1031 Exchange Rules Success Stories For Real Estate Investors 2021

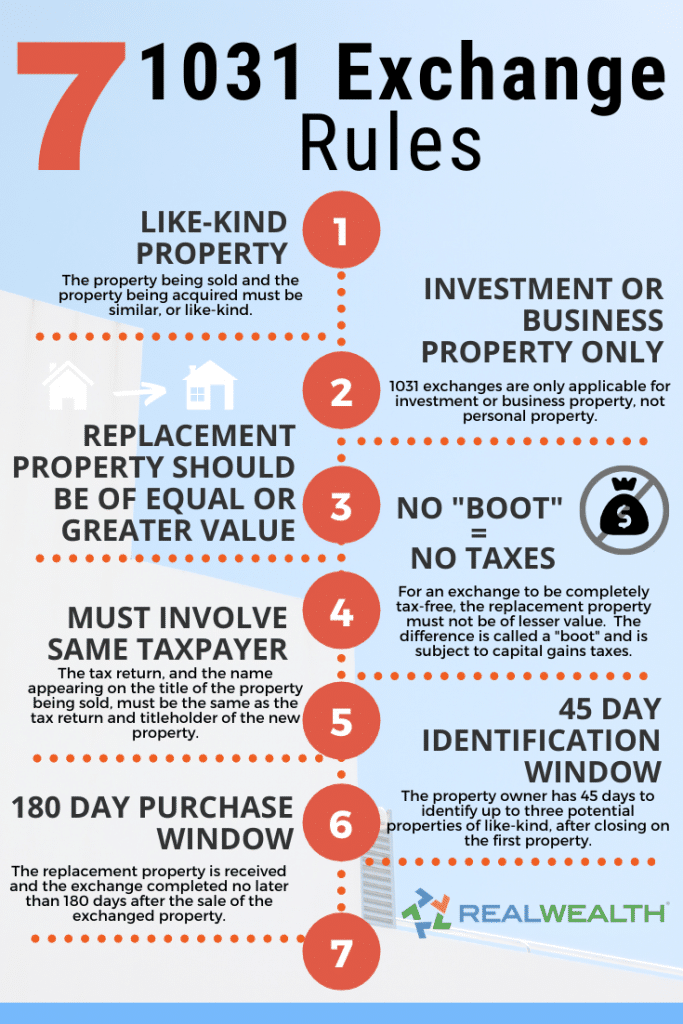

1031 Exchange Rules Success Stories For Real Estate Investors 2021 1031 exchange rules for real estate investors. there are 7 primary 1031 exchange rules, which include: the like kind property rule. investment or business purposes only. greater or equal value. must not receive “boot”. same taxpayer. 45 day identification window. 180 day purchase window. A 1031 exchange, also known as a like kind exchange, is a tax deferred transaction that allows real estate investors to sell a property and reinvest the proceeds into a new property of equal or greater value, all while deferring the payment of capital gains taxes. this powerful strategy can provide significant financial benefits and enhance.

1031 Exchange Rules Success Stories For Real Estate Investors 2021 When executed effectively, the 1031 exchange can be a cornerstone in the wealth building journey of real estate investors, unlocking new avenues for growth and financial success. real estate investors are constantly seeking strategies to maximize returns and defer capital gains taxes. the 1031 exchange, a provision in the u.s. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Scenario 2: 1031 exchange. using a 1031 exchange, you defer the $86,400 in taxes, allowing you to reinvest the full $600,000. this additional $86,400 can significantly enhance your purchasing power, especially when leveraging a loan to value (ltv) ratio. with a 75% ltv, that $86,400 could equate to $345,600 in additional purchasing power. The 1031 exchange has gained popularity among real estate investors for its ability to defer capital gains taxes and unlock opportunities for wealth creation. while the concept of a 1031 exchange may sound appealing in theory, real life success stories provide concrete evidence of the significant tax savings and wealth accumulation that can be achieved through.

Irs 1031 Real Estate Exchange Rules 1031 Exchange Rules 2021 Scenario 2: 1031 exchange. using a 1031 exchange, you defer the $86,400 in taxes, allowing you to reinvest the full $600,000. this additional $86,400 can significantly enhance your purchasing power, especially when leveraging a loan to value (ltv) ratio. with a 75% ltv, that $86,400 could equate to $345,600 in additional purchasing power. The 1031 exchange has gained popularity among real estate investors for its ability to defer capital gains taxes and unlock opportunities for wealth creation. while the concept of a 1031 exchange may sound appealing in theory, real life success stories provide concrete evidence of the significant tax savings and wealth accumulation that can be achieved through. Fortunately, unless congress changes the 1031 exchange rules, which have been in existence for more than 100 years, there is a way for savvy real estate investors to defer payment of capital gains. A 1031 exchange, also known as a like kind exchange or a starker exchange, is a transaction that allows real estate investors to defer capital gains taxes when selling an investment property and acquiring a replacement property of equal or greater value. by using a 1031 exchange, investors can preserve their financial resources and reinvest the.

1031 Exchanges Understanding The Rules And Benefits For Real Estate Fortunately, unless congress changes the 1031 exchange rules, which have been in existence for more than 100 years, there is a way for savvy real estate investors to defer payment of capital gains. A 1031 exchange, also known as a like kind exchange or a starker exchange, is a transaction that allows real estate investors to defer capital gains taxes when selling an investment property and acquiring a replacement property of equal or greater value. by using a 1031 exchange, investors can preserve their financial resources and reinvest the.

How Does A 1031 Exchange Work For Real Estate Investors

What Is A 1031 Exchange Mt Helix Lifestyles Real Estate Services

Comments are closed.