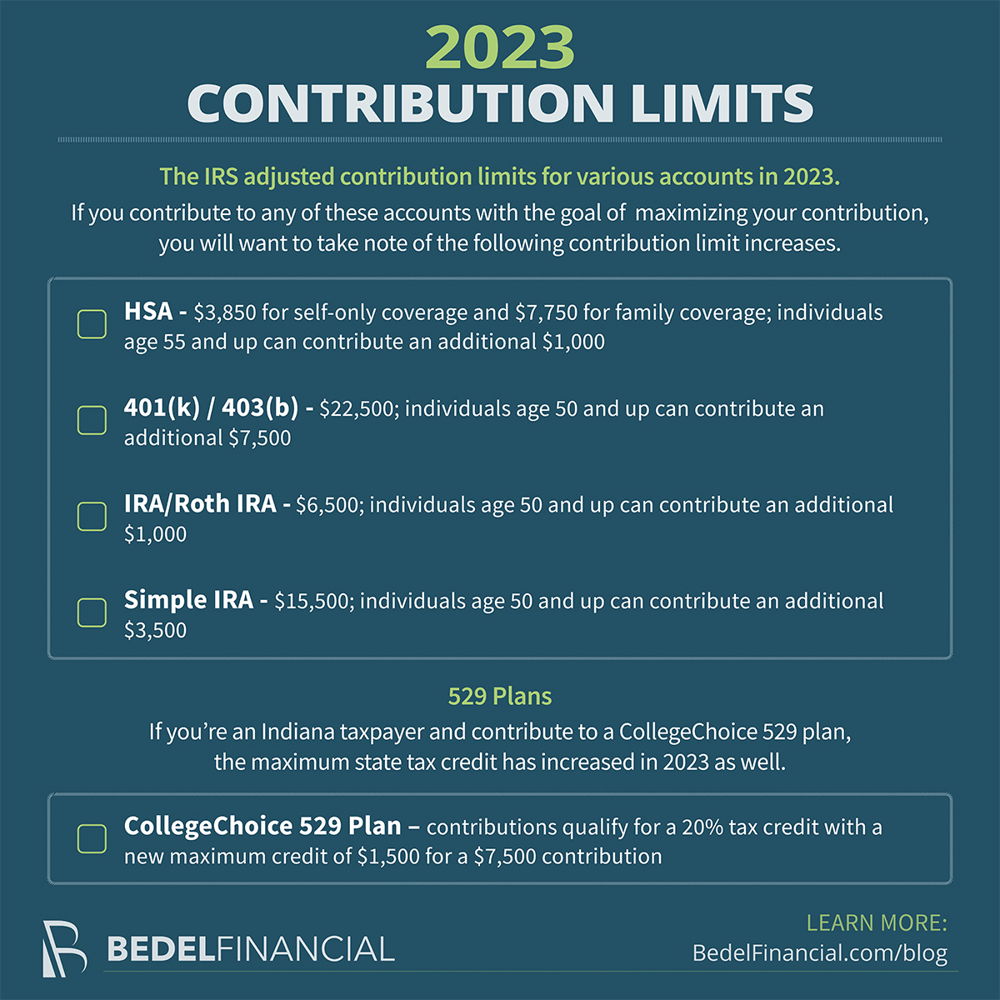

2023 Contribution Limits

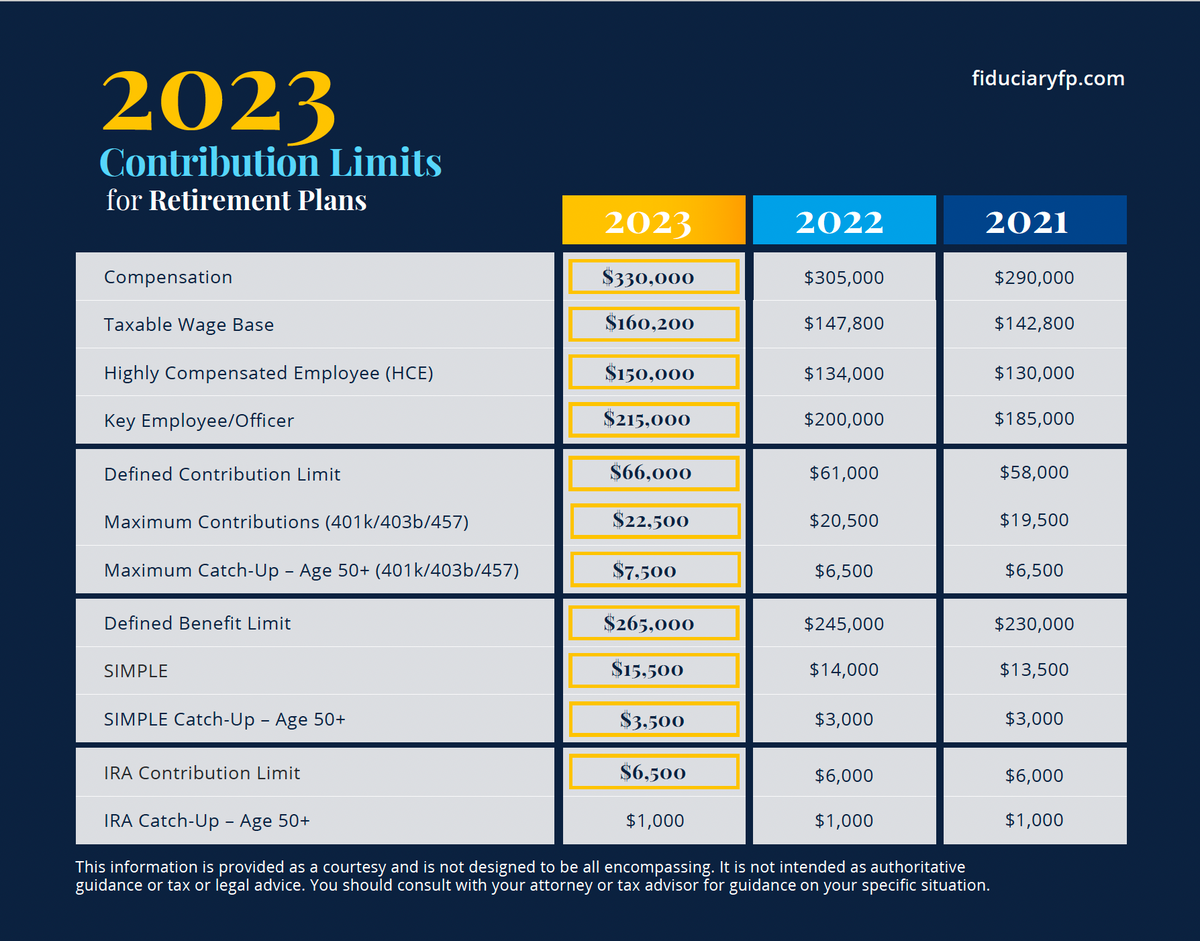

2023 Plan Contribution Limits Announced By Irs Abbeystreet The irs increased the contribution limit for 401 (k) plans to $22,500 and the limit for iras to $6,500 for tax year 2023. the catch up contribution limit for 50 and older participants also rose to $7,500 for 401 (k) plans and $3,500 for simple plans. In 2023, your ira contribution limit is $6,500. however, because of your filing status and agi, the limit on the amount you can deduct is $3,500. you can make a nondeductible contribution of $3,000 ($6,500 – $3,500). in an earlier year, you received a $3,000 qualified reservist distribution, which you would like to repay this year.

401 K Contribution Limits In 2023 Meld Financial 2023 amount of roth ira contributions you can make for 2023; ira contributions after age 70½. for 2020 and later, there is no age limit on making regular contributions to traditional or roth iras. for 2019, if you’re 70 ½ or older, you can't make a regular contribution to a traditional ira. however, you can still contribute to a roth ira. Learn how much you can save in your 401 (k) each year, including roth, pretax, and catch up contributions. find out the irs guidelines, tips, and penalties for avoiding excess contributions. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. The irs has released 2023 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. ( ir 2022 188 ; notice 2022 55, 2022 45 irb) for 2023, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $22,500, up from $20,500 in 2022.

2023 Contribution Limits The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. The irs has released 2023 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. ( ir 2022 188 ; notice 2022 55, 2022 45 irb) for 2023, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $22,500, up from $20,500 in 2022. Americans saving for retirement through a 401(k) account will be able to increase their maximum contributions of pretax wages into it by almost 10 percent in 2023, thanks to a new limit announced. For 2023, the roth 401 (k) contribution limit is $22,500. in 2024, the max is $23,000. if you are 50 or older, you can save $7,500 more in your roth 401 (k) as a "catch up contribution" for both 2023 and 2024. roth 401 (k)s let you invest dollars you've already paid taxes on for retirement. you can then withdraw your contributions—plus any.

2023 Contribution Limits For Retirement Plans Sandbox Financial Partners Americans saving for retirement through a 401(k) account will be able to increase their maximum contributions of pretax wages into it by almost 10 percent in 2023, thanks to a new limit announced. For 2023, the roth 401 (k) contribution limit is $22,500. in 2024, the max is $23,000. if you are 50 or older, you can save $7,500 more in your roth 401 (k) as a "catch up contribution" for both 2023 and 2024. roth 401 (k)s let you invest dollars you've already paid taxes on for retirement. you can then withdraw your contributions—plus any.

2023 Contribution Limits For Retirement Plans Fiduciary Financial

Comments are closed.