2024 Retirement Plan Contribution Limits Planmember Retirement

2024 Retirement Plan Contribution Limits Planmember Retirement For 2024, almost all the annual retirement plan contribution limits have increased from their 2023 levels. limits for 2024 include: for individuals under age 50, the maximum contribution to 401 (k), 403 (b), and 457 (b) plans increased to $23,000. for individuals age 50 and older, the additional catch up contribution to 401 (k), 403 (b) and. For 2024, almost all the annual retirement plan contribution limits have increased from their 2023 levels. limits for 2024 include: for individuals under age 50, the maximum contribution to 401(k), 403(b), and 457(b) plans increased to $23,000.

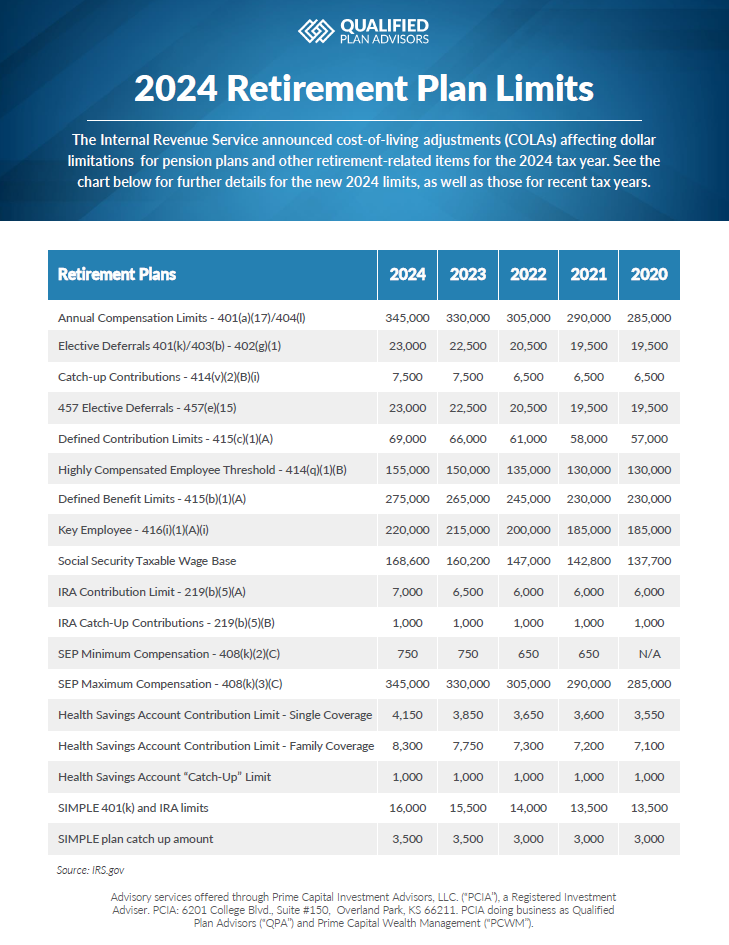

2024 Ira And Retirement Plan Limits Intelligent Investing If you have questions about 2024 irs plan contribution limits, contact the planmember service center at (800) 874 6910. The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the. Qualified plan (or another retirement plan specified in section 219(g)(5)) and have adjusted gross incomes (as defined in section 219(g)(3)(a)) between $79,000 and $89,000, increased from between $77,000 and $87,000. for married couples filing jointly, if the spouse who makes the ira contribution is an active participant,. The catch up contribution limit for individuals age 50 is $7,500 in 2024 (unchanged from 2023). defined contribution plans in total. the total contribution limit for defined contribution plans is $69,000 in 2024 (up from $66,000 in 2023). iras. the contribution limit to an individual retirement account (ira) is $7,000 (up from $6,500 in 2023).

.jpg?width=600&height=1500&name=2024 Contribution Limits Retirement Plans Infographic (1).jpg)

Irs Announces 2024 Retirement Plan Limits Qualified plan (or another retirement plan specified in section 219(g)(5)) and have adjusted gross incomes (as defined in section 219(g)(3)(a)) between $79,000 and $89,000, increased from between $77,000 and $87,000. for married couples filing jointly, if the spouse who makes the ira contribution is an active participant,. The catch up contribution limit for individuals age 50 is $7,500 in 2024 (unchanged from 2023). defined contribution plans in total. the total contribution limit for defined contribution plans is $69,000 in 2024 (up from $66,000 in 2023). iras. the contribution limit to an individual retirement account (ira) is $7,000 (up from $6,500 in 2023). The irs has released 2024 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (irs notice 2023 75) contribution limits. 401(k), 403(b), and most 457 plans for 2024, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $23,000, up from $22,500 in 2023. The irs has announced an increase in the annual employee deferral limit for workplace retirement plans, including 401(k)s, 403(b)s, and others, effective 2024. this change aims to encourage more.

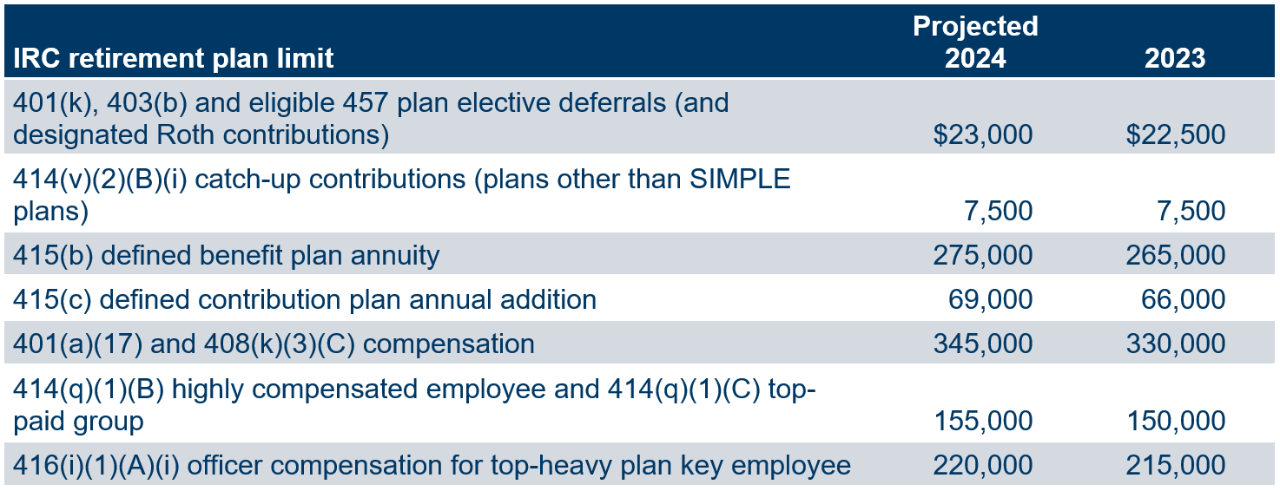

Mercer Projects 2024 Retirement Plan Limits Updated The irs has released 2024 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (irs notice 2023 75) contribution limits. 401(k), 403(b), and most 457 plans for 2024, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $23,000, up from $22,500 in 2023. The irs has announced an increase in the annual employee deferral limit for workplace retirement plans, including 401(k)s, 403(b)s, and others, effective 2024. this change aims to encourage more.

2024 Retirement Plan Limits Qualified Plan Advisors Qpa

Comments are closed.