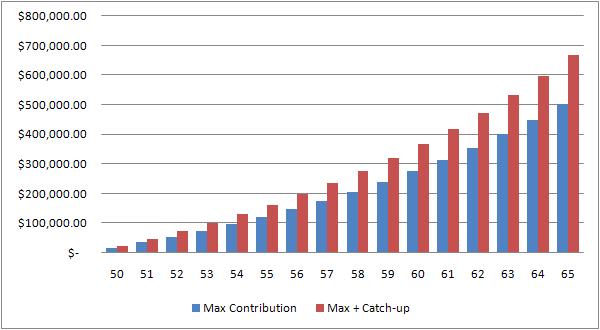

401k Calculator With Catch Up Contributions The 401(k) calculator assumes 2% annual income growth. there is no inflation assumption. (in 2024 and 2025, people age 50 and older can contribute an extra $7,500 as a catch up contribution. Catch up contributions: if you’re age 50 to 59 or 64 or older, you’re eligible for an additional $7,500 in catch up contributions, raising your employee contribution limit to $31,000. beginning in 2025, those between 60 and 63 will be eligible to contribute up to $11,250 as a catch up contribution.

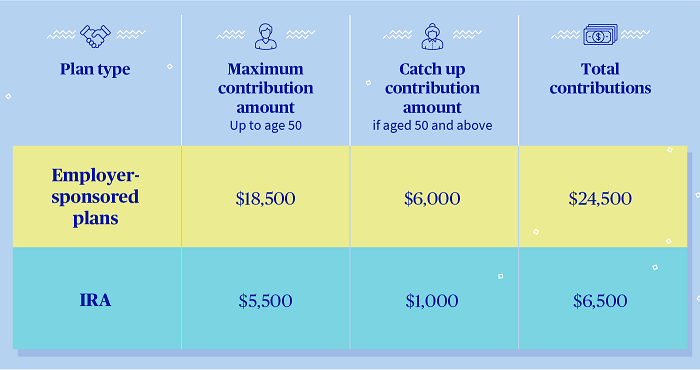

401k Calculator With Catch Up Contributions On the other hand, contributions to a 401(k), both from employees and employers, are always tax deductible because they reduce taxable income, lowering total taxes owed. high contribution limits–401(k)s have relatively high annual contribution limits. for 2024, the limit is $23,000 for those under 50, and $30,500 for those over 50. Calculate how much you can save for retirement with a 401 (k) plan using this online tool. enter your current balance, salary, contributions, rate of return, and retirement age to see your total account value and catch up contributions. With a 50% match, your employer will add another $750 to your 401 (k) account. if you increase your contribution to 10%, your annual contribution is $2,500 per year. your employer match, however. Adults 50 and older can contribute an additional $7,500 to their 401 (k) plans in 2024. in total, qualifying adults can save up to $30,500 per year. when also considering employer matching.

401k Calculator With Catch Up Contributions With a 50% match, your employer will add another $750 to your 401 (k) account. if you increase your contribution to 10%, your annual contribution is $2,500 per year. your employer match, however. Adults 50 and older can contribute an additional $7,500 to their 401 (k) plans in 2024. in total, qualifying adults can save up to $30,500 per year. when also considering employer matching. The irs sets limits on how much money someone can contribute to a 401 (k) over the course of a tax year. for 2024, this contribution limit is set at $23,000. however, if you're over the age of 50, you can also deposit up to $7,500 in "catch up" contributions to your 401 (k) during the 2024 tax year, which means the total limit for these savers. Simple 401k calculator terms & definitions. 401k – a tax qualified, defined contribution pension account as defined in subsection 401 (k) of the internal revenue taxation code. inflation – the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

Free 401k Calculator For Excel Calculate Your 401k Savings The irs sets limits on how much money someone can contribute to a 401 (k) over the course of a tax year. for 2024, this contribution limit is set at $23,000. however, if you're over the age of 50, you can also deposit up to $7,500 in "catch up" contributions to your 401 (k) during the 2024 tax year, which means the total limit for these savers. Simple 401k calculator terms & definitions. 401k – a tax qualified, defined contribution pension account as defined in subsection 401 (k) of the internal revenue taxation code. inflation – the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

401k Calculator With Catch Up Contributions

Comments are closed.