18 Mortgage Cap Rate Griogairnorea

:max_bytes(150000):strip_icc()/Capitalizationrate-122a804a049444c788fceb400986e3df.jpg)

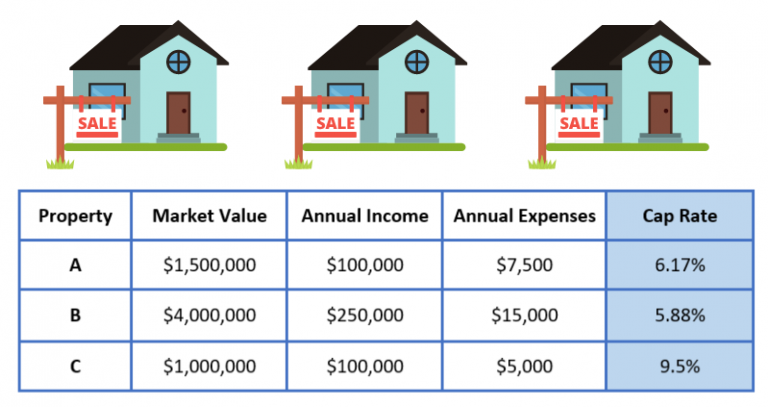

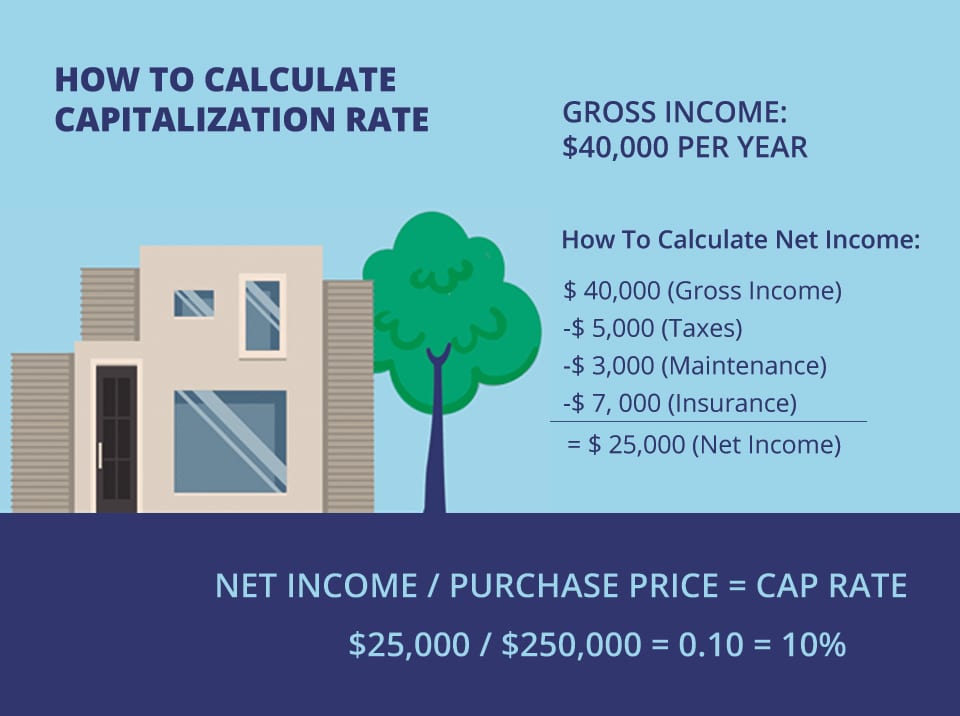

18 Mortgage Cap Rate Griogairnorea Cap rate list. use the cap rate list tool to search for the average cap rate (capitalization rate) by top us cities and states. last updated: 2024 11 03 13:45:18. The formula for cap rate is: cap rate = net operating income (noi) ∕ current market value × 100. let’s walk through an example to better illustrate how to use this formula. 1. calculate the property’s net operating income. first, you’ll need to learn how to calculate the net operating income (noi). the noi is essentially the sum of a.

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor An interest rate cap works by controlling how much a borrower’s interest rate can rise in an adjustment period. a rate cap can protect you from a continuously climbing mortgage rate. the market conditions, including the secured overnight finance rate (sofr), have a big impact on interest rate caps. while mortgage lenders can set interest rate. To calculate the market value of your property, you simply have to divide the net income by the cap rate: $33,600 9.7% = $33,600 0.097 = $346,392. this result is the value of your property. of course, consider this as a rule of thumb – there might be other reasons for increasing or lowering the selling price. Capitalization rate (cap rate): 5.2%. gross operating income = gross rental income − vacancy allowance. gross operating income = $20,000 − $1,000 = $19,000. net operating income (noi) = gross operating income − operating expenses. net operating income = $19,000 − $6,000 = $13,000. capitalization rate = net operating income purchase price. Step 3: divide noi by market value. once you have determined the property's noi and market value, divide the noi by the market value to calculate the cap rate. the formula for calculating cap rate is: cap rate = noi market value. for example, if a property has an noi of $100,000 and a market value of $1,000,000, the cap rate would be:.

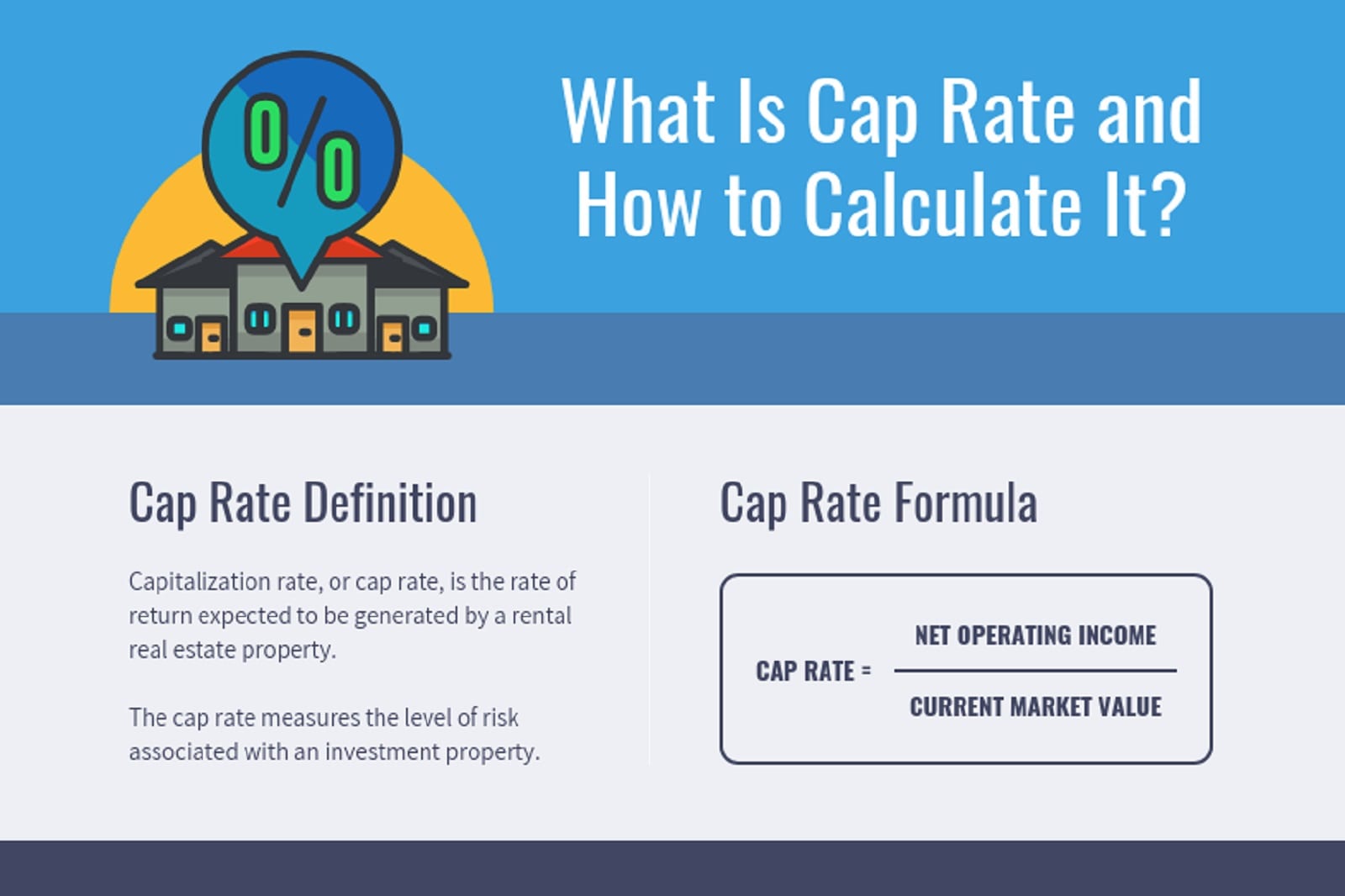

How To Use Cap Rate Real Estate At Frances Lazo Blog Capitalization rate (cap rate): 5.2%. gross operating income = gross rental income − vacancy allowance. gross operating income = $20,000 − $1,000 = $19,000. net operating income (noi) = gross operating income − operating expenses. net operating income = $19,000 − $6,000 = $13,000. capitalization rate = net operating income purchase price. Step 3: divide noi by market value. once you have determined the property's noi and market value, divide the noi by the market value to calculate the cap rate. the formula for calculating cap rate is: cap rate = noi market value. for example, if a property has an noi of $100,000 and a market value of $1,000,000, the cap rate would be:. However, the periodic interest rate cap protects you from rapid market changes throughout the life of the loan, rather than at the initial interest adjustment. the periodic interest rate cap is lower than the initial cap, usually set at 1%. if your interest rate was 3% before the adjustment, it could not exceed 4% or decrease beyond 2%. A cap rate, or capitalization rate, is a metric used in real estate to assess the return on an investment property. it is calculated by dividing the net operating income (noi) of the property by its current market value, then multiplying by 100 to get a percentage. this figure gives an indication of the potential return on investment.

What Is Cap Rate How To Calculate It Infographic Mashvisor However, the periodic interest rate cap protects you from rapid market changes throughout the life of the loan, rather than at the initial interest adjustment. the periodic interest rate cap is lower than the initial cap, usually set at 1%. if your interest rate was 3% before the adjustment, it could not exceed 4% or decrease beyond 2%. A cap rate, or capitalization rate, is a metric used in real estate to assess the return on an investment property. it is calculated by dividing the net operating income (noi) of the property by its current market value, then multiplying by 100 to get a percentage. this figure gives an indication of the potential return on investment.

What Is A Cap Rate And How Is It Calculated Hanover Mortgages

What Is A Cap Awesomefintech Blog

Comments are closed.