2024 W4 Form Tutorial Step By Step How To Fill Out A W4 Form

How To Fill In 2024 W 4 Form Step By Step Instructions Please leave a comments. foragertax. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents.

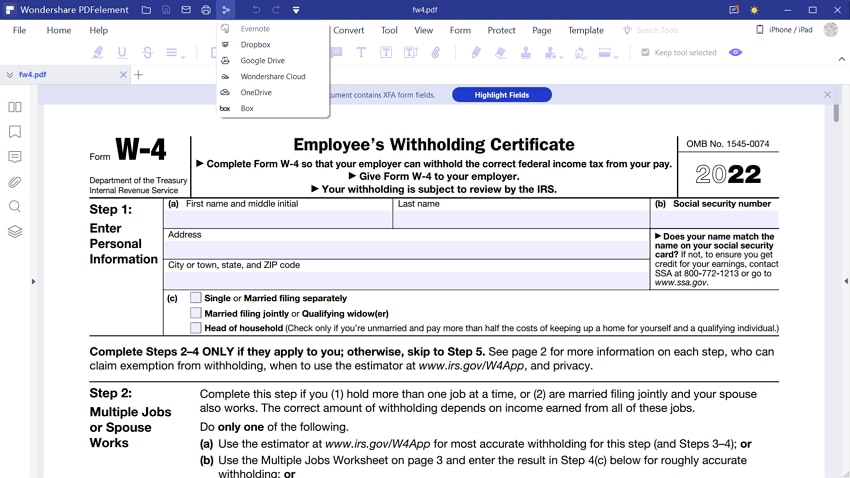

W4 Form 2024 Quick Overview Filling Out The W 4 Tax Form Money How to fill out a w 4. step 1: enter your personal information. fill in your name, address, social security number and tax filing status. importantly, your tax filing status is the basis for which. Step by step guide on how to accurately fill out the irs w 4 form, including tips for dealing with multiple jobs, claiming dependents, and utilizing deductio. The 2024 update in step 2. the most notable change in the 2024 w 4 form occurs in step 2, which deals with considerations for those who have multiple jobs or are filing jointly with a working spouse. the irs has updated this section to replace the previous "reserved for future use" with a direct prompt to utilize the irs’ w 4 tax withholding. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

How To Fill Out An Irs W 4 Form 2024 W4 Tax Form Money Instructor The 2024 update in step 2. the most notable change in the 2024 w 4 form occurs in step 2, which deals with considerations for those who have multiple jobs or are filing jointly with a working spouse. the irs has updated this section to replace the previous "reserved for future use" with a direct prompt to utilize the irs’ w 4 tax withholding. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. The redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Above by writing “exempt” on form w 4 in the space below step 4(c). then, complete steps 1(a), 1(b), and 5. do not complete any other steps. you will need to submit a new form w 4 by february 15, 2025. your privacy. steps 2(c) and 4(a) ask for information regarding income you received from sources other than the job associated with this.

W4 Form 2024 For Employee To Fill Out And Print Reeta Celestia The redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Above by writing “exempt” on form w 4 in the space below step 4(c). then, complete steps 1(a), 1(b), and 5. do not complete any other steps. you will need to submit a new form w 4 by february 15, 2025. your privacy. steps 2(c) and 4(a) ask for information regarding income you received from sources other than the job associated with this.

Irs W4 Form How To Fill Out W4 Tax Form W4 Form Step By Step Walk

Comments are closed.