2024 Contribution Limits Announced By The Irs

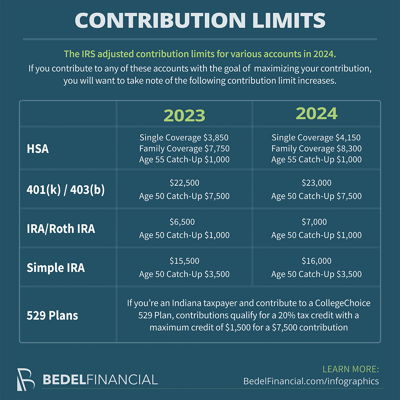

2024 Contribution Limits Announced By The Irs The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the. 2024 limitations adjusted as provided in section 415(d), etc. notice 2023 75 . section 415 of the internal revenue code (“code”) provides for dollar limitations on benefits and contributions under qualified retirement plans. section 415(d) requires that the secretary of the treasury annually adjust these limits for cost of living increases.

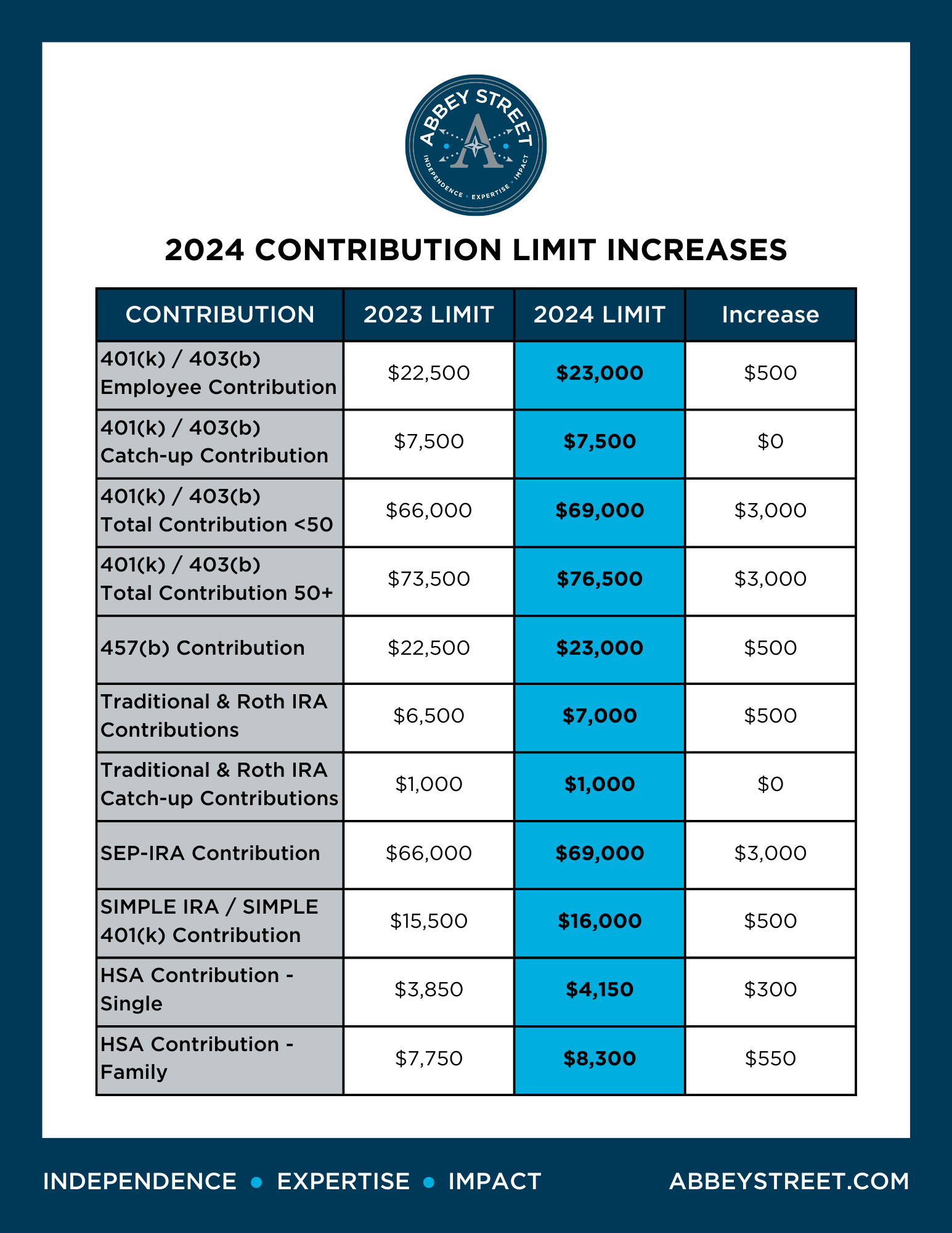

2024 Contribution Limits For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024. this amount is an increase of $500 from the 2023 401 (k. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. The irs has announced an increase in the annual employee deferral limit for workplace retirement plans, including 401(k)s, 403(b)s, and others, effective 2024. this change aims to encourage more. 2024 limit. maximum contribution. $6,500. $7,000. catch up contribution (for those 50 and older) $1,000. $1,000. irs. the income levels used to determine eligibility for ira contribution.

2024 Plan Contribution Limits Announced By Irs Abbeystreet The irs has announced an increase in the annual employee deferral limit for workplace retirement plans, including 401(k)s, 403(b)s, and others, effective 2024. this change aims to encourage more. 2024 limit. maximum contribution. $6,500. $7,000. catch up contribution (for those 50 and older) $1,000. $1,000. irs. the income levels used to determine eligibility for ira contribution. The irs says that the amount you can sock away for retirement is going up. in 2024, individuals can contribute up to $23,000 to their 401 (k) plans in 2024—up from $22,500 for 2023. and those. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older. those limits reflect an increase of $500 over the 2023.

2024 Plan Contribution Limits Announced By Irs Abbeystreet The irs says that the amount you can sock away for retirement is going up. in 2024, individuals can contribute up to $23,000 to their 401 (k) plans in 2024—up from $22,500 for 2023. and those. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older. those limits reflect an increase of $500 over the 2023.

Comments are closed.