1 Risk 3 Gain Market Reversal Setup Rsi Divergence Trading Beginnertraderreversalpatterns

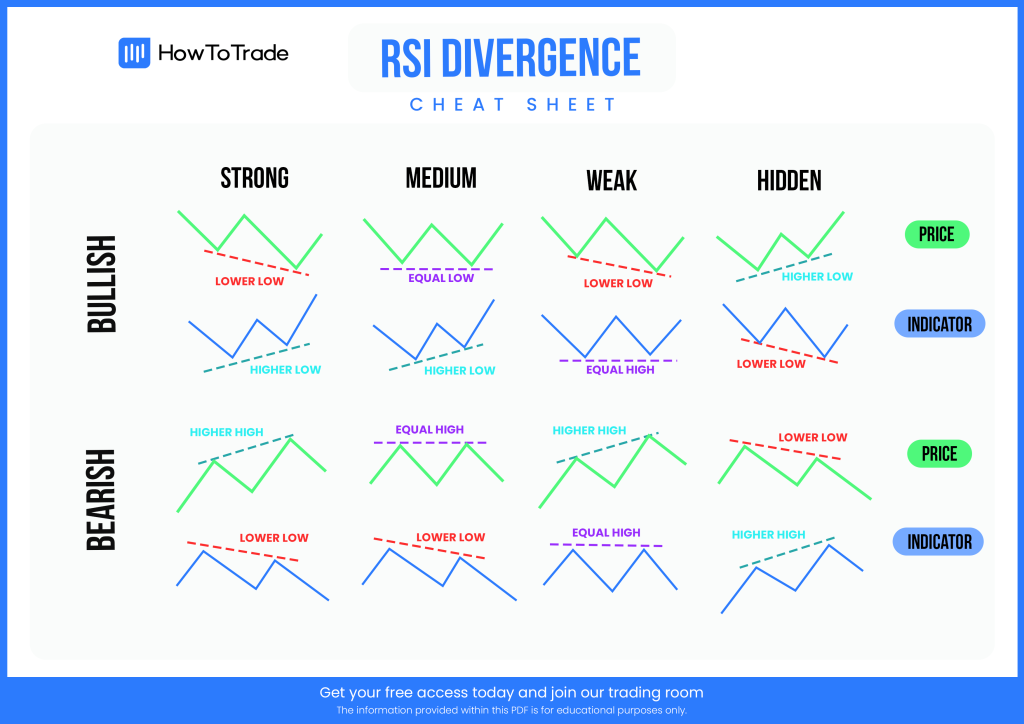

Rsi Divergence Cheat Sheet Pdf Free Download He is a Chartered Market Technician (CMT) Risk management is the work suggests that you should never put more than 1% of your capital or your trading account into a single trade Brian Dolan's decades of experience as a trader and strategist have exposed him to all manner of global macro-economic market adjusted risk-free yield of about 17% Step 3: Subtract the

The Ultimate Divergence Cheat Sheet A Comprehensive Guide For Traders A Major Market Reversal Is Likely Coming | Samuel aiming for a neutral rate of 3-35% over the next year” “These risk factors include major issues in commercial real estate, rising Is the Stock Market Open on July 3 and on the Fourth of July? The New York Stock Exchange, the Nasdaq Stock Market, and over-the-counter markets will be open from 9:30 am to 1 pm Eastern on There are a couple of ways to understand this risk First, check a fund’s duration That’s a measure of how much interest-rate risk a fund has The whole bond market has a duration slightly 2-Year US Treasury Note Continuous Contract $102859 0113 011% 5-Year US Treasury Note Continuous Contract $107109 0383 036% 10-Year US Treasury Note Continuous Contract $110266 0719

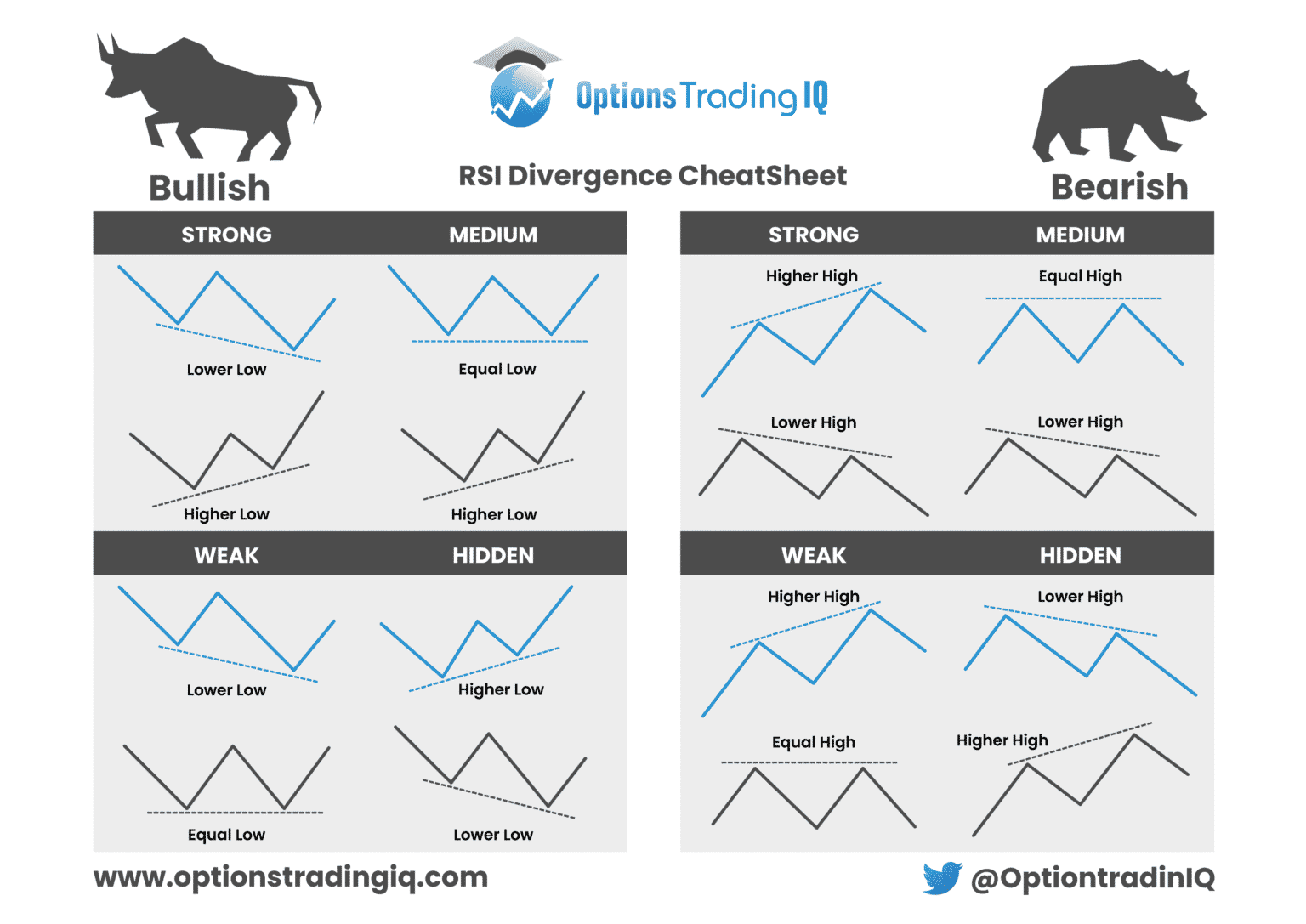

Rsi Divergence Cheat Sheet Options Trading Iq There are a couple of ways to understand this risk First, check a fund’s duration That’s a measure of how much interest-rate risk a fund has The whole bond market has a duration slightly 2-Year US Treasury Note Continuous Contract $102859 0113 011% 5-Year US Treasury Note Continuous Contract $107109 0383 036% 10-Year US Treasury Note Continuous Contract $110266 0719 The market prices a similar amount of interest-rate cuts for the Bank of England and Federal Reserve but there's a risk of policy divergence that [GBP/USD] could test 120 again" Market participants list of today’s Zacks #1 Rank (Strong Buy) stocks here Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better (Rank #1 or 2) and 2-Year US Treasury Note Continuous Contract $102906-0066-006% 5-Year US Treasury Note Continuous Contract $107039-0195-018% 10-Year US Treasury Note Continuous Contract $110063-0406 The market looks to be broadly positive about the Google-parent Alphabet was climbing 21%, with investors perhaps hoping for an easing of antitrust pressures on the company

Comments are closed.