10 Essential Steps For Retirement Planning Worldwideartla

10 Essential Steps For Retirement Planning Worldwideartla Setting financial goals. one of the most important components of retirement planning is setting financial goals. it’s impossible to create an in depth retirement plan if you don’t know exactly what you’re planning for. when you’re setting goals, make sure they’re smart: specific, measurable, achievable, relevant, and time bound. Leverage employer sponsored retirement plans: if your employer provides a retirement savings plan like a 401(k) or a 403(b), don’t hesitate to enroll and contribute as much as possible. these plans often include pre tax contributions and employer matching, which essentially amounts to free money.

10 Essential Steps For Retirement Planning Worldwideartla Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return. Set clear retirement goals and create a detailed financial plan. diversify personal investments, and review business operations. employ effective financial strategies, and create an emergency folder. review healthcare and insurance coverage, and develop an advanced care directive. communicate with family members, and embrace leisure time. Step 1: determine your retirement goals. the first step is to identify your retirement goals. your goals may include traveling, starting a business, or enjoying a comfortable retirement. consider your lifestyle, interests, and priorities to determine your retirement goals. in addition, consider your health, family, and other personal circumstances. Move that money to a high interest savings account or a certificate of deposit. you can buy a 10 year cd and lock in a guaranteed 4% interest rate on otherwise idle cash. this would be a good time.

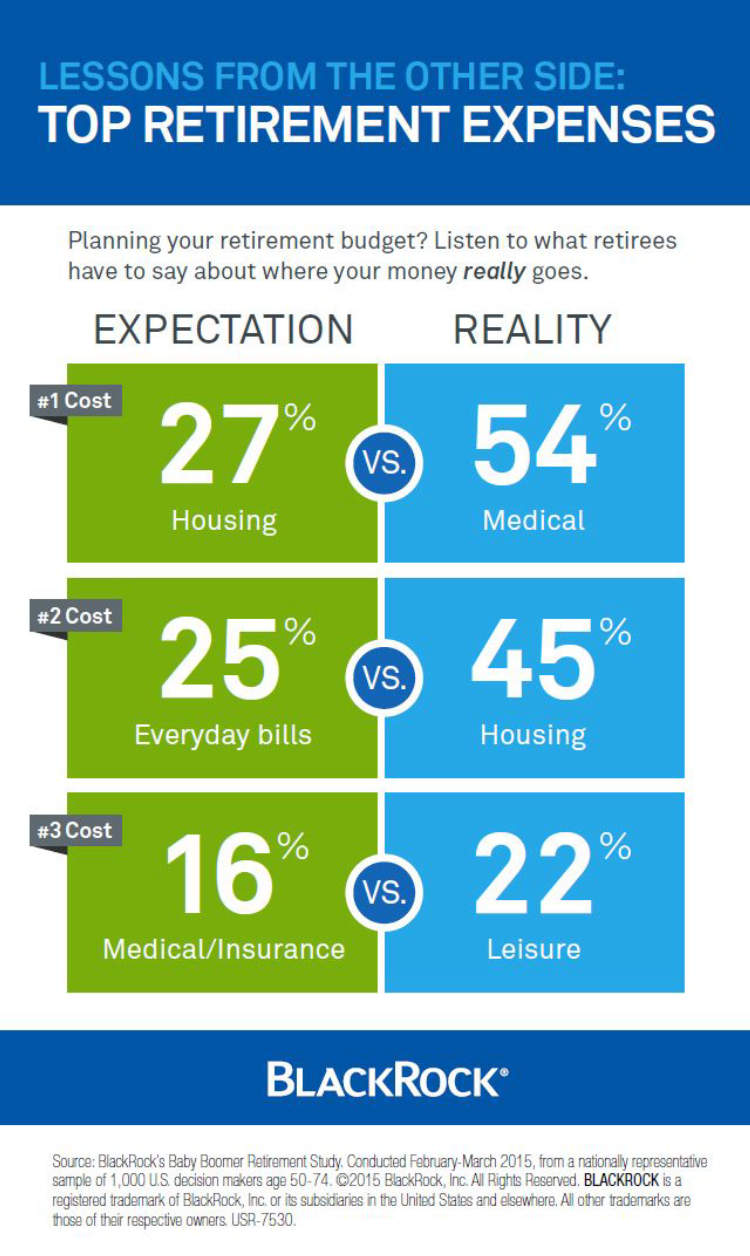

10 Essential Steps In Retirement Planning Step 1: determine your retirement goals. the first step is to identify your retirement goals. your goals may include traveling, starting a business, or enjoying a comfortable retirement. consider your lifestyle, interests, and priorities to determine your retirement goals. in addition, consider your health, family, and other personal circumstances. Move that money to a high interest savings account or a certificate of deposit. you can buy a 10 year cd and lock in a guaranteed 4% interest rate on otherwise idle cash. this would be a good time. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. 2. estimate your expenses. once you know how you want to spend retirement, you can plan how to pay for it. this starts by determining your expenses. one rule of thumb says to expect your expenses.

Comments are closed.