1031 Exchange Real Estate In Md Va Dc Call Today

1031 Exchange Real Estate In Md Va Dc Call Today The basics. section 1031 of the internal revenue code of 1986, as amended, permits a taxpayer to relinquish (transfer) property held for “productive use in a trade or business” or for “investment” in exchange for a “like kind” replacement property which is intended to be held for “productive use in a trade or business” or for. Direct: (312) 489 0804. cell: (781) 789 5050. email: brian.mcnulty@ipx1031 . ipx1031 northeast regional office. 84 business park drive, suite 109. armonk, ny 10504. start a reverse exchange with brian mcnulty. brian mcnulty is a vice president with investment property exchange services, inc. (ipx1031) and has almost 30 years of experience in.

1031 Real Estate Exchange The Ultimate Guide For Real Estate Investors To be a successful 1031 tax deferred exchange, certain criteria must be met for the real estate to be like kind. since our founding in 1990, realty exchange corporation’s sole mission is to provide qualified intermediary service to real property investors and their advisors for 1031 exchanges. Washington dc, maryland, delaware & reit real estate exchange. brian has over 20 years of experience in the banking and financial services industry and is a well respected and nationally recognized expert in providing comprehensive and strategic 1031 exchange solutions. Asset exchange llc charges $750.00 to conduct a 1031 tax deferred exchange and prepare and record the necessary documents. learn more call today for expert advice in all your settlement, and closing needs !. Conveniently located by nyc, the ipx1031 northeast & mid atlantic region office handles all 1031 exchange qi services for ny, nj, dc, pa, md, de, ct, ri, ma, nh, me, vt start an exchange today call toll free: (888) 771 1031.

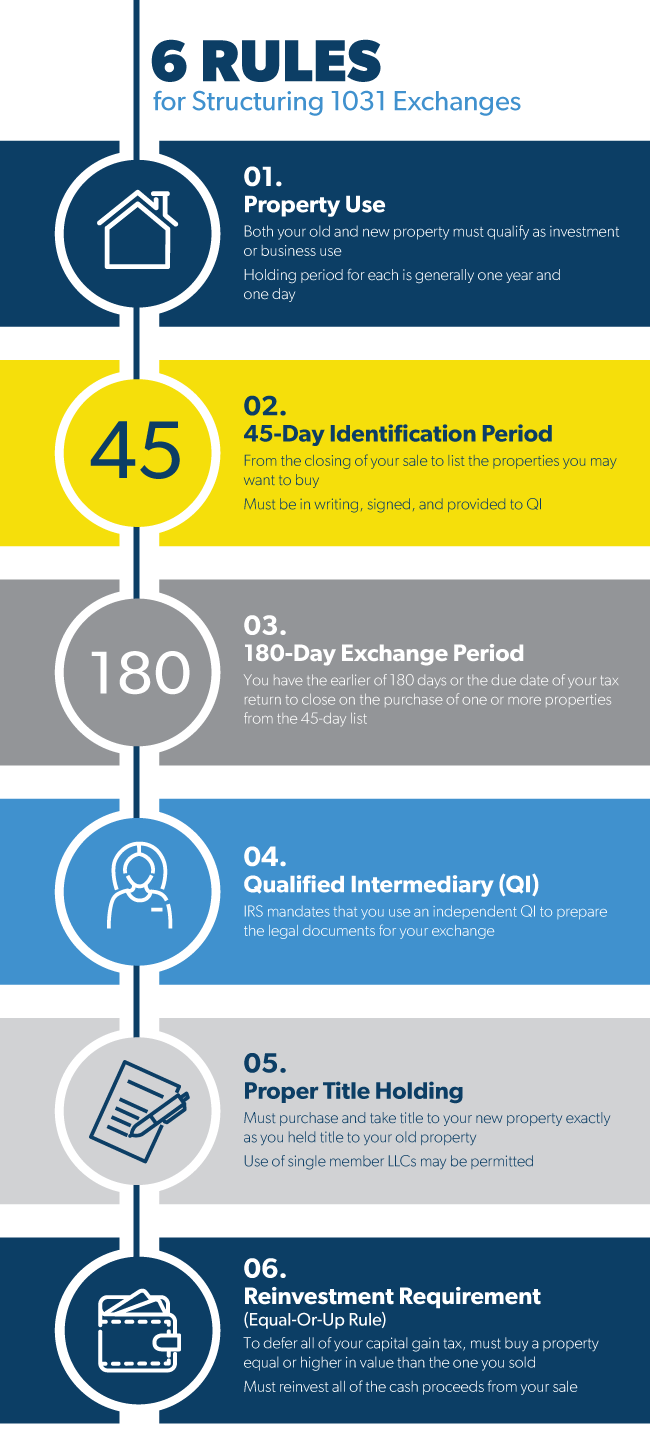

The Ultimate Guide To 1031 Exchange In Real Estate Investing Asset exchange llc charges $750.00 to conduct a 1031 tax deferred exchange and prepare and record the necessary documents. learn more call today for expert advice in all your settlement, and closing needs !. Conveniently located by nyc, the ipx1031 northeast & mid atlantic region office handles all 1031 exchange qi services for ny, nj, dc, pa, md, de, ct, ri, ma, nh, me, vt start an exchange today call toll free: (888) 771 1031. About us. realty exchange corporation is a family operated business owned by bill and jeff horan. founded in 1990, realty exchange has facilitated tens of thousands of exchanges of all values. we are the largest exclusive intermediary in the mid atlantic region. 1031 exchanges are one of the best ways to avoid paying undue taxes when selling a real estate property in maryland. essentially, a 1031 exchange allows investors to defer capital gains tax on a property sold when the funds are directly used to finance the purchase of another investment property. however, there are a myriad of rules and.

Comments are closed.