4 Factors That Could Force A Housing Market Correction This Fall

4 Factors That Could Force A Housing Market Correction This Fall Youtube Borrowers saw their equity slip by 1.7% in q2 2023 compared to the year before with an average decline of $8,700 between q1 and q2, according to a recent corelogic report. nonetheless, home equity. National housing market predictions for 2025 2029. following is a summary for year end 2024, 2025 and predictions for the housing market through 2029. although a recession is no longer predicted, economic growth is expected to decline from 2023’s fairly robust rate of 2.5% to 2.1% in 2024 and 2% in 2025.

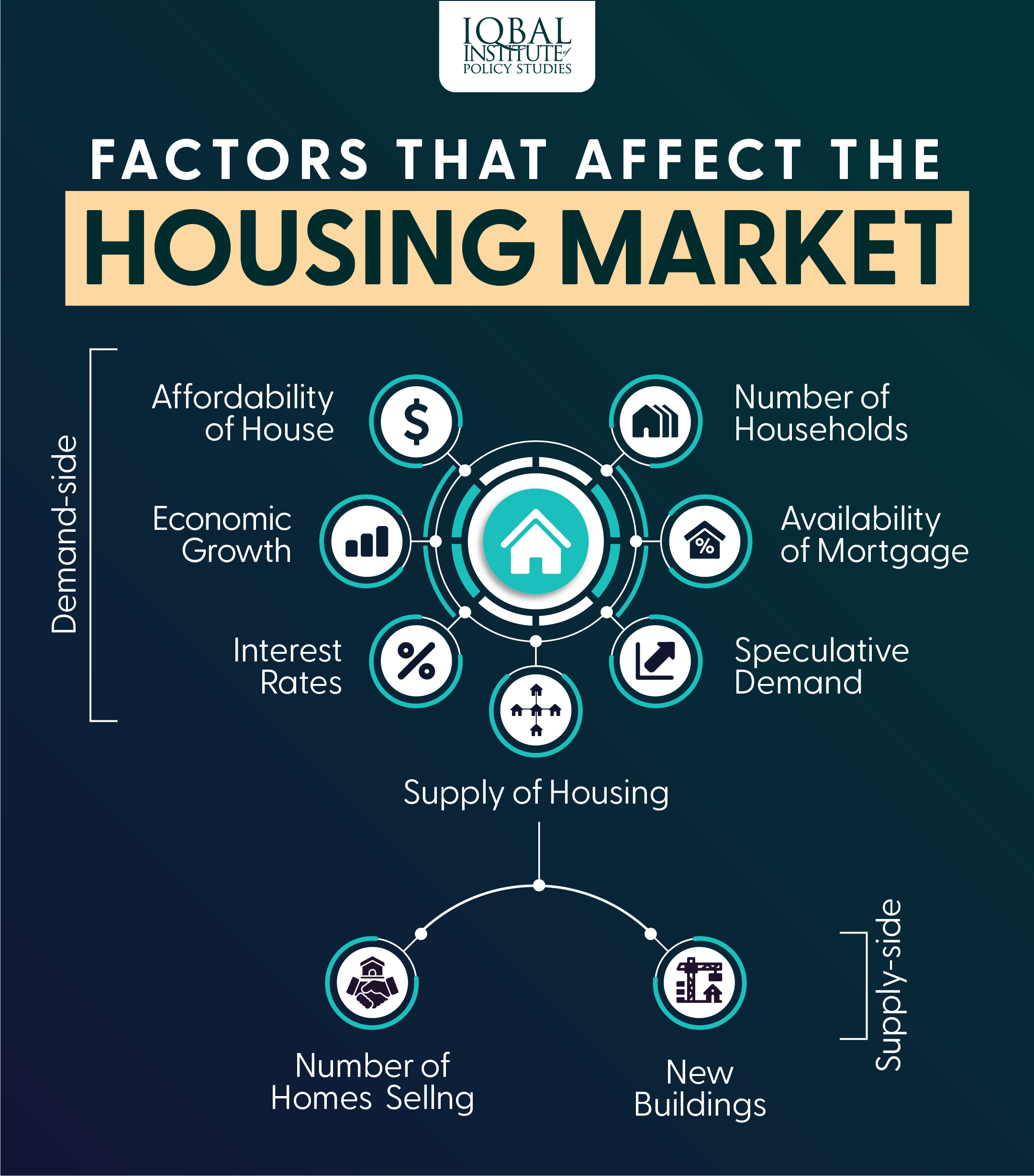

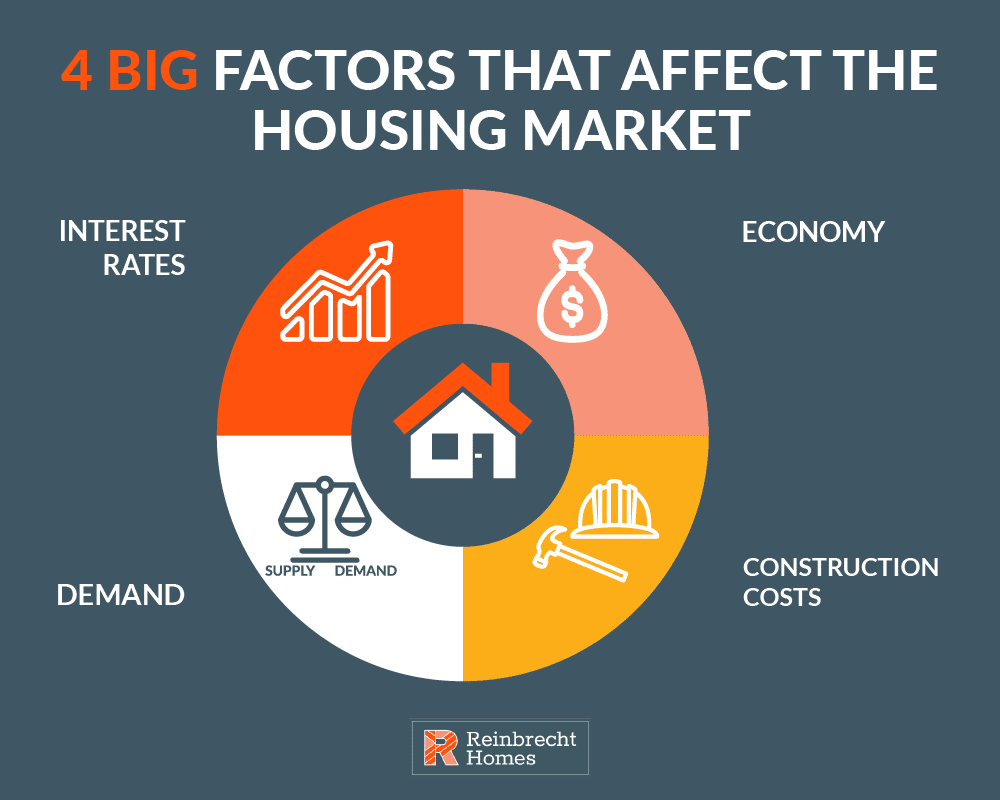

Factors That Affect The Housing Market Iips Infographics February 1, 2023, 3:10 pm pst. speaking to clients in spring 2022, researchers at john burns real estate consulting made their case for why the red hot u.s. housing market would soon plunge into a. Fannie mae sees home prices rising 6.1% year over year by the end of 2024. in 2025, home price growth could slow to 3% year over year. the mortgage bankers association believes prices could rise 3. Everybody knows that mortgage rates are by far the dominant force in determining home prices. the steep fed induced drop that sent the 30 year from nearly 5% in the fall of 2018 to under 3% from. This could come as something of a surprise given that mortgage rates are also at new highs of around 7%. according to michael rehaut, head of u.s. homebuilding and building products research at j.p. morgan, rates don’t need to fall to drive housing market activity — they just need to stabilize. “during a period of rising rates, the ground.

The Housing Market Correction As Told By 4 Charts Abc Times Everybody knows that mortgage rates are by far the dominant force in determining home prices. the steep fed induced drop that sent the 30 year from nearly 5% in the fall of 2018 to under 3% from. This could come as something of a surprise given that mortgage rates are also at new highs of around 7%. according to michael rehaut, head of u.s. homebuilding and building products research at j.p. morgan, rates don’t need to fall to drive housing market activity — they just need to stabilize. “during a period of rising rates, the ground. As homebuyers pull back, zandi says the housing correction will see inventory levels rise and home sales volumes fall. it would also, he said, put much of the nation at risk of falling home prices. If home prices drop more dramatically, a housing crash could occur – and it would be more obvious than a correction. during the housing crash that went hand in hand with the great recession, home prices fell by more than 30% in many markets. based on current housing market conditions, such an accelerated drop in home prices seems unlikely.

How Interest Rates Affect New Home Costs A Trustworthy Guide As homebuyers pull back, zandi says the housing correction will see inventory levels rise and home sales volumes fall. it would also, he said, put much of the nation at risk of falling home prices. If home prices drop more dramatically, a housing crash could occur – and it would be more obvious than a correction. during the housing crash that went hand in hand with the great recession, home prices fell by more than 30% in many markets. based on current housing market conditions, such an accelerated drop in home prices seems unlikely.

Factors That Affect The Value Of A House Market Forces Propertybook

Comments are closed.