3 Misconceptions About Va Loans

The Top Three Takeaway Top Three Misconceptions About Va Loans Focus Myth 3: "veterans are 'guaranteed' a va loan". fact: no one is guaranteed a loan. even service members with va loan entitlement. the word “guaranty” often pops up in va loan discussions. consequently, many buyers think military service entitles veterans to a “no strings attached” va loan. not so. Myth #3: va loans require private mortgage insurance (pmi). fact: private mortgage insurance is not required for va loans. pmi typically adds 0.2% 0.9% of expenses to your monthly mortgage payments when you put less than 20% down. that’s a big additional expense you don’t have to worry about when you get a va loan.

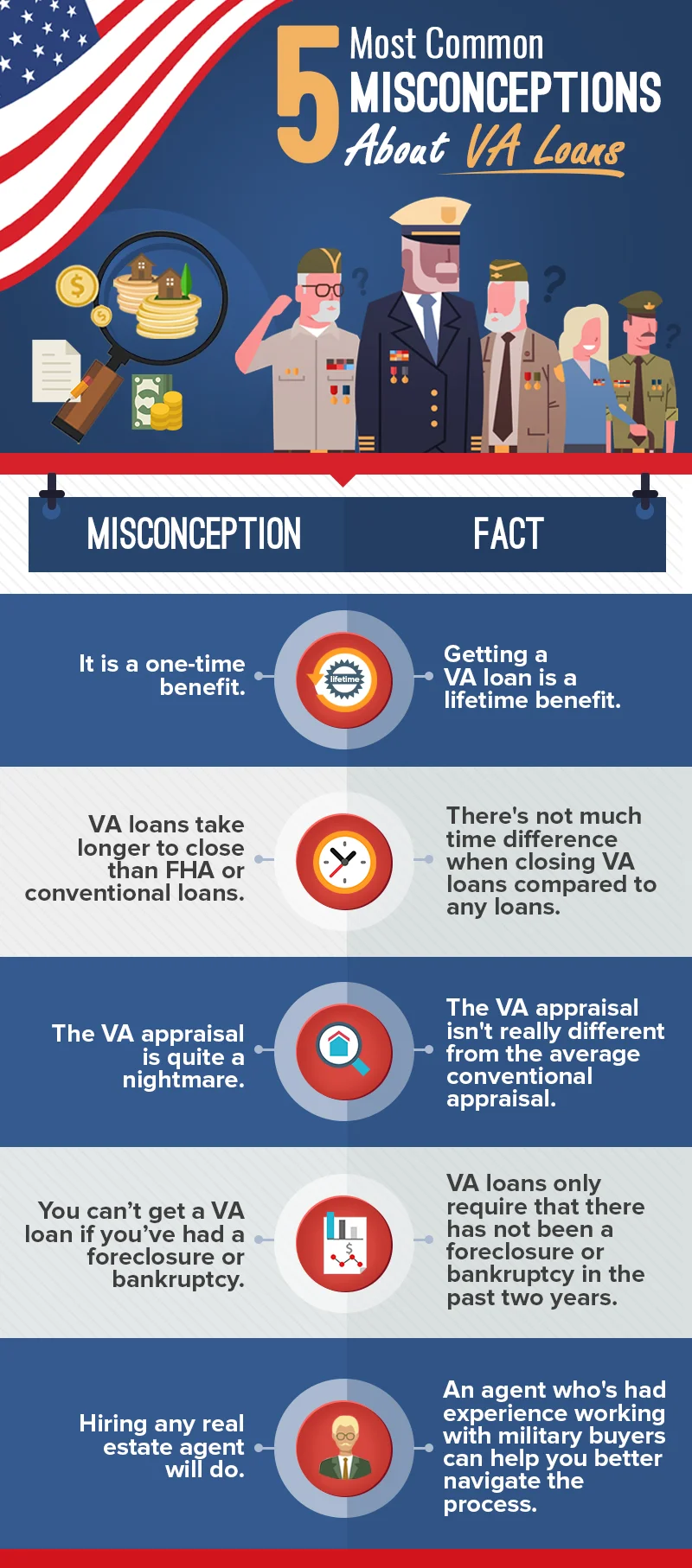

5 Most Common Misconceptions About Va Loans The Pro Team Realtors Va loan interest rates are usually as low or lower than competitive rates on conventional loans. based on data from ellie mae, the average interest rate on 30 year conventional loans was 4.39%. So let’s set the record straight regarding four common va loan myths. myth 1: this is a lousy loan product. fact: this is one of the best loan options on the market. qualified buyers can purchase up to $417,000 in most locations before needing to make a down payment. fha loans require a 3.5 percent down payment, and many conventional lenders. Previously, the va loan program required borrowers to make a down payment on any loan that exceeded conventional loan limits. but not anymore. as of january 1, 2020, va eligible borrowers can get. You can ask the seller to pay all of your closing costs, regardless of the total amount. the va does have a cap on seller concessions at 4 percent of the loan amount. but feel free to ask for the moon when it comes to the closing costs. there's no guarantee the seller will bite, but you won't know if you don't ask.

3 Common Misconceptions Surrounding Va Home Loans Five Talents Realty Previously, the va loan program required borrowers to make a down payment on any loan that exceeded conventional loan limits. but not anymore. as of january 1, 2020, va eligible borrowers can get. You can ask the seller to pay all of your closing costs, regardless of the total amount. the va does have a cap on seller concessions at 4 percent of the loan amount. but feel free to ask for the moon when it comes to the closing costs. there's no guarantee the seller will bite, but you won't know if you don't ask. Myth #3: the va appraisal is a nightmare or takes a long time and calls for repairs. fact: va appraisals are no more difficult than other loan appraisals unless the home is in poor condition. the va uses minimum property requirement (mpr) guidelines to make sure the home is in good condition, safe, sanitary, and structurally sound. Here are four common va loan myths that are incorrect. 1. va loans feature high note rates. reality: va loans offer a consistently lower note rate over 30 years than conventional loans. mid.

Comments are closed.