1031 Exchanges Landtrust Wisconsin May 2024 Patrick Harrigan Pres Of Gain Exchange

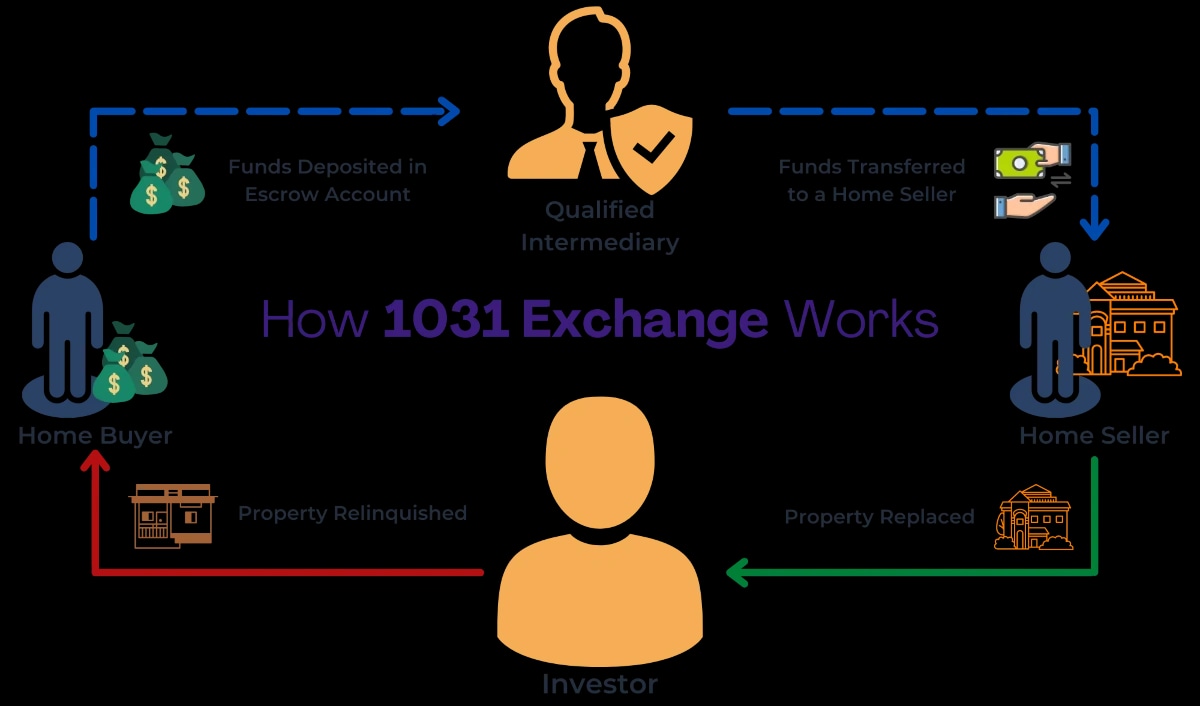

Bio Patrick T Harrigan 1031 Exchange Expert And Certified Exchange Gain1031exchangecompany patrick harrigan bio 00:00 introduction00:13 introduction to land trust wisconsin 01:59 introduction to gain 1031. More on 1031 exchanges. a 1031 exchange, also known as a like kind exchange, tax free exchange or starker exchange is a way to defer payment of taxes on the sale of real estate. the seller cannot sell the property outright. to have a valid exchange, the property being sold must be exchanged for other property through a specific process.

Patrick T Harrigan President Coo Gain 1031 Exchange Company Llc The ability to complete a 1031 exchange began in 1921 and is just a few years shy of 100 years old. exchanges have withstood the test of time and will continue to be a useful tool for sellers of commercial and investment real estate. on wednesday, december 20, 2017, congress passed tax reform bill h.r.1, also known as the tax cuts and jobs act. About. gain 1031 exchange company llc. over 14 years focused on the process of 1031 exchange transactions as a qualified intermediary which facilitates 1031 tax deferred exchanges. certified. The strategic use of a 1031 exchange allows investors to swap investment properties without immediate tax consequences, thereby enhancing their retirement savings or investment breadth. these exchanges do not apply to primary residences but are pivotal for upgrading or diversifying investment real estate holdings. Patrick harrigan is president coo of gain 1031 exchange company llc, which acts as a qualified intermediary of like kind (starker) exchanges. patrick has focused his career on exchanges for over 10 years and has 15 years of experience with commercial and investment real estate transactions. he is a member of both the.

1031 Exchange Full Guide Casaplorer The strategic use of a 1031 exchange allows investors to swap investment properties without immediate tax consequences, thereby enhancing their retirement savings or investment breadth. these exchanges do not apply to primary residences but are pivotal for upgrading or diversifying investment real estate holdings. Patrick harrigan is president coo of gain 1031 exchange company llc, which acts as a qualified intermediary of like kind (starker) exchanges. patrick has focused his career on exchanges for over 10 years and has 15 years of experience with commercial and investment real estate transactions. he is a member of both the. Patrick t. harrigan, esq., ces, is the president of gain 1031 exchange company llc, which operates exclusively in wisconsin and minnesota. he has been working full time in the exchange industry since october 2005. Patrick harrigan patrick.harrigan@gainexchangecompany . 80 south 8th street, suite 900. minneapolis, minnesota 55402. gain 1031 exchange company, llc. our company serves the wisconsin, minnesota and now north dakota markets and we are always happy to provide objective information about the exchange process. we work with clients and their tax.

1031 Exchange Timeline 2024 Heddi Paloma Patrick t. harrigan, esq., ces, is the president of gain 1031 exchange company llc, which operates exclusively in wisconsin and minnesota. he has been working full time in the exchange industry since october 2005. Patrick harrigan patrick.harrigan@gainexchangecompany . 80 south 8th street, suite 900. minneapolis, minnesota 55402. gain 1031 exchange company, llc. our company serves the wisconsin, minnesota and now north dakota markets and we are always happy to provide objective information about the exchange process. we work with clients and their tax.

The Benefits Of 1031 Exchanges Landtrust Title Services

1031 Exchange Florida 2024 Cal Leanor

Comments are closed.