1031 Exchange Explained Ppt

1031 Exchange Explained Ppt 1031 exchange—basic rules. rule #4: the taxpayer must enter into an exchange agreement on or before the date of transfer of the relinquished property. rule #5: the taxpayer must identify – in writing – potential properties that will be the replacement property in the exchange. the treasury regulations require that this written. No taxable event you can defer capital gains tax by using a 1031 exchange! we work together with the nation’s largest direct and fully managed single family real estate platform. they source the highest yielding cash flow properties using advanced analytics and then manage the property end to end, opening up this amazing market to investors.

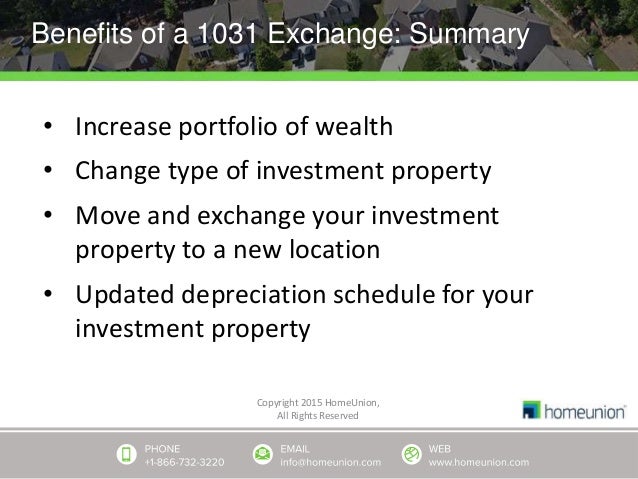

1031 Exchange Explained Ppt A common myth of section 1031 is that taxes are eliminated. the truth is at some point the tax is paid. the ling & petrova study found that the overwhelming majority (88%) of properties acquired through an exchange are later sold in a taxable transaction, at which time the tax is paid. the remaining 12% includes all non taxable transfers such. A 1031 exchange involves identifying and purchasing replacement property within strict time limits. by completing a 1031 exchange, investors can defer taxes and potentially earn higher returns by benefiting from long term appreciation on the replacement property. the document outlines the tax benefits of a 1031 exchange compared to a regular. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Named after the irs tax code section, a strategy called a 1031 exchange is used to defer taxes when selling an investment property by reinvesting the proceeds into a property type without incurring immediate capital gains taxes on the sale, as nesteggs ceo eachan fletcher explained. this method helps retain a portion of an investment's growth.

1031 Exchange Ppt A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Named after the irs tax code section, a strategy called a 1031 exchange is used to defer taxes when selling an investment property by reinvesting the proceeds into a property type without incurring immediate capital gains taxes on the sale, as nesteggs ceo eachan fletcher explained. this method helps retain a portion of an investment's growth. This document provides an overview of 1031 tax deferred exchanges, which allow investors to defer capital gains taxes when selling investment property and purchasing replacement property. it outlines the key requirements of a 1031 exchange including identifying and purchasing a replacement property within certain time frames. A 1031 exchange, also known as a like kind exchange, is a transaction under u.s. tax law that allows an investor to defer capital gains taxes when they sell a property and reinvest the proceeds in a new, "like kind" property. it's named after section 1031 of the u.s. internal revenue code.

1031 Exchange Explained This document provides an overview of 1031 tax deferred exchanges, which allow investors to defer capital gains taxes when selling investment property and purchasing replacement property. it outlines the key requirements of a 1031 exchange including identifying and purchasing a replacement property within certain time frames. A 1031 exchange, also known as a like kind exchange, is a transaction under u.s. tax law that allows an investor to defer capital gains taxes when they sell a property and reinvest the proceeds in a new, "like kind" property. it's named after section 1031 of the u.s. internal revenue code.

1031 Exchanges Explained

1031 Exchanges Explained Rules Requirements More Gatsby Investment

Comments are closed.