1031 Exchange Companies Overview Process Considerations

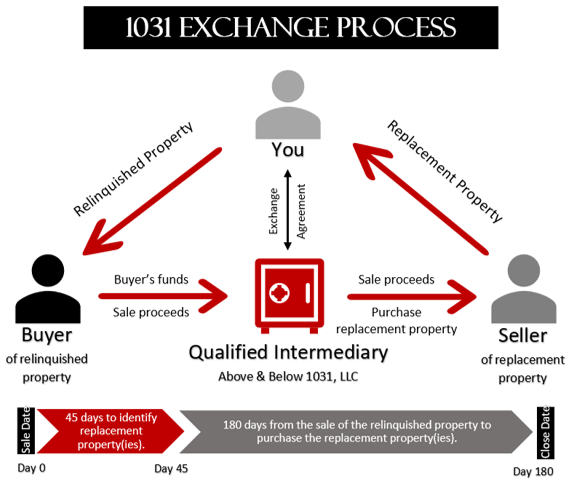

1031 Exchange Companies Overview Process Considerations 1031 exchange companies overview. 1031 exchange companies, also known as qualified intermediaries (qis), are entities that facilitate property transactions under section 1031 of the irs tax code, allowing real estate investors to defer capital gains taxes. when an investment property is sold, the proceeds are transferred directly to the qi. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest.

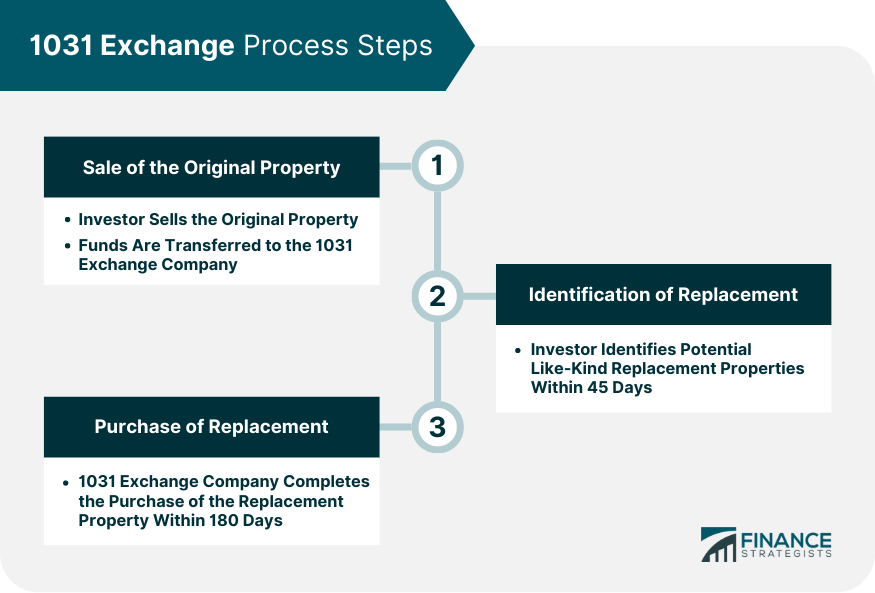

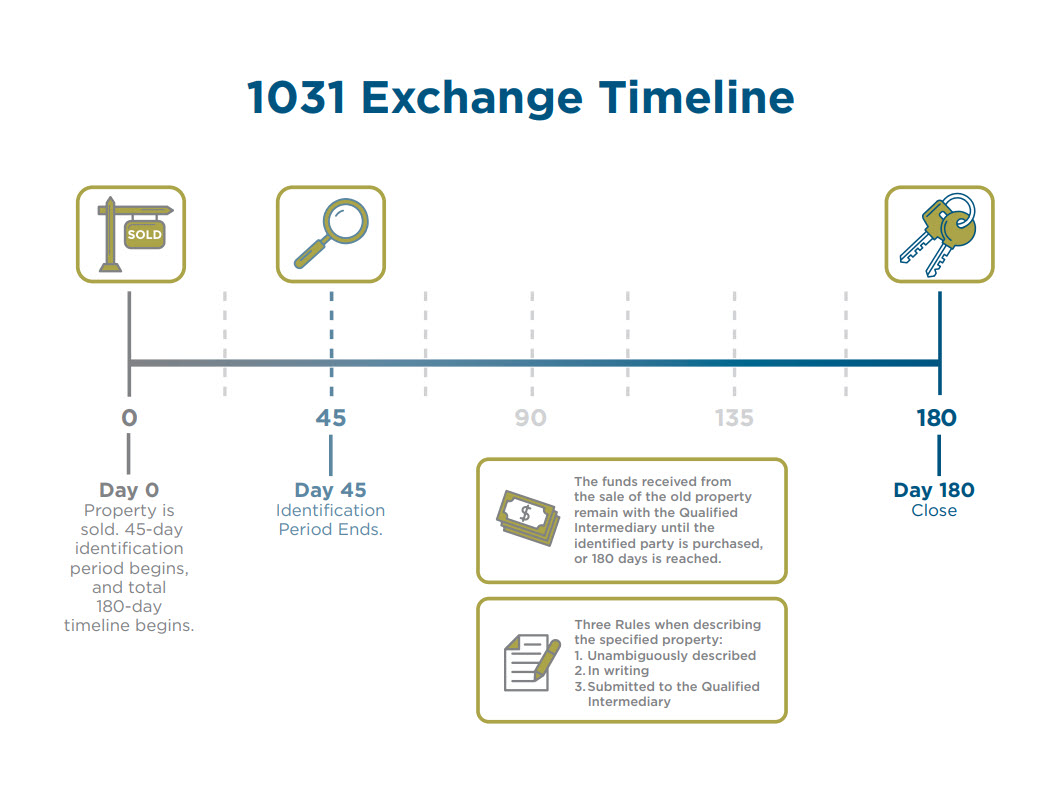

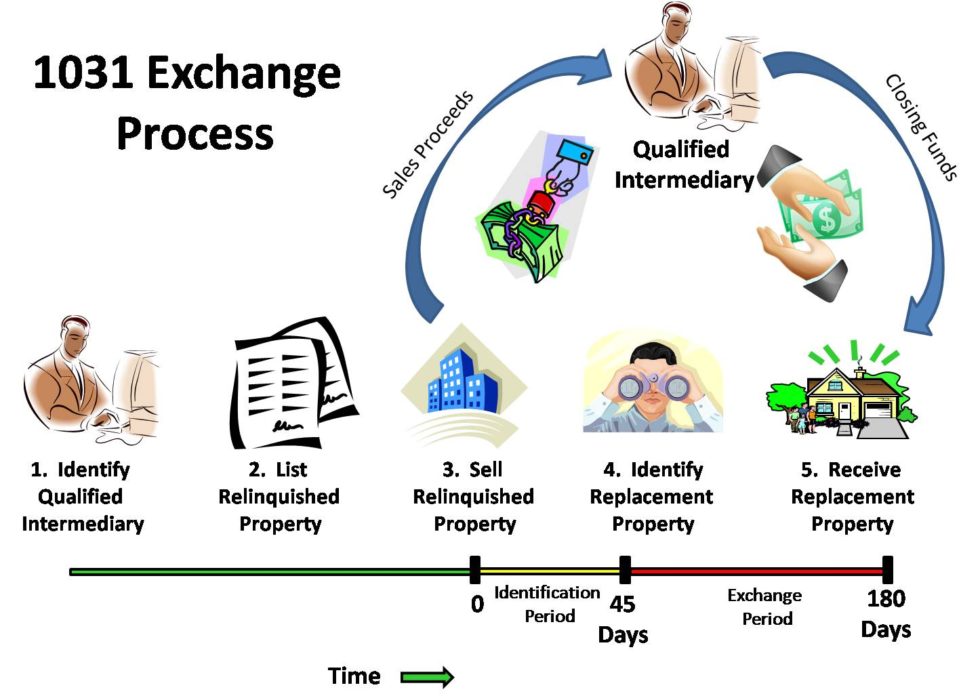

1031 Exchange Timeline Overview And Considerations Accruit Step by step guide to execute the 1031 exchange process. a 1031 exchange presents a strategic opportunity for real estate investors to defer capital gains taxes while repositioning their investment assets. the below steps designed to simplify the 1031 exchange process with precision, offering you a structured pathway through its complexities: 1. To qualify a 1031 exchange property for conversion into a primary residence, the safe harbor rules state that the property must be held for at least 24 months. personal use must not exceed 14 days or 10% of the days rented during each of the 12 month periods within those 24 months. Irc section 1031 exchange programs, commonly called 1031 exchange programs, can unlock tax saving opportunities for those with appreciated real estate. explore the evolution of the space and the potential benefits and considerations of utilizing a 1031 exchange program. download now. enter your business email to download this resource. A 1031 exchange, also known as a like kind exchange, is a transaction under u.s. tax law that allows an investor to defer capital gains taxes when they sell a property and reinvest the proceeds in a new, "like kind" property. it's named after section 1031 of the u.s. internal revenue code.

Step By Step 1031 Qi Requirements For The 1031 Exchange Irc section 1031 exchange programs, commonly called 1031 exchange programs, can unlock tax saving opportunities for those with appreciated real estate. explore the evolution of the space and the potential benefits and considerations of utilizing a 1031 exchange program. download now. enter your business email to download this resource. A 1031 exchange, also known as a like kind exchange, is a transaction under u.s. tax law that allows an investor to defer capital gains taxes when they sell a property and reinvest the proceeds in a new, "like kind" property. it's named after section 1031 of the u.s. internal revenue code. Cash flow considerations: the temporary loss of liquidity during the exchange process may pose challenges for investors who need immediate access to funds. by anticipating and addressing these challenges proactively, investors can better position themselves to navigate the 1031 exchange process successfully. A 1031 exchange empowers real estate investors to defer capital gains taxes when selling and reinvesting in property. this tax deferral strategy preserves and reinvests capital, fostering continuous growth in real estate portfolios. 1031 exchanges have strict rules and timelines that must be followed to take advantage of their tax benefits.

1031 Exchange Companies Overview Process Considerations Cash flow considerations: the temporary loss of liquidity during the exchange process may pose challenges for investors who need immediate access to funds. by anticipating and addressing these challenges proactively, investors can better position themselves to navigate the 1031 exchange process successfully. A 1031 exchange empowers real estate investors to defer capital gains taxes when selling and reinvesting in property. this tax deferral strategy preserves and reinvests capital, fostering continuous growth in real estate portfolios. 1031 exchanges have strict rules and timelines that must be followed to take advantage of their tax benefits.

1031 Exchange What You Need To Know Stu Simone S Rock Real Estate

How To Do A 1031 Exchange In Florida

Comments are closed.