14 4 Accounting For Prepaid Expenses

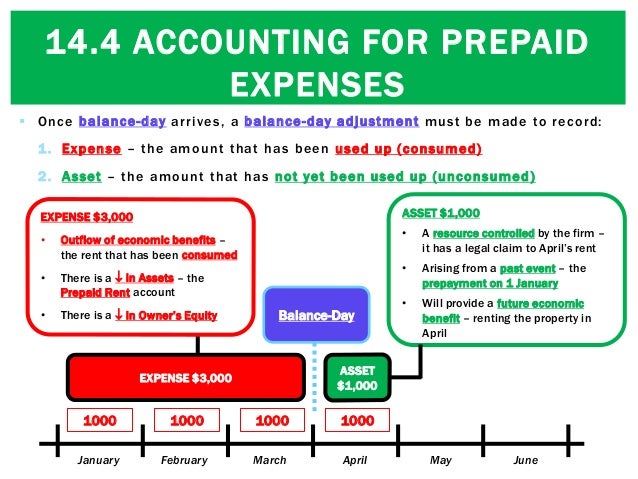

14 4 Accounting For Prepaid Expenses Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. a “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to. The correct insurance expenses for 2019 comprise 4 12th of $4,800 = $1,600. the balance, $3,200 (4,800 1,600), relates to 2020 and should be charged to that year's profit and loss account. although mr. john's trial balance does not disclose it, there is a current asset of $3,200 on 31 december 2019.

14 4 Accounting For Prepaid Expenses The classification and treatment of prepaid expenses have far reaching implications for financial reporting. accurate recording of these expenses ensures that a company’s financial statements present a true and fair view of its financial position. misclassification or improper amortization can lead to distorted financial metrics, which can. A prepaid expense is an expenditure paid for in one accounting period, but for which the underlying asset will not be consumed until a future period. when the asset is eventually consumed, it is charged to expense. if consumed over multiple periods, there may be a series of corresponding charges to expense. expenditures are recorded as prepaid. This process allows for accurately matching expenses with the periods in which the benefits are received. examples of such expenses include. insurance premiums. rent payments. subscription services. utility bills. companies make these prepayments to secure future benefits and manage their cash flow effectively. Refer to the first example of prepaid rent. the adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). the expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000.

14 4 Accounting For Prepaid Expenses This process allows for accurately matching expenses with the periods in which the benefits are received. examples of such expenses include. insurance premiums. rent payments. subscription services. utility bills. companies make these prepayments to secure future benefits and manage their cash flow effectively. Refer to the first example of prepaid rent. the adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). the expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Examples of prepaid expenses. examples of prepaid expenses include: paying for a subscription for a year upfront because they were offering a large discount. signing a 12 month lease for office space that requires 6 months of upfront payment. paying for a 24 month insurance policy for office space with cash upfront. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months). once expenses incur, the prepaid asset account is reduced, and an entry is made to the expense account on the income statement.

14 4 Accounting For Prepaid Expenses Youtube Examples of prepaid expenses. examples of prepaid expenses include: paying for a subscription for a year upfront because they were offering a large discount. signing a 12 month lease for office space that requires 6 months of upfront payment. paying for a 24 month insurance policy for office space with cash upfront. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months). once expenses incur, the prepaid asset account is reduced, and an entry is made to the expense account on the income statement.

14 4 Accounting For Prepaid Expenses

Comments are closed.