2024 W 2 Form Irs Angel Blondie

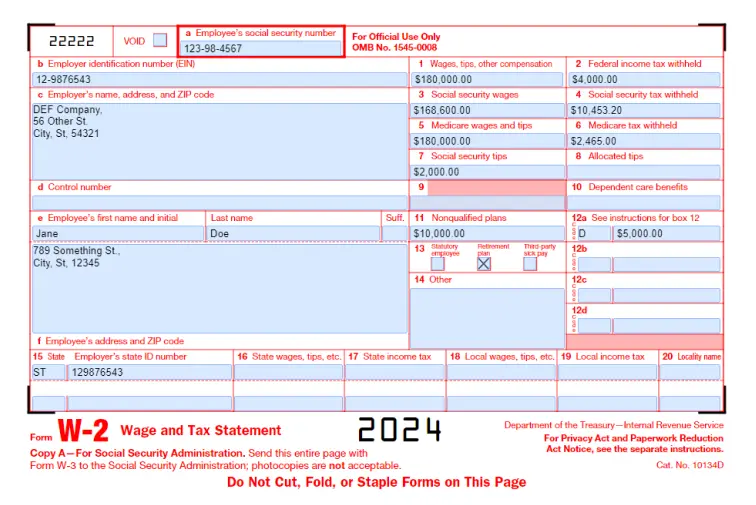

2024 W 2 Form Irs Angel Blondie The ssa is unable to process these forms. instead, you can create and submit them online. see e filing, later. due dates. by january 31, 2025, furnish copies b, c, and 2 to each person who was your employee during 2024. mail or electronically file copy a of form(s) w 2 and w 3 with the ssa by january 31, 2025. The entries on form w 2 must be based on wages paid during the calendar year. use form w 2 for the correct tax year. for example, if the employee worked from december 15, 2024, through december 28, 2024, and the wages for that period were paid on january 3, 2025, include those wages on the 2025 form w 2.

2024 W 2 Forms Printable Tova Ainsley Online ordering for information returns and employer returns. other current products. information about form w 2, wage and tax statement, including recent updates, related forms and instructions on how to file. form w 2 is filed by employers to report wages, tips, and other compensation paid to employees as well as fica and withheld income taxes. Changes in federal laws through the secure 2.0 act may change the way employers fill out w 2 forms for tax year 2024. subscribe to newsletters must be reported on form 1099 r for the year in. Form w 2 reports an employee’s annual wages as well as the amount of taxes withheld from their pay by their employer. employees use the information on the w 2 to complete their personal income tax return. employers must file a copy of each employee’s w 2 with the social security administration (ssa) and the internal revenue service (irs). Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2.

W 2 Form 2024 Irs W2 Tax Pdf Template Form w 2 reports an employee’s annual wages as well as the amount of taxes withheld from their pay by their employer. employees use the information on the w 2 to complete their personal income tax return. employers must file a copy of each employee’s w 2 with the social security administration (ssa) and the internal revenue service (irs). Boxes e and f — employee name and address. enter employee names as shown on your forms 941, 943, 944, ct 1, or schedule h (form 1040). if the name of an employee is too long, put the initials of their first and middle name. it’s more important to have the full last name of your employee on irs form w 2. Also known as a “wage and tax statement,” form w 2 is a document that reports your annual wages and the amount of taxes withheld from your paycheck and sent to the irs. it also shows other. The w 2, wage and tax statement, is an irs form that shows your earnings and the taxes withheld from your paycheck for the year. employers are responsible for sending w 2s to all their employees, whether they are full time, part time, or seasonal workers. if you don’t receive a w 2 from your employer, there are many steps you can take to.

2024 Form W2 Gladys Courtney Also known as a “wage and tax statement,” form w 2 is a document that reports your annual wages and the amount of taxes withheld from your paycheck and sent to the irs. it also shows other. The w 2, wage and tax statement, is an irs form that shows your earnings and the taxes withheld from your paycheck for the year. employers are responsible for sending w 2s to all their employees, whether they are full time, part time, or seasonal workers. if you don’t receive a w 2 from your employer, there are many steps you can take to.

Comments are closed.