2019 Medicare Part D Notice Fosterthomas

2019 Medicare Part D Notice Fosterthomas 2019 medicare part d notice the following information is provided as guidance for employers and their employees regarding medicare part d notification requirements. should you have specific questions regarding your organization’s health plan, or other employee benefits, please contact a fosterthomas employee benefits specialist. Medicare part d notices 2019: your complete guide by matt mccarthy | sep 14, 2020 | aca , affordable care act , employee benefits , health care in preparation for the medicare fall open enrollment period, employers sponsoring group health plans that include prescription drug coverage are required to notify all medicare eligible individuals.

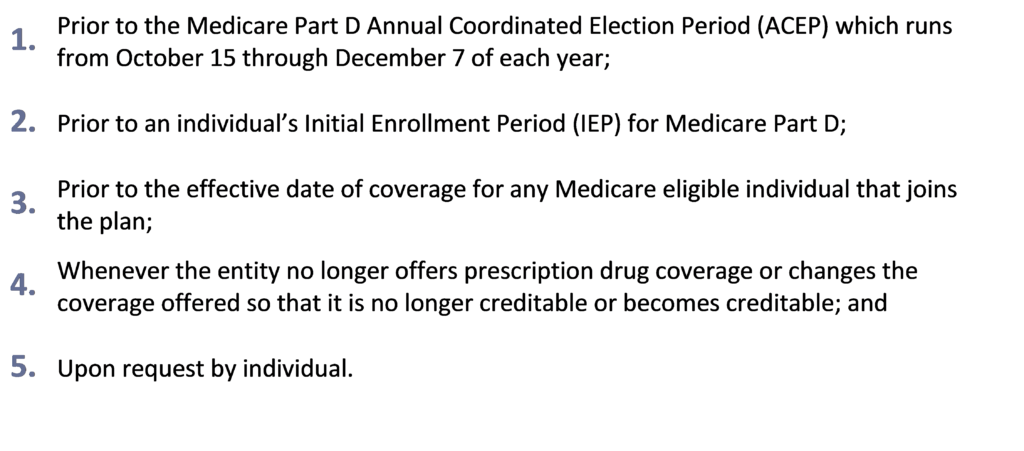

2019 Medicare Part D Notice Fosterthomas Employers sponsoring a group health plan with prescription drug benefits are required to notify their medicare eligible participants and beneficiaries as to whether the drug coverage provided under the plan is “creditable” or “non creditable.” this notification must be provided prior to october 15th each year. also, the employer must notify cms of the creditable status of the drug plan. 10.08.2018. alexander mattingly. the deadline for providing the annual medicare part d creditable coverage notice (the “notice”) is quickly approaching. this notice is provided to inform participants whether or not your plan’s prescription drug coverage is creditable. a group health plan’s prescription drug coverage is considered. Next newsroom article. today, the centers for medicare & medicaid services (cms) released part ii of the 2019 advance notice of methodological changes for medicare advantage (ma) capitation rates and part d payment policies (the advance notice), and draft call letter. cms released part i of the advance notice on december 27, 2017. Get the right medicare drug plan for you. what medicare part d drug plans cover. overview of what medicare drug plans cover. learn about formularies, tiers of coverage, name brand and generic drug coverage. official medicare site. costs for medicare drug coverage. learn about the types of costs you’ll pay in a medicare drug plan.

2019 Medicare Part D Notice Fosterthomas Next newsroom article. today, the centers for medicare & medicaid services (cms) released part ii of the 2019 advance notice of methodological changes for medicare advantage (ma) capitation rates and part d payment policies (the advance notice), and draft call letter. cms released part i of the advance notice on december 27, 2017. Get the right medicare drug plan for you. what medicare part d drug plans cover. overview of what medicare drug plans cover. learn about formularies, tiers of coverage, name brand and generic drug coverage. official medicare site. costs for medicare drug coverage. learn about the types of costs you’ll pay in a medicare drug plan. Health plans, inc. compliance toolkit – 08 2019 guidelines for electronic distribution of medicare part d notices cms guidance indicates that group health plan sponsors may use the electronic disclosure rules in dol reg. §2520.104b 1(c)(1) to provide the notices to medicare part d eligible individuals, with a. Other expenses for which you are responsible include the initial deductible, initial coverage limit, out of pocket costs, and the coverage gap (donut hole). in 2022, the medicare part d deductible cannot exceed $545 for any plan or carrier. additionally, the average medicare part d monthly premium is $34.70.

What Is A Medicare Part D Auto Enrollment Notice Health plans, inc. compliance toolkit – 08 2019 guidelines for electronic distribution of medicare part d notices cms guidance indicates that group health plan sponsors may use the electronic disclosure rules in dol reg. §2520.104b 1(c)(1) to provide the notices to medicare part d eligible individuals, with a. Other expenses for which you are responsible include the initial deductible, initial coverage limit, out of pocket costs, and the coverage gap (donut hole). in 2022, the medicare part d deductible cannot exceed $545 for any plan or carrier. additionally, the average medicare part d monthly premium is $34.70.

Comments are closed.