1031 Exchange Discover 1031 Investment Rules

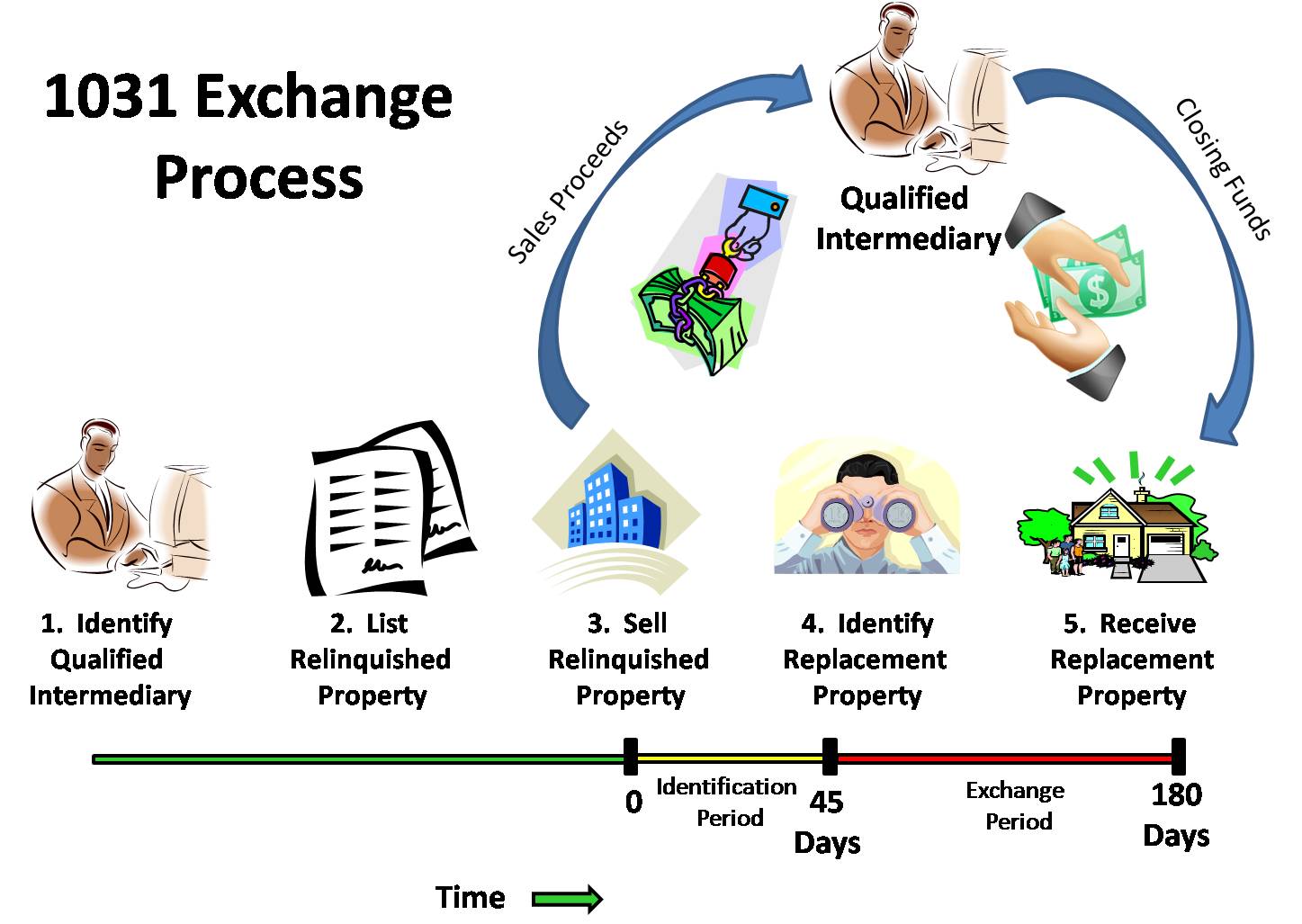

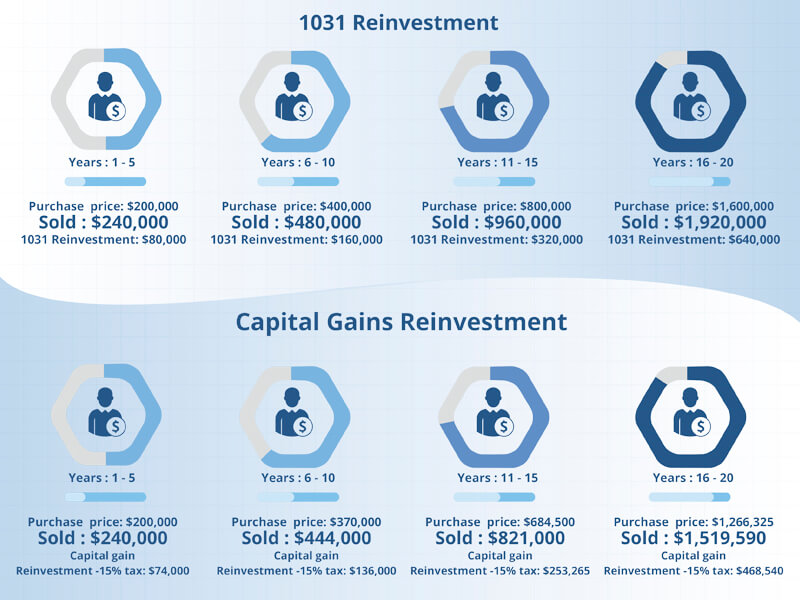

1031 Exchange Discover 1031 Investment Rules Unfortunately, real estate investors know that it comes with the same cost as most other forms of investment: taxes Fortunately, unless Congress changes the 1031 exchange rules, which have been By adhering to these timelines and rules, you can successfully complete a 1031 exchange and defer capital gains tax on your investment property Still, it's always advisable to consult with a tax

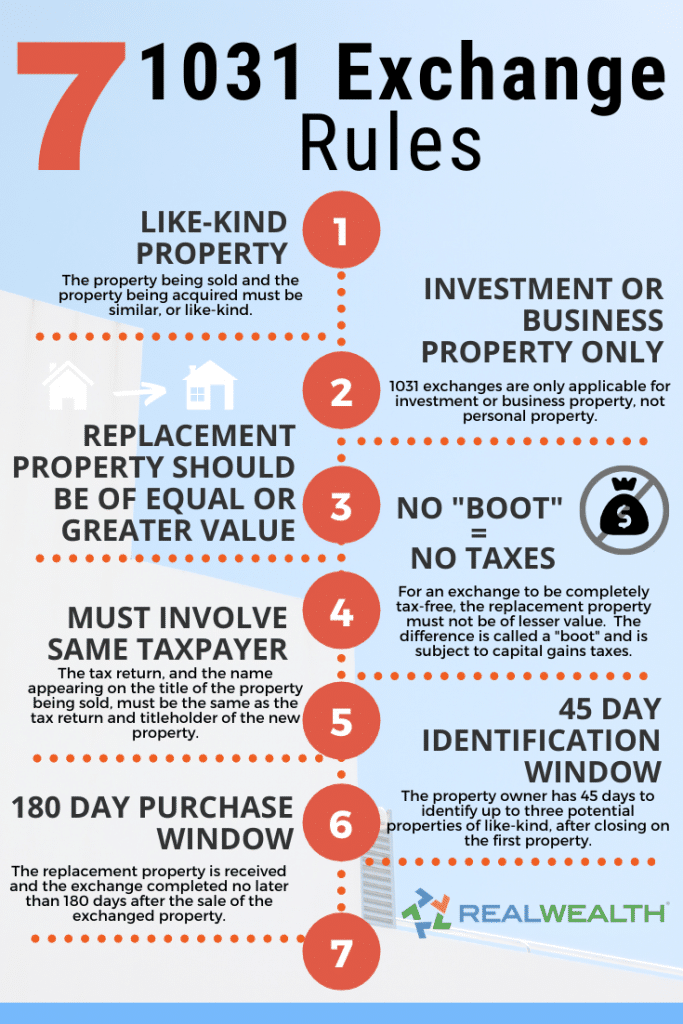

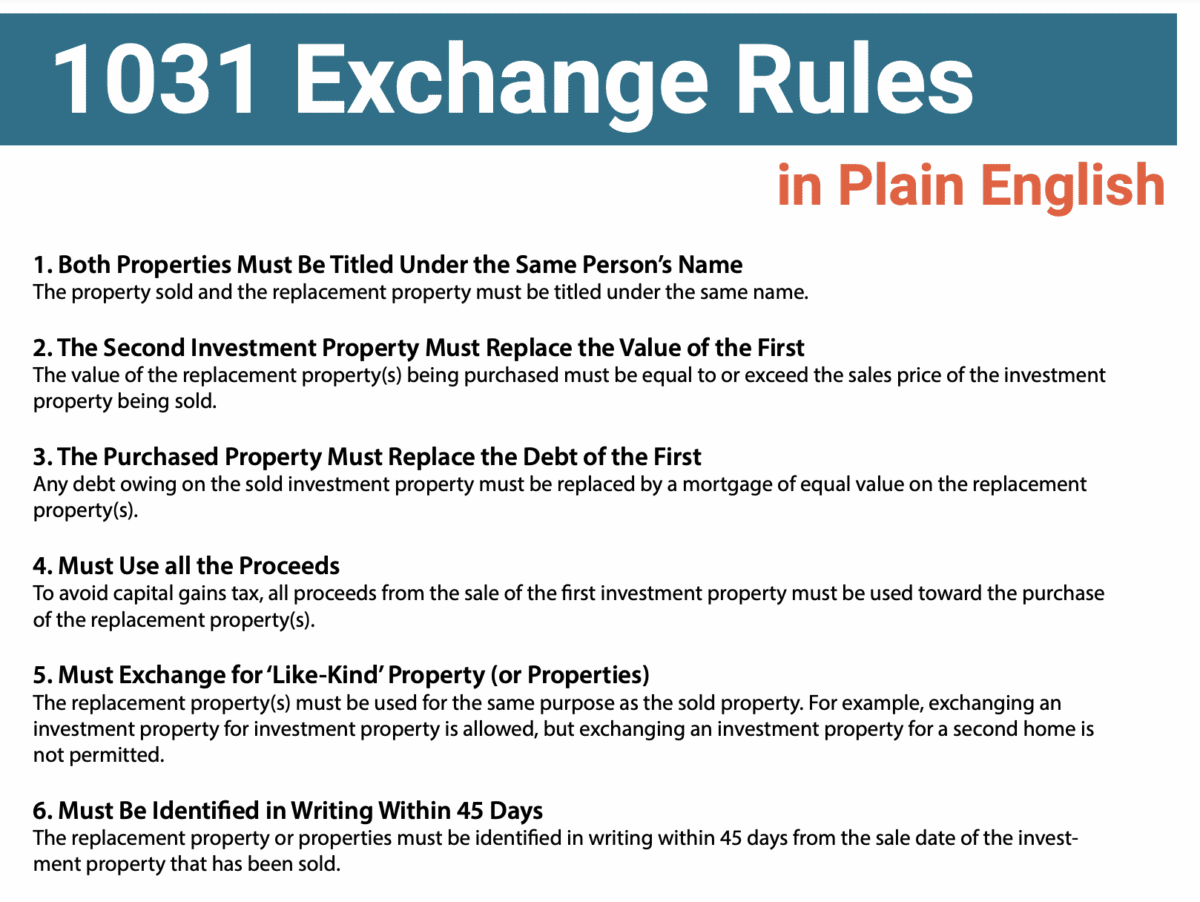

1031 Exchange Rules Success Stories For Real Estate Investors 2022 Section 1031 of the Internal Revenue Code allows you to avoid taxes on investment property when you buy another property – if you follow the rules There are four major types of 1031 exchange Among these rules, it is important to review your 1031 exchange strategy with a professional who understands the exchange process before you put your investment property up for sale There are The rules may vary by state A 1031 exchange is for investment and business property, not for your primary residence Your own home is subject to a different tax break that can be more valuable 1031 Exchange specialist releases a new article aimed at informing real estate investors about exchange rules and timelines to pay attention to AUSTIN, TX, UNITED STATES, October 16, 2024

How To Explain 1031 Exchange Rules To Your Clients The rules may vary by state A 1031 exchange is for investment and business property, not for your primary residence Your own home is subject to a different tax break that can be more valuable 1031 Exchange specialist releases a new article aimed at informing real estate investors about exchange rules and timelines to pay attention to AUSTIN, TX, UNITED STATES, October 16, 2024 Extensive inventory of 1031 exchange QOF investment may benefit from a step-up in basis This means potential permanent exclusion of appreciation on those gains, subject to program rules a 1031 exchange allows investors to defer capital gains taxes when selling investment property by reinvesting in other non-related investment property There are timing rules, and you must set Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale

1031 Exchange Guide Rules Benefits Blue Rock Financial Group Extensive inventory of 1031 exchange QOF investment may benefit from a step-up in basis This means potential permanent exclusion of appreciation on those gains, subject to program rules a 1031 exchange allows investors to defer capital gains taxes when selling investment property by reinvesting in other non-related investment property There are timing rules, and you must set Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale

The Ultimate Guide To Understanding 1031 Exchange Rules Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale

1031 Exchange Millcreek Commercial Discover Freedom

Comments are closed.