1031 Exchange Ownership Rules Alternative Investor

1031 Exchange Ownership Rules Alternative Investor What are some of the 1031 exchange ownership rules you need to know about? the same taxpayer rule in 1031 exchanges. the same taxpayer rule is fundamental in every 1031 exchange, especially if you want to enjoy tax deferral treatment. the person who sells the relinquished property must purchase a replacement property. Published 27 july 2020. in features. one of the most attractive real estate tax benefits available in the u.s. is the like kind exchange, which is governed by section 1031 of the internal revenue.

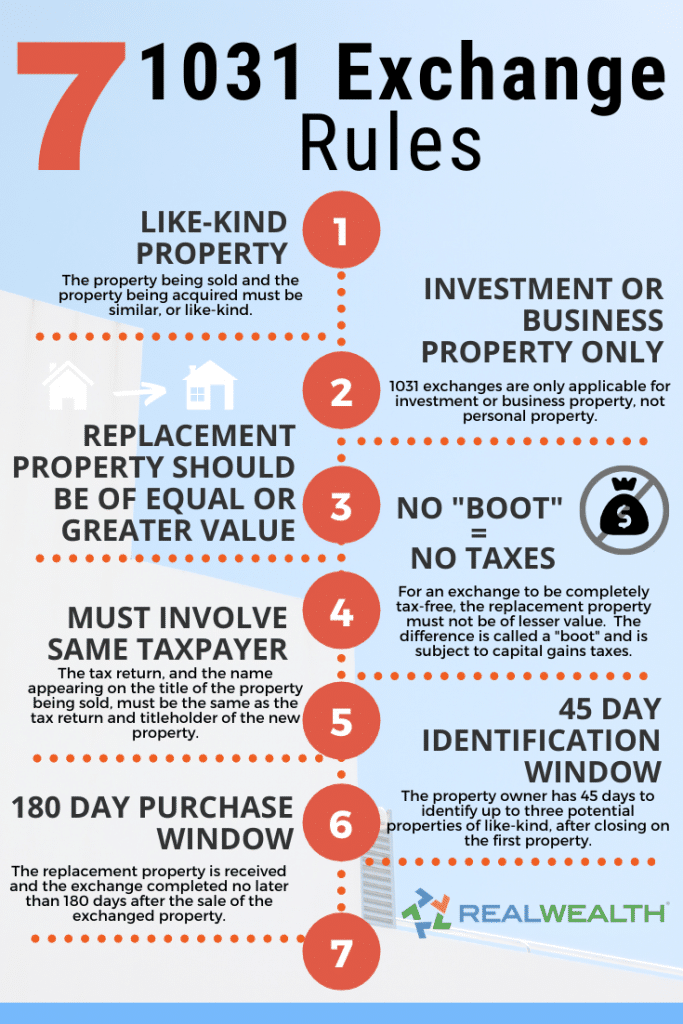

Understanding 1031 Exchange And Its Rules Alternative Investor How the 90% rule applies to 1031 exchange transactions. the 90% rule plays a big part in the success of a 1031 exchange. investors must pick new properties to replace the old ones within 45 days. this step is key to follow irs rules on swapping similar properties. they also need to finish the exchange in 180 days to keep the tax benefits. Some real estate investors believe that in order for the 1031 exchange to work, deferring all capital gains tax, the like kind replacement property must be identical to the investment property. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Irc section 1031 exchange programs, commonly called 1031 exchange programs, can unlock tax saving opportunities for those with appreciated real estate. explore the evolution of the space and the potential benefits and considerations of utilizing a 1031 exchange program. download now. enter your business email to download this resource.

1031 Exchange Rules Success Stories For Real Estate Investors 2021 A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Irc section 1031 exchange programs, commonly called 1031 exchange programs, can unlock tax saving opportunities for those with appreciated real estate. explore the evolution of the space and the potential benefits and considerations of utilizing a 1031 exchange program. download now. enter your business email to download this resource. Key takeaways. a 1031 exchange is a tax break. you can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose, allowing you to. Investors save on taxes with a 1031 exchange by investing in similar properties. the new property’s value should be as much as or more than the old one. this is to fully defer taxes. plus, they must report the deal on form 8824 during tax season, showing they followed the rules. 1031 exchanges do more than just push taxes later.

Comments are closed.