2023 Roth Ira Contribution Limit Inflation Protection

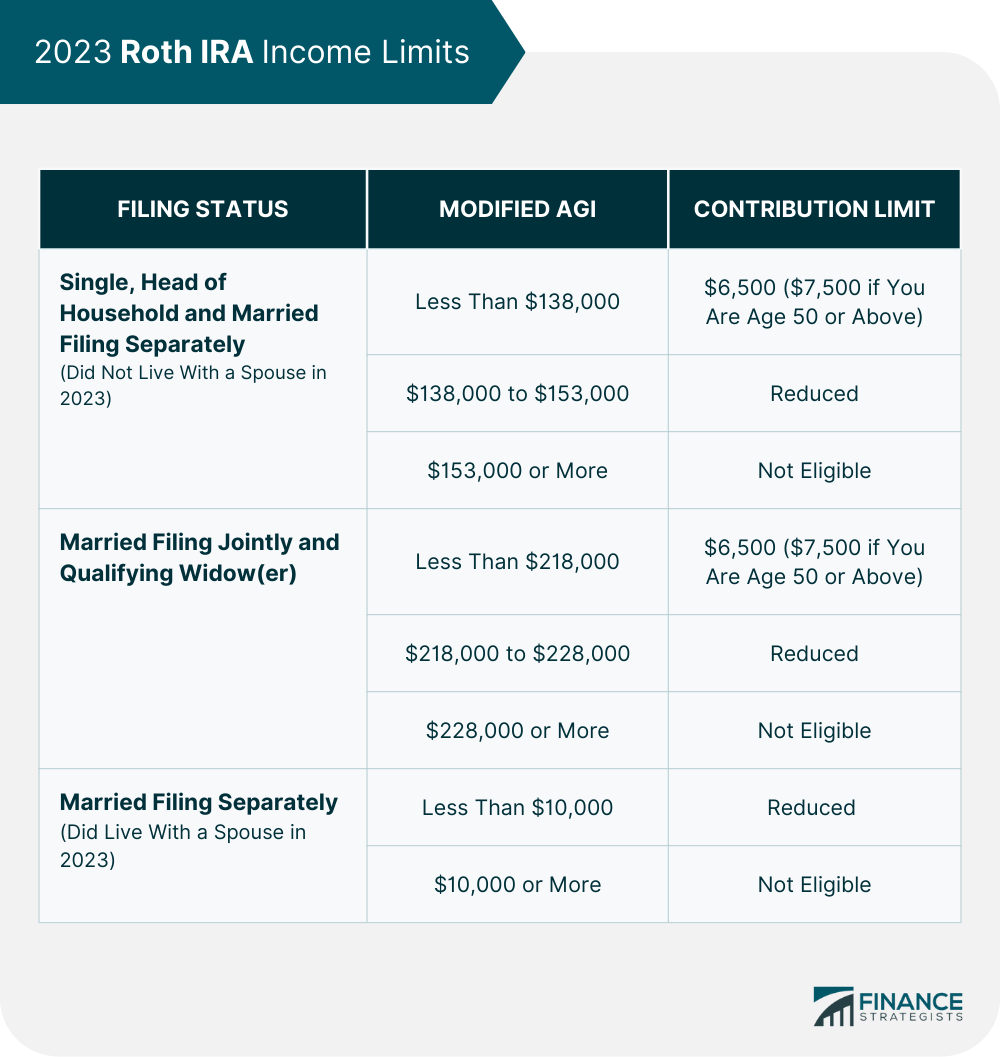

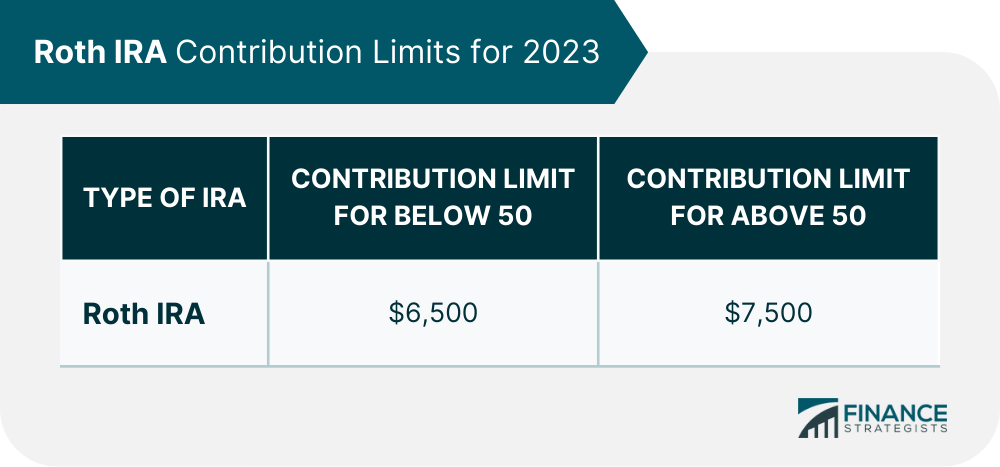

2023 Roth Ira Contribution Limit Inflation Protection Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing a separate return and you lived with your spouse at any time during the year). multiply the maximum contribution limit (before reduction by this adjustment and before reduction for any contributions to traditional iras) by the result. The maximum total annual contribution for all your iras combined is: tax year 2023 $6,500 if you're under age 50 $7,500 if you're age 50 or older. tax year 2024 $7,000 if you're under age 50 $8,000 if you're age 50 or older. with the passage of secure 2.0 act, effective 1 1 2024 you may also be eligible to contribute to your roth ira.

Ira Contribution Limits In 2023 Meld Financial Ira contribution limit increased. beginning in 2023, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). increase in required minimum distribution age. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2024. people 50 and older can make an extra $1,000 catch up contribution in both 2023 and 2024. individuals with high. Roth ira income limits 2024. roth ira contribution limits 2024. single, head of household, or married filing separately (if you didn't live with spouse during year) less than $146,000. $7,000. The roth ira has contribution limits, which are $6,500 for 2023 and $7,000 in 2024. if you’re age 50 or older, you can contribute an additional $1,000 as a catch up contribution. contributions.

Roth Ira Contribution Limits 2023 Withdrawal Rules Roth ira income limits 2024. roth ira contribution limits 2024. single, head of household, or married filing separately (if you didn't live with spouse during year) less than $146,000. $7,000. The roth ira has contribution limits, which are $6,500 for 2023 and $7,000 in 2024. if you’re age 50 or older, you can contribute an additional $1,000 as a catch up contribution. contributions. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

Roth Ira Rules And Contribution Limits For 2023 Royalblog For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

Roth Ira Contribution Limits 2023 Withdrawal Rules

Roth Ira 401k 403b Retirement Contribution And Income Limits 2023

Comments are closed.