2024 W 9 Form Blank Printable Doti Nannie

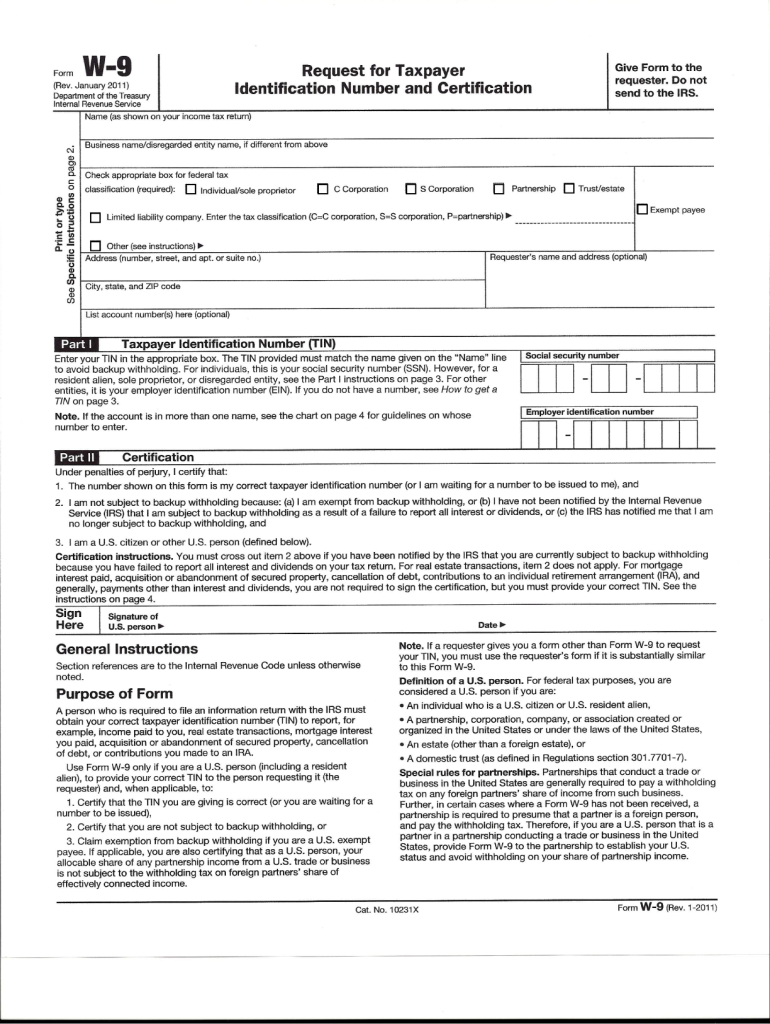

Blank W 9 Form Printable 2024 See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity. Form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file.

W 9 Form Printable Fill Out Sign Online Dochub An irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. pdf. updated october 24, 2024. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. The irs w 9 form certifies that the tin (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. this tax document may be found online on the irs. W 9. (rev. march 2024. you begin.request for taxpayer identification number and certificati. atest information.for. uidance related to the purpo. e of form w 9, seepurp. of form, below.give form. o the requester. do. ot send to the irs. name of entity individual. an entry is required. (for a sole proprietor or disregarded entity, enter the.

W 9 Form 2024 Printable Free Pdf Kimmy Ashleigh The irs w 9 form certifies that the tin (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. this tax document may be found online on the irs. W 9. (rev. march 2024. you begin.request for taxpayer identification number and certificati. atest information.for. uidance related to the purpo. e of form w 9, seepurp. of form, below.give form. o the requester. do. ot send to the irs. name of entity individual. an entry is required. (for a sole proprietor or disregarded entity, enter the. Fill out w 9 form. fill in your information and tax identification number (ssn or ein). 2. add signature. esign form by clicking "sign field" at the end of part ii. 3. send to your client. click the “send” button and opt to “send via email” or download it as pdf. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly.

W9 Form 2024 What Is A W 9 Tax Form Who Can Fill It And How Complete Fill out w 9 form. fill in your information and tax identification number (ssn or ein). 2. add signature. esign form by clicking "sign field" at the end of part ii. 3. send to your client. click the “send” button and opt to “send via email” or download it as pdf. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly.

2024 W 9 Form Fillable Carma Cristal

Comments are closed.