2024 Retirement Plan Limits Hrpro

2024 Retirement Plan Limits Hrpro The internal revenue service (irs) has released notice 2023 75, containing cost of living adjustments for 2023 that affect amounts employees can contribute to 401(k) plans and individual retirement accounts (iras). 2024 increases the employee contribution limit for 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. other key limit increases include the following:…. Irs releases hsa limits for 2025: irs issued revenue procedure 2024 25, which provides the 2025 cost of living contribution and coverage adjustments for hsas, as required under code section 223(g). it also includes the 2025 limit for excepted benefit hras. the limits for all items increased for 2025.

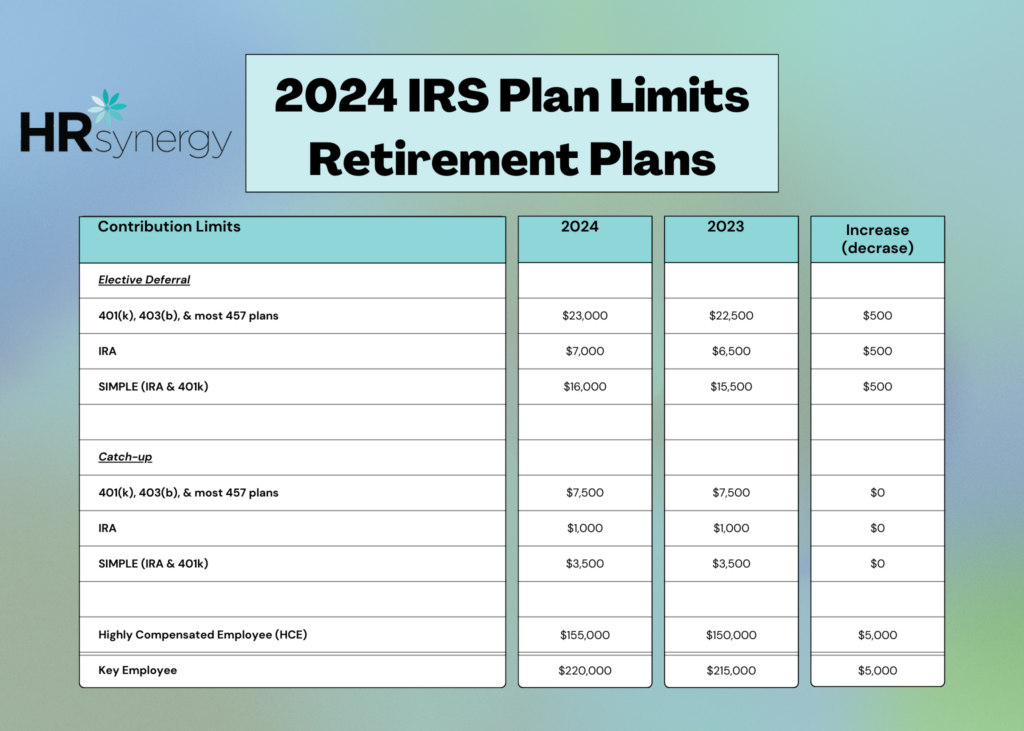

Irs 2024 Plan Limits Hr Synergy Llc Key employees' compensation threshold for top heavy plan testing 4. $220,000. $215,000. $5,000. highly compensated employees’ threshold for nondiscrimination testing 5. $155,000. $150,000. Qualified plan (or another retirement plan specified in section 219(g)(5)) and have adjusted gross incomes (as defined in section 219(g)(3)(a)) between $79,000 and $89,000, increased from between $77,000 and $87,000. for married couples filing jointly, if the spouse who makes the ira contribution is an active participant,. Contribution limits for 401 (k)s and other defined contribution plans: the annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403 (b) and 457 plans, as well as for salary reduction simplified employee pension (sarsep) plans. the annual limits will rise to $16,000 (up from $15,500) for savings incentive match. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension.

Just In 2024 Benefit Limits Hrpro Contribution limits for 401 (k)s and other defined contribution plans: the annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403 (b) and 457 plans, as well as for salary reduction simplified employee pension (sarsep) plans. the annual limits will rise to $16,000 (up from $15,500) for savings incentive match. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension. Ira and roth ira deduction and contribution phase out limits for 2023 and 2024. traditional ira (magi* deduction phase out) 2023. 2024. single or head of household (if the individual is an active participant in another plan) $73,001–$82,999. $77,001–$86,999. married filing jointly (if the individual is an active participant in another plan. 2024 magi limits for traditional ira tax deduction . married filing jointly or qualifying widow(er) if the contributor is an active participant, or both spouses participate, in an employee sponsored retirement plan: $123,000 $143,000.

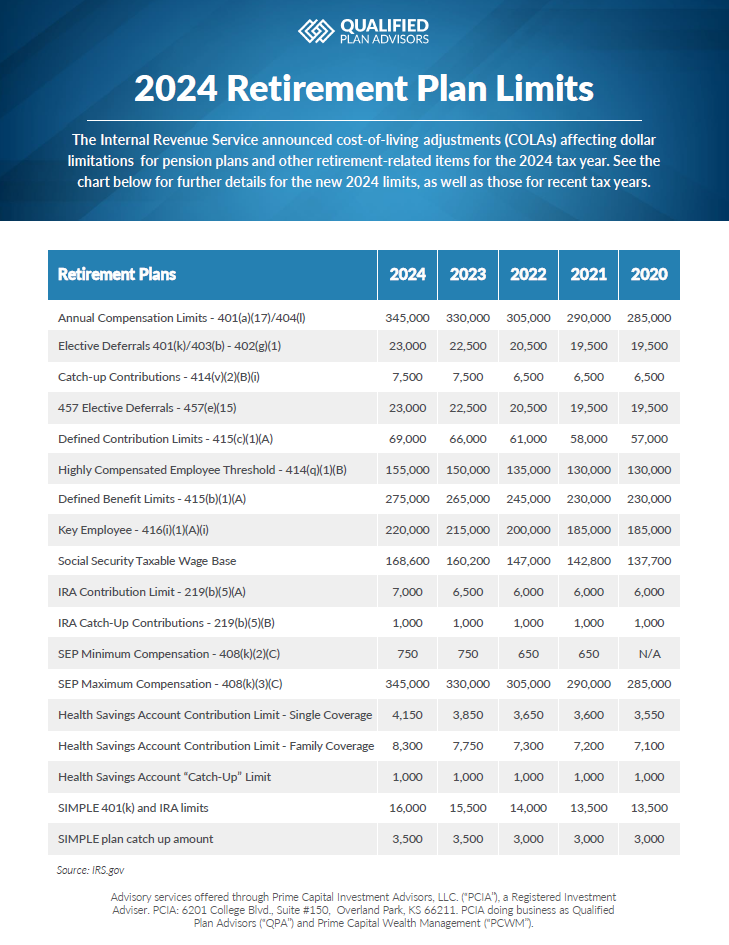

2024 Retirement Plan Limits Qualified Plan Advisors Qpa Ira and roth ira deduction and contribution phase out limits for 2023 and 2024. traditional ira (magi* deduction phase out) 2023. 2024. single or head of household (if the individual is an active participant in another plan) $73,001–$82,999. $77,001–$86,999. married filing jointly (if the individual is an active participant in another plan. 2024 magi limits for traditional ira tax deduction . married filing jointly or qualifying widow(er) if the contributor is an active participant, or both spouses participate, in an employee sponsored retirement plan: $123,000 $143,000.

Just In 2024 Benefit Limits Hrpro

.jpg?width=600&height=1500&name=2024 Contribution Limits Retirement Plans Infographic (1).jpg)

Irs Announces 2024 Retirement Plan Limits

Comments are closed.