2023 Irs Contribution Limits And Tax Rates

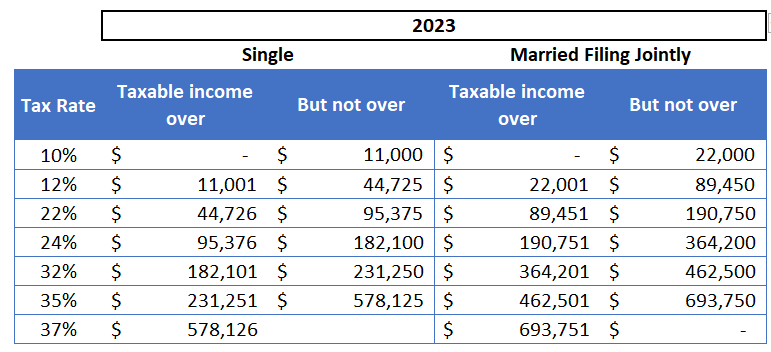

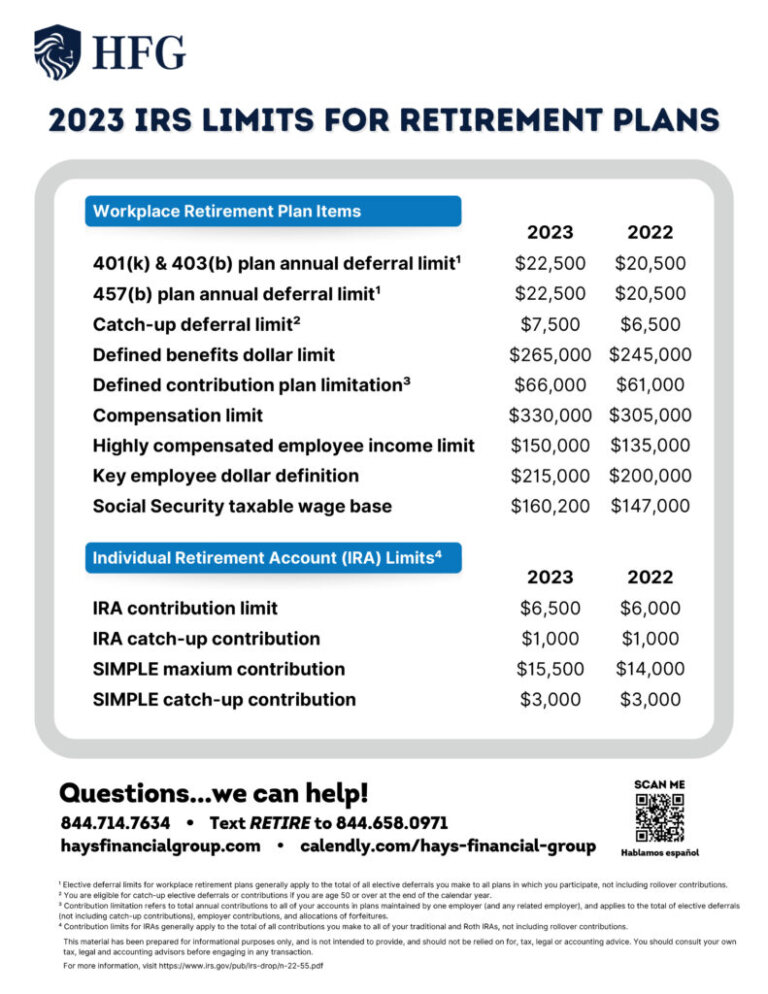

2023 Irs Contribution Limits And Tax Rates By Kristin Mckenna Harvest The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. The irs today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement related items for tax year 2023 in notice 2022 55 pdf, posted today on irs.gov. highlights of changes for 2023. the contribution limit for employees who participate in 401(k), 403(b.

2023 Irs Contribution Limits And Tax Rates For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments. Ir 2023 203, nov. 1, 2023. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. the irs today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for. The irs has released 2023 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (ir 2022 188; notice 2022 55, 2022 45 irb) for 2023, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $22,500, up from $20,500 in 2022. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

2023 Irs Contribution Limits The irs has released 2023 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. (ir 2022 188; notice 2022 55, 2022 45 irb) for 2023, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $22,500, up from $20,500 in 2022. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. For anyone saving for retirement with a traditional or roth ira, the 2023 limit on annual contributions to their account goes up $500 – from $6,000 this year to $6,500 next year. that's an. The internal revenue service announced today that young workers will be allowed to contribute up to $22,500 pretax to a 401 (k) or similar retirement savings plan in 2023, a $2,000 jump from the.

Comments are closed.