2024 Retirement Plan Contribution Limits Northwest Bank

2024 Retirement Plan Contribution Limits Northwest Bank The internal revenue service announced retirement plan contribution limits for 2024. for the most part the 2024 limits are unchanged from the 2023 limits. the notable changes were the increase in the roth ira eligibility threshold and the ability for 401(k) and simple ira participants to increase their contributions, as well as ira investors. The retirement plan has a matching contribution with access to personalized financial advice to help you achieve your financial goals. enrollment in the retirement plan: if you are age 18 or older you are eligible to contribute after your first pay with northwest. you can make changes to your contribution rate at any time.

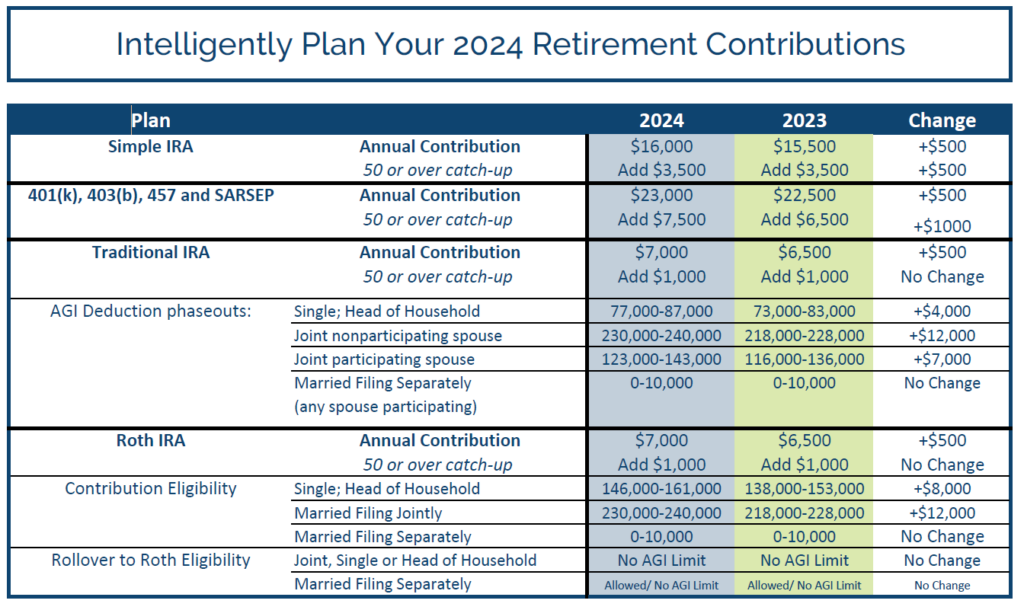

2024 Retirement Plan Contribution Limits Northwest Bank This handy chart shows the 2024 benefits plan limits and thresholds for 401(k) plans, adoption assistance, health savings accounts, flexible spending accounts and more. 2024: 2023: change: hsa. The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the. An employer with 26 to 100 employees would be permitted to provide these higher deferral limits, but only if the employer either provides a 4% matching contribution or a 3% “nonelective” employer contribution. 6. under a simple 401 (k) plan, compensation is generally limited to $345,000 in 2024. 7. The catch up contribution limit for individuals age 50 is $7,500 in 2024 (unchanged from 2023). defined contribution plans in total. the total contribution limit for defined contribution plans is $69,000 in 2024 (up from $66,000 in 2023). iras. the contribution limit to an individual retirement account (ira) is $7,000 (up from $6,500 in 2023).

2024 Retirement Plan Contribution Limits Northwest Bank An employer with 26 to 100 employees would be permitted to provide these higher deferral limits, but only if the employer either provides a 4% matching contribution or a 3% “nonelective” employer contribution. 6. under a simple 401 (k) plan, compensation is generally limited to $345,000 in 2024. 7. The catch up contribution limit for individuals age 50 is $7,500 in 2024 (unchanged from 2023). defined contribution plans in total. the total contribution limit for defined contribution plans is $69,000 in 2024 (up from $66,000 in 2023). iras. the contribution limit to an individual retirement account (ira) is $7,000 (up from $6,500 in 2023). The irs has released 2024 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (irs notice 2023 75) contribution limits. 401(k), 403(b), and most 457 plans for 2024, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $23,000, up from $22,500 in 2023. When you put money into an employer sponsored plan or an individual retirement account (ira), you get certain tax benefits as an incentive for saving for your future. this article covers: the 2024 retirement plan contribution limits; considerations for traditional and roth ira contributions; 5 tips for making the most of your retirement.

2024 Ira And Retirement Plan Limits Intelligent Investing The irs has released 2024 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (irs notice 2023 75) contribution limits. 401(k), 403(b), and most 457 plans for 2024, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $23,000, up from $22,500 in 2023. When you put money into an employer sponsored plan or an individual retirement account (ira), you get certain tax benefits as an incentive for saving for your future. this article covers: the 2024 retirement plan contribution limits; considerations for traditional and roth ira contributions; 5 tips for making the most of your retirement.

Comments are closed.