2022 Irs Hsa Hdhp Limits Announced Table Published Gente

2022 Irs Hsa Hdhp Limits Announced Table Published Gente Your withdrawals are also tax-free as long as you use the money for healthcare expenses approved by the IRS HSA contribution 2025 HDHP minimum deductibles and maximum out-of-pocket limits The IRS just dropped a raft of changes, big and small, to the US tax code that could shift how much you owe — or save — in 2025 From bigger deductions to higher limits on health-related

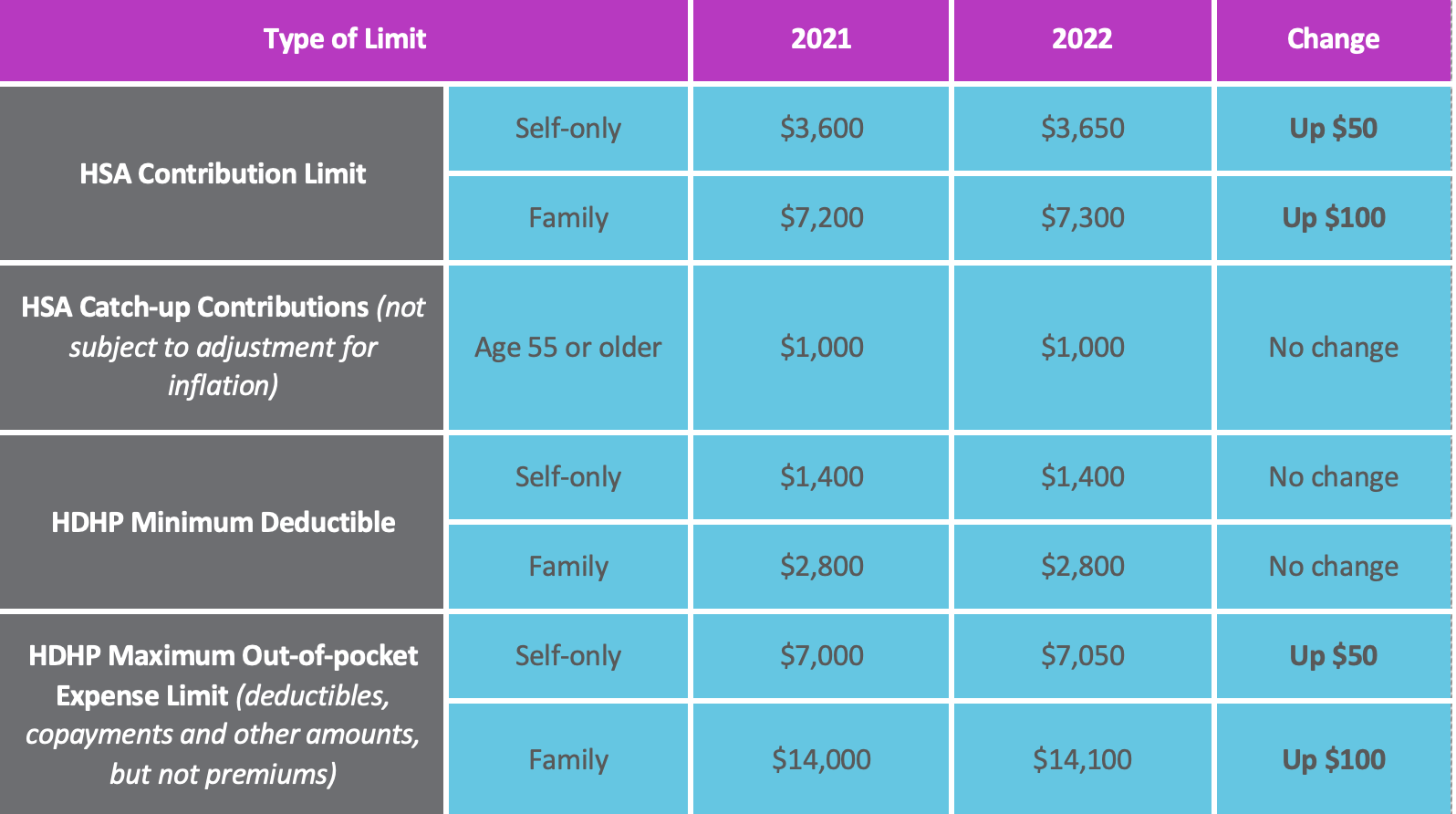

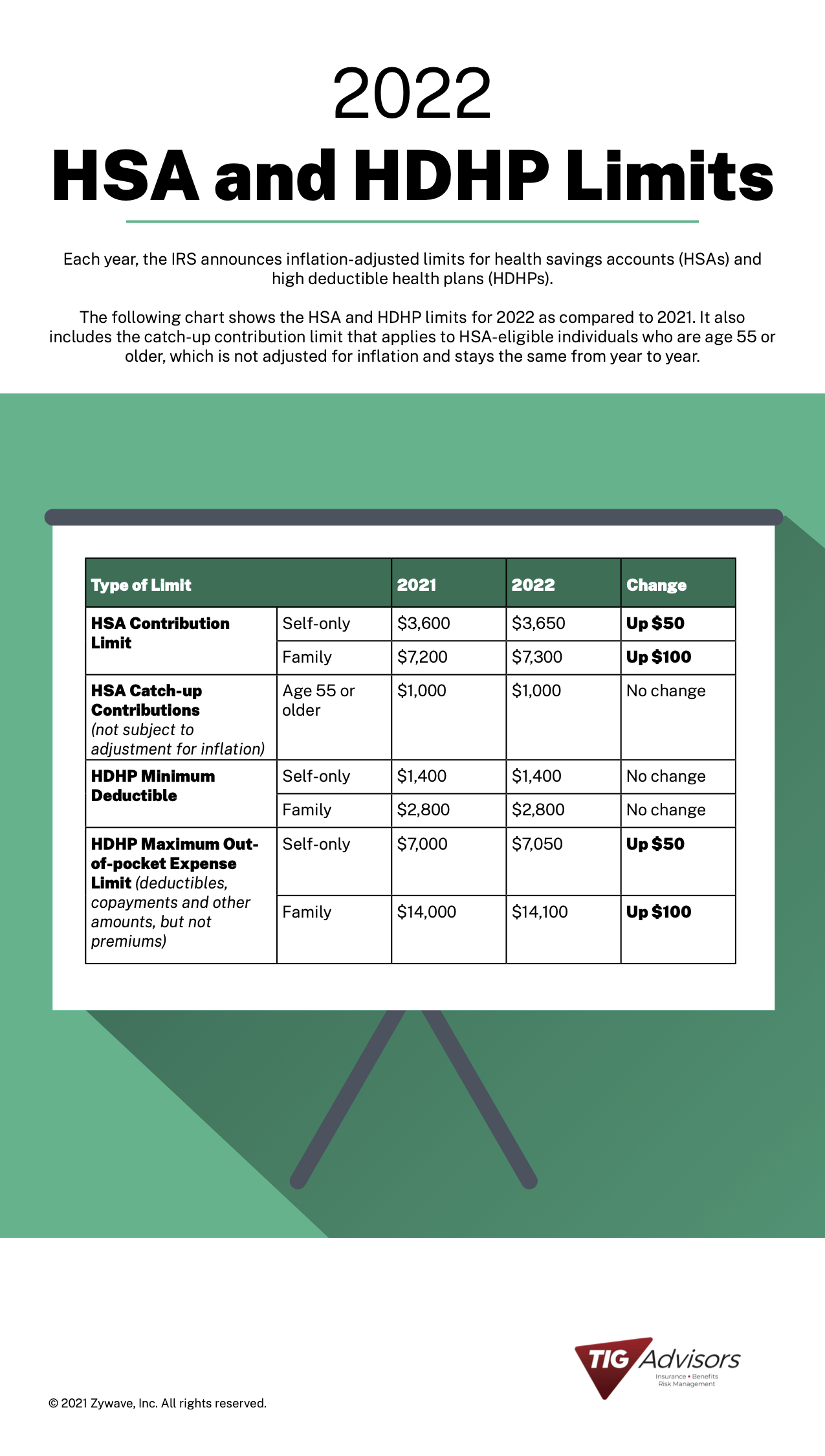

How Do Your 2022 Hsa Hdhp Limits Compare To 2021 S Tig Advisors 2022 On Friday, the IRS announced new increased limits for pension and retirement plan contributions The Internal Revenue Service (IRS) building in seen in Washington, DC on August 19 The Internal Revenue Service (IRS) on Friday announced that it increased the limit of $23,000 in 2024 to $23,500 in 2025 Those limits also apply to several other retirement plans and will And the IRS just announced 2025's contribution limits Here's what you need to know In 2025, you'll be able to contribute up to $23,500 to your 401(k) if you're under the age of 50 That's a $500 The IRS has announced higher 401(k) contribution limits for 2025 Starting in 2025, employees can defer $23,500 into workplace plans, up from $23,000 in 2024 Only 14% of employees deferred the

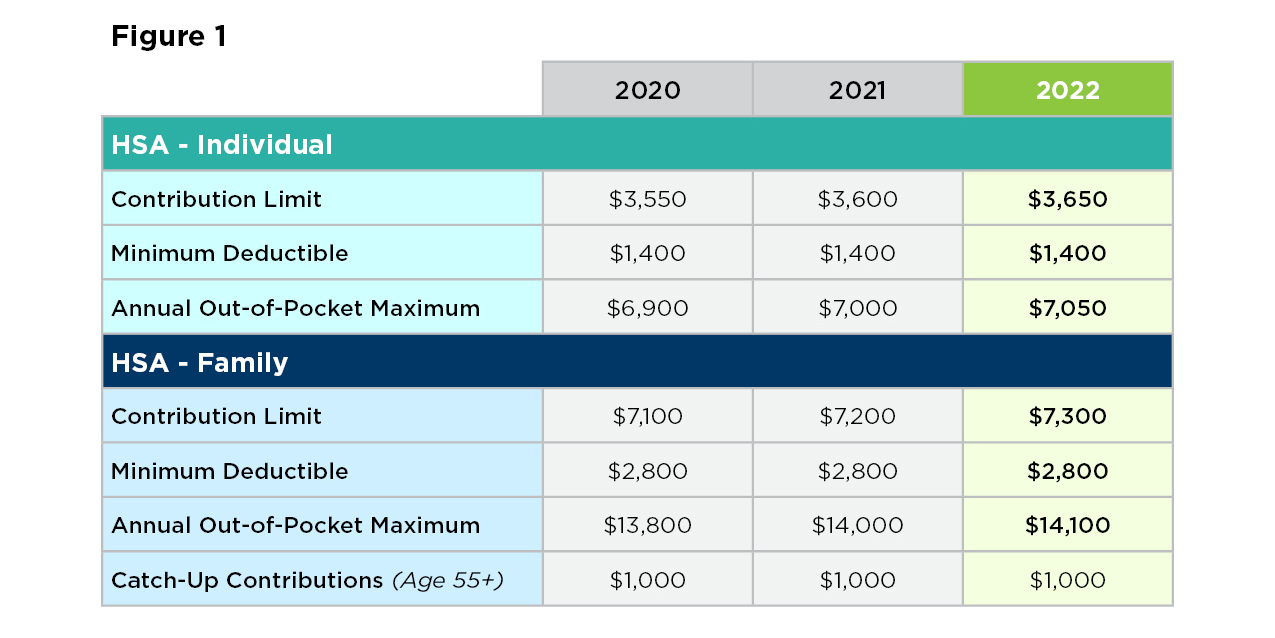

Irs Releases 2022 Hsa Contribution Limits And Hdhp Deductible And Out And the IRS just announced 2025's contribution limits Here's what you need to know In 2025, you'll be able to contribute up to $23,500 to your 401(k) if you're under the age of 50 That's a $500 The IRS has announced higher 401(k) contribution limits for 2025 Starting in 2025, employees can defer $23,500 into workplace plans, up from $23,000 in 2024 Only 14% of employees deferred the

Hsa Limits For 2022 Announced Sheakley

Irs Announces 2023 Hsa Limits Blog Medcom Benefits

Comments are closed.