2024 Hsa Maximum Contribution Limits Nona Thalia

2024 Hsa Contribution Limits The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2024. the new 2024 hsa contribution limit is $4,150 if you are single—a 7.8%.

Irs Makes Historical Increase To 2024 Hsa Contribution Limits First We've also included the catch up contribution for each year, which is an additional amount the government allows you to contribute each year if you're 55 or older. all data has been sourced from the irs and is updated as new information and limits come out. year. limit (single) limit (married) catch up limit. 2025. $4,300. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. (people 55 and older can stash away an extra $1,000.) the 2024 caps were adjusted from this year’s limits of $3,850 for individuals and $7,750 for families. the $300 contribution limit increase for individuals is the largest ever. 2024 hsa contribution limits. you can contribute the following amounts to an hsa in 2024 if you have an eligible hdhp: up to $4,150 if you have self only coverage. up to $8,300 if you have family. The maximum contribution for self only coverage is $4,150. the maximum contribution for family coverage is $8,300. those age 55 and older can make an additional $1,000 catch up contribution. add.

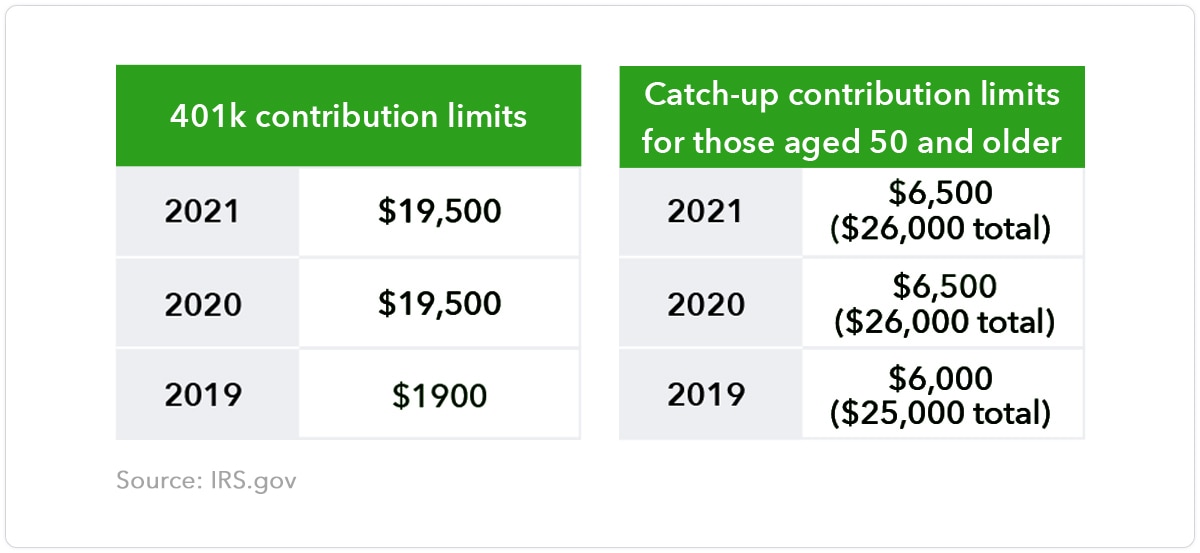

2024 401k Contribution Limits 2024 Catch Up Chart Raye Valene 2024 hsa contribution limits. you can contribute the following amounts to an hsa in 2024 if you have an eligible hdhp: up to $4,150 if you have self only coverage. up to $8,300 if you have family. The maximum contribution for self only coverage is $4,150. the maximum contribution for family coverage is $8,300. those age 55 and older can make an additional $1,000 catch up contribution. add. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. the hsa contribution limit for family coverage is $8,300. those amounts are about. If you have an eligible health plan for the entirety of 2024, your contribution limits for 2024 are $4,150 for single coverage or $8,300 for family coverage. if you’re 55 years or older, you can also contribute another $1,000 to your hsa in 2024. with this extra $1,000, your total contribution limits would be $5,150 if your plan only covers.

Hsa 2024 Contribution Limits Tonye Gwenneth For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. the hsa contribution limit for family coverage is $8,300. those amounts are about. If you have an eligible health plan for the entirety of 2024, your contribution limits for 2024 are $4,150 for single coverage or $8,300 for family coverage. if you’re 55 years or older, you can also contribute another $1,000 to your hsa in 2024. with this extra $1,000, your total contribution limits would be $5,150 if your plan only covers.

Comments are closed.