2020 Hsa Hdhp Contribution Limits Bhgp S

2020 Hsa Hdhp Contribution Limits Bhgp S Age 55 catch up contribution as in 401k and ira contributions, you are allowed to contribute extra if you are above a certain age. if you are age 55 or older by the end of year, you can contribute additional $1,000 to your hsa. if you are married, and both of you are age 55, each of you can contribute additional $1,000. december 10, 2019 2:52 pm. The catch up contribution limit (for hsa eligible individuals age 55 or older) is set forth in code § 223(b)(3) and remains at $1,000 for 2020. for more information, see ebia’s consumer driven health care manual at sections x (“hsas: required hdhp coverage”) and xii (“hsas: contributions”).

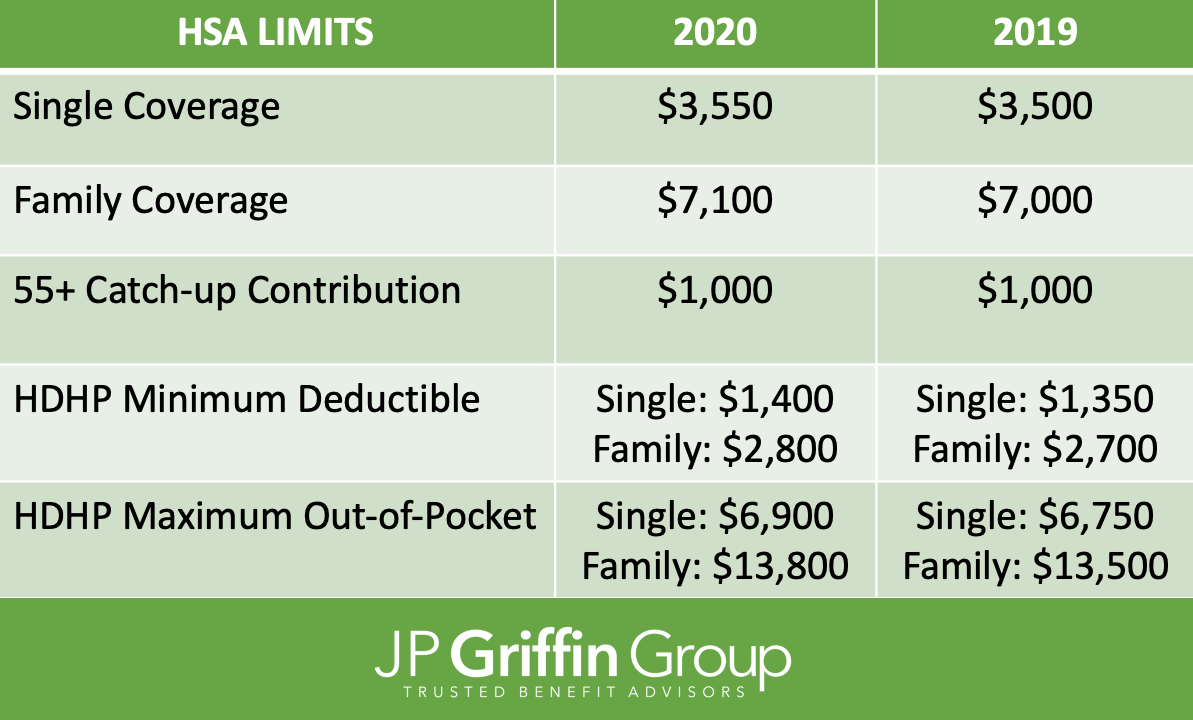

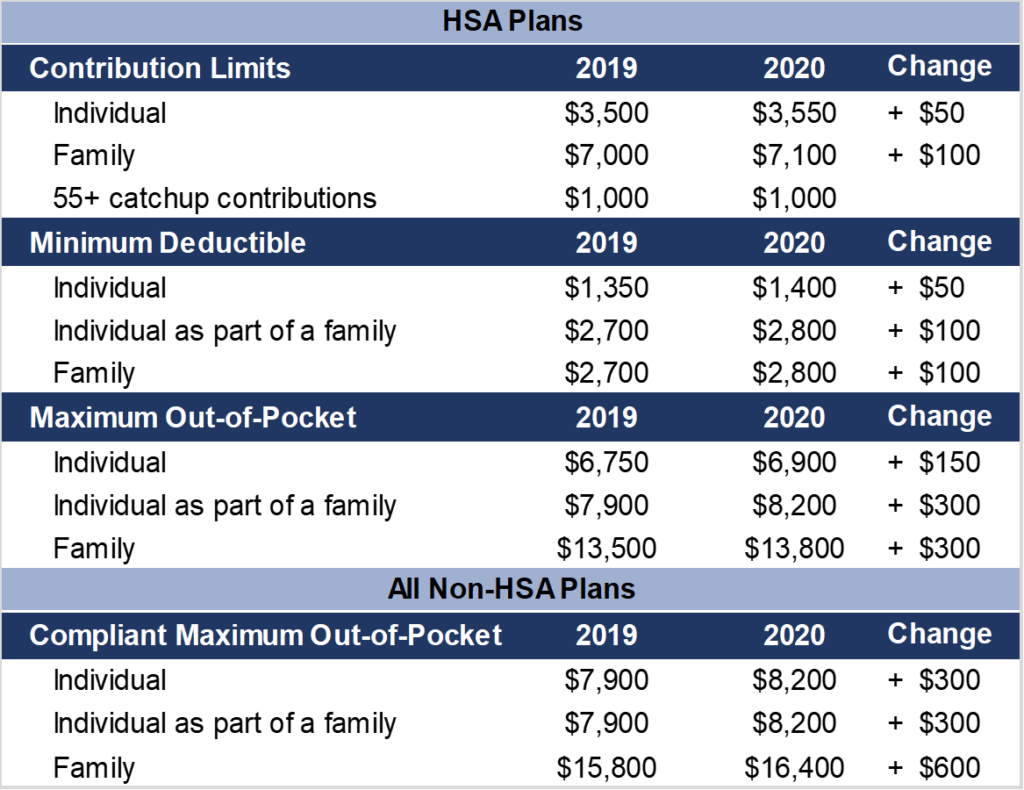

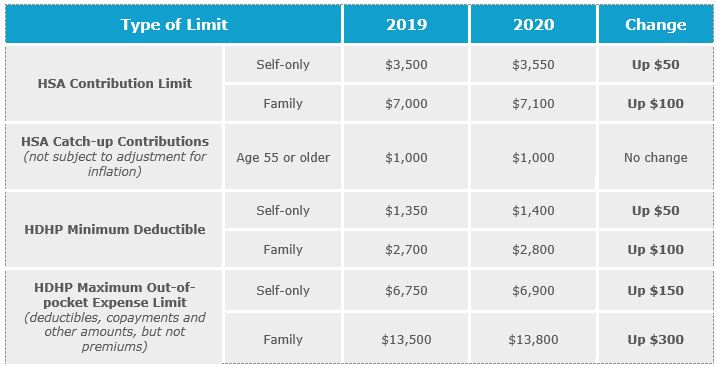

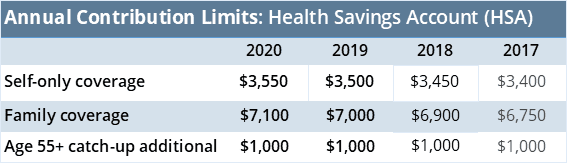

Hsa Limits For 2020 The consolidated appropriations act (p. l. 116 260, december 27, 2020) provides for the following optional plan amendments. a health fsa may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. These limits are indexed for inflation and released annually by june 1st for the following year, as established under the tax relief and health care act of 2006. 2020 annual hsa contribution limits: self only hdhp coverage: $3,550* (up $50 from 2019) family hdhp coverage: $7,100* (up $100 from 2019) *however, an individual who has reached the. That’s about a 1.5 percent increase from this year.in revenue procedure 2019 25, the irs confirmed hsa contribution limits effective for calendar year 2020, along with minimum deductible and. Hsa contribution limits for 2020. for 2020, the annual limit on deductible contributions is $3,550 for individuals with self only coverage under an hdhp (a $50 increase from 2019) and $7,100 for family coverage (a $100 increase from 2019). the limits on annual deductibles are also subject to annual inflation adjustments.

Irs Finally Announces Official Contribution Caps For Fsas 401 K S That’s about a 1.5 percent increase from this year.in revenue procedure 2019 25, the irs confirmed hsa contribution limits effective for calendar year 2020, along with minimum deductible and. Hsa contribution limits for 2020. for 2020, the annual limit on deductible contributions is $3,550 for individuals with self only coverage under an hdhp (a $50 increase from 2019) and $7,100 for family coverage (a $100 increase from 2019). the limits on annual deductibles are also subject to annual inflation adjustments. This means that for the 2020 plan year, an hdhp subject to the aca out of pocket limit rules may have a $6,900 (self only) $13,800 (family) out of pocket limit (and be hsa compliant) so long as there is an embedded individual out of pocket limit in the family tier no greater than $8,150 (so that it is also aca compliant). For 2020, hdhp annual out of pocket expenses (deductibles, copayments, and other amounts, but not premiums) cannot exceed $6,900 for self only coverage and $13,800 for family coverage. the 2020 annual contribution limit to an hsa for individuals with self only coverage under a hdhp is $3,550, and for an individual with family coverage under a.

2020 Health Savings Account And Compliant Health Plan Limits Fosterthomas This means that for the 2020 plan year, an hdhp subject to the aca out of pocket limit rules may have a $6,900 (self only) $13,800 (family) out of pocket limit (and be hsa compliant) so long as there is an embedded individual out of pocket limit in the family tier no greater than $8,150 (so that it is also aca compliant). For 2020, hdhp annual out of pocket expenses (deductibles, copayments, and other amounts, but not premiums) cannot exceed $6,900 for self only coverage and $13,800 for family coverage. the 2020 annual contribution limit to an hsa for individuals with self only coverage under a hdhp is $3,550, and for an individual with family coverage under a.

Hsa Hdhp Limits Increase For 2020

Health Savings Account Limits Increase For 2020 Irs Core Documents

Comments are closed.