2023 401k Contribution Limits Unprecedented Increase Projected

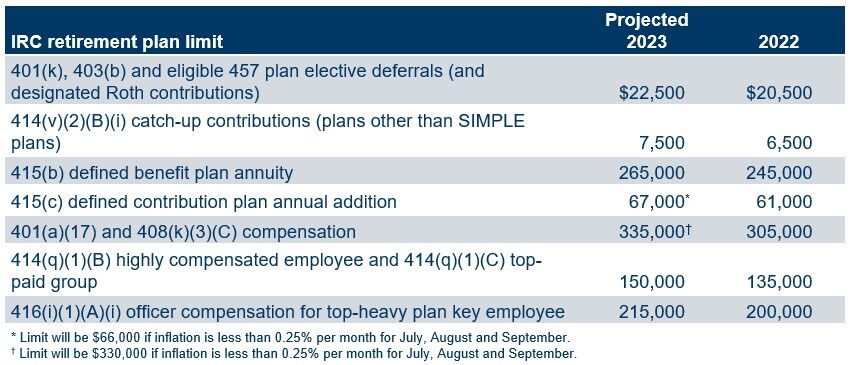

2023 Retirement Plan Contribution Limits Mercer S Projections The ira catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $7,500, up from. Back in june, milliman projected that rampant inflation this year would lead to the 401 (k) contribution limit for 2023 to jump to $22,000 from this year’s $20,500 limit. now another major benefits consulting firm is projecting the limit will jump even higher—by another $500. projections released recently from mercer indicate that 2023.

401k Limit In 2023 Tabitomo The catch up contribution in the 401 (k) and other workplace plans – the amount plan participants who are 50 and older may save on top of the federal contribution limit – also will get a big. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. This article was updated. e mployee 401(k) contributions for 2023 will top off at $22,500—a $2,000 increase from the $20,500 cap for 2022—the irs announced on oct. 21. plan participants age 50. For 2023, the amount an individual can contribute to a 401 (k), 403 (b), and most 457 plans increases to $22,500, up from $20,500 in 2022. the catch up contribution amount, for employees 50 and older who participate in these plans, increases to $7,500 from $6,500. note. this means participants over 50 can contribute up to $30,000 to one of.

401 K Contribution Limits In 2023 Meld Financial This article was updated. e mployee 401(k) contributions for 2023 will top off at $22,500—a $2,000 increase from the $20,500 cap for 2022—the irs announced on oct. 21. plan participants age 50. For 2023, the amount an individual can contribute to a 401 (k), 403 (b), and most 457 plans increases to $22,500, up from $20,500 in 2022. the catch up contribution amount, for employees 50 and older who participate in these plans, increases to $7,500 from $6,500. note. this means participants over 50 can contribute up to $30,000 to one of. This amount is up modestly from 2024, when the individual 401 (k) contribution limit was $23,000, or $30,500 for employees who were 50 or older. 2025 is also the first year that a new, higher. The 401 (k) contribution limit will increase to $22,500 in 2023. some of the income limits for 401 (k) plans will also increase. here's how the 401 (k) plan limits will change in 2023: the 401 (k.

Comments are closed.