1031 Exchanges Explained Learn Of The Power This Opportunity Offers

1031 Exchange Locations In this brief short, you too can learn and utilize the 1031 exchange that can contribute to your success. Both offer compelling advantages, but they serve different purposes. 1031 exchanges provide a time tested way to defer taxes and grow a portfolio with stable cash flow, while opportunity zones offer the possibility of long term, tax free gains in exchange for higher risk and commitment.

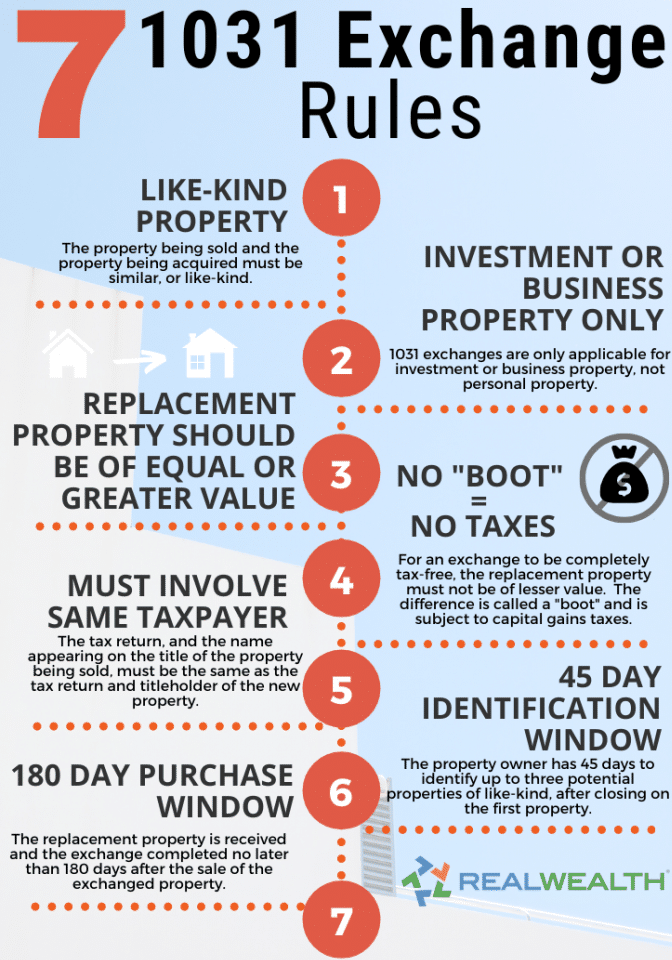

1031 Exchanges Explained Key principles of 1031 exchange rules. rule 1: a qualified intermediary (qi) must facilitate the exchange process. investors are prohibited from directly transferring funds between the sale of their existing property and the purchase of the replacement property. rule 2: the identification period begins on the day of the sale of the relinquished. Opportunity zones: while you can invest only your gains (not the entire proceeds from a sale), the potential for growth in these up and coming areas can be significant. it's a bit like backing a. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. 1031 exchanges explained. a 1031 exchange, also known as a like kind exchange, is a powerful tax deferral strategy that allows real estate investors to postpone paying capital gains taxes. by selling one investment property and reinvesting the proceeds into another of equal or greater value, investors can utilize this strategy under section.

How 1031 Exchanges Work Big Block Realty A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. 1031 exchanges explained. a 1031 exchange, also known as a like kind exchange, is a powerful tax deferral strategy that allows real estate investors to postpone paying capital gains taxes. by selling one investment property and reinvesting the proceeds into another of equal or greater value, investors can utilize this strategy under section. A 1031 exchange allows an investor to defer capital gains taxes on the sale of an investment property as long as the proceeds are used to purchase a like kind property. in other words, the investor can exchange one investment property for another without triggering a capital gains tax event. here's an example to illustrate the concept:. A 1031 exchange, or starker exchange, is named after section 1031 of the u.s. internal revenue code. it allows investors to defer capital gains taxes on the sale of investment property if the asset being sold is exchanged for “like kind” property within a certain time frame. the “like kind” nature of the properties simply means that the.

Lunch Learn Understanding The Power Of 1031 Exchanges 9800 A 1031 exchange allows an investor to defer capital gains taxes on the sale of an investment property as long as the proceeds are used to purchase a like kind property. in other words, the investor can exchange one investment property for another without triggering a capital gains tax event. here's an example to illustrate the concept:. A 1031 exchange, or starker exchange, is named after section 1031 of the u.s. internal revenue code. it allows investors to defer capital gains taxes on the sale of investment property if the asset being sold is exchanged for “like kind” property within a certain time frame. the “like kind” nature of the properties simply means that the.

1031 Exchanges Explained Exactly How To Use Them Why Youtube

1031 Exchange Explained Ppt

Comments are closed.