➡️ How A W9 Tax Form Could Lead To A 1099

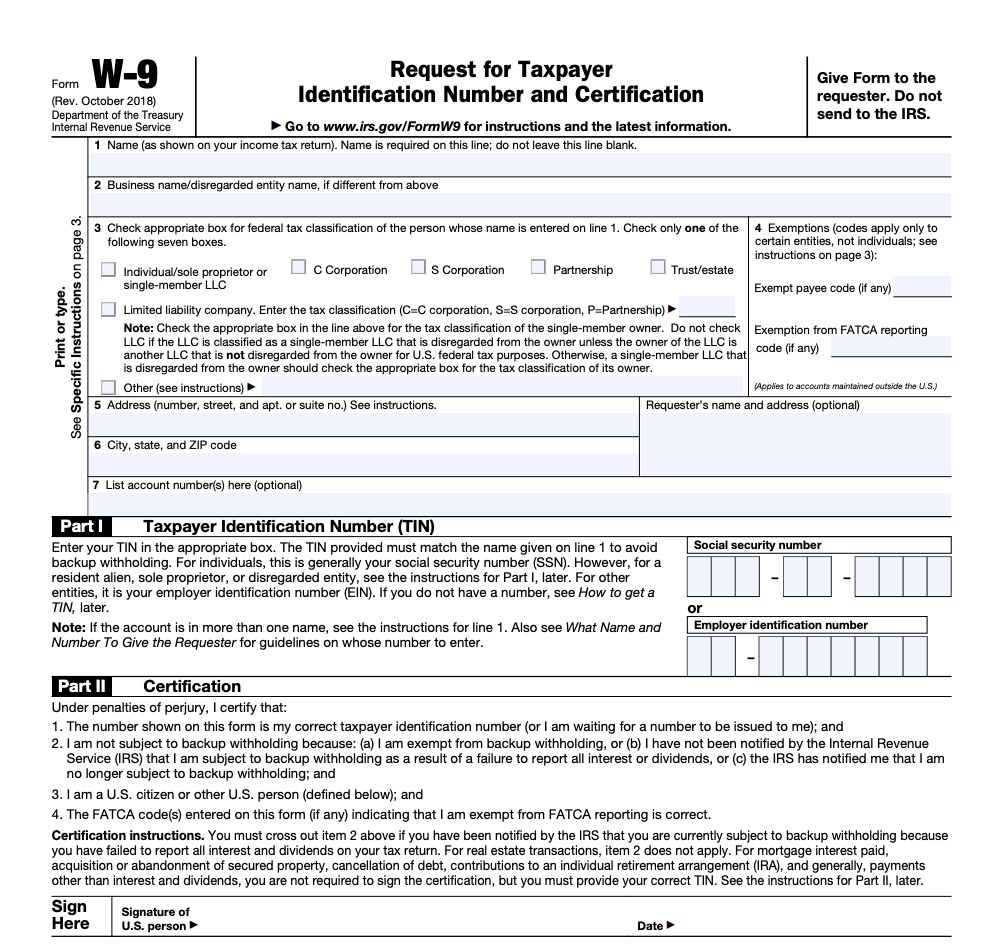

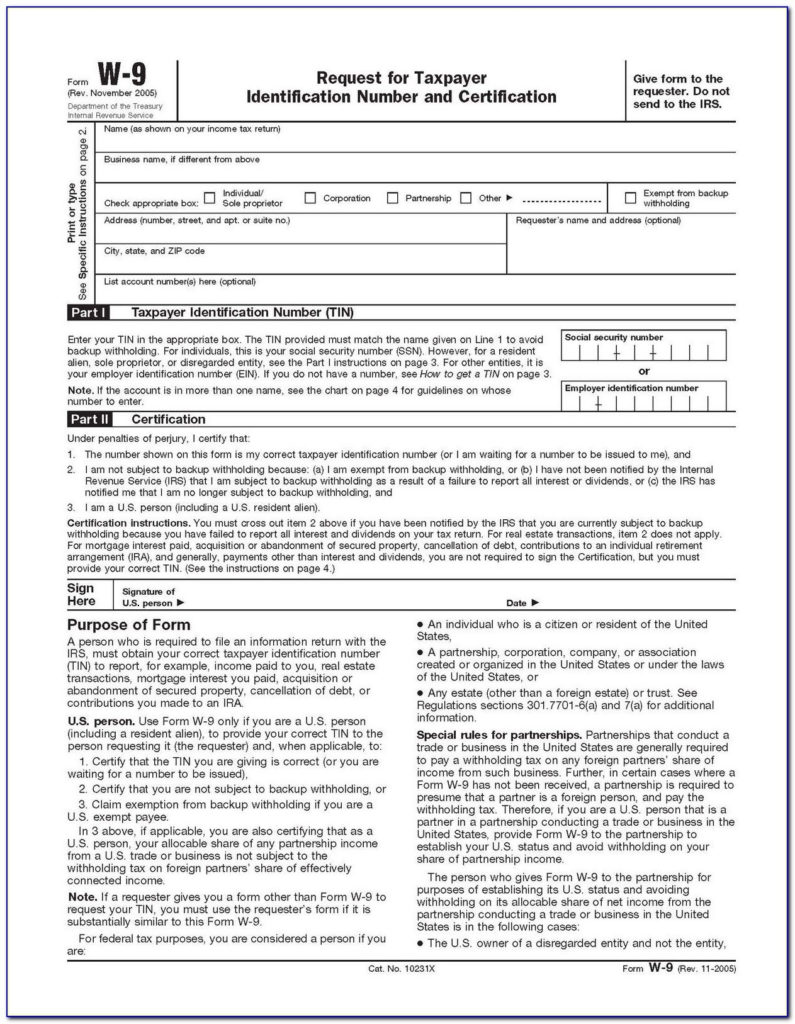

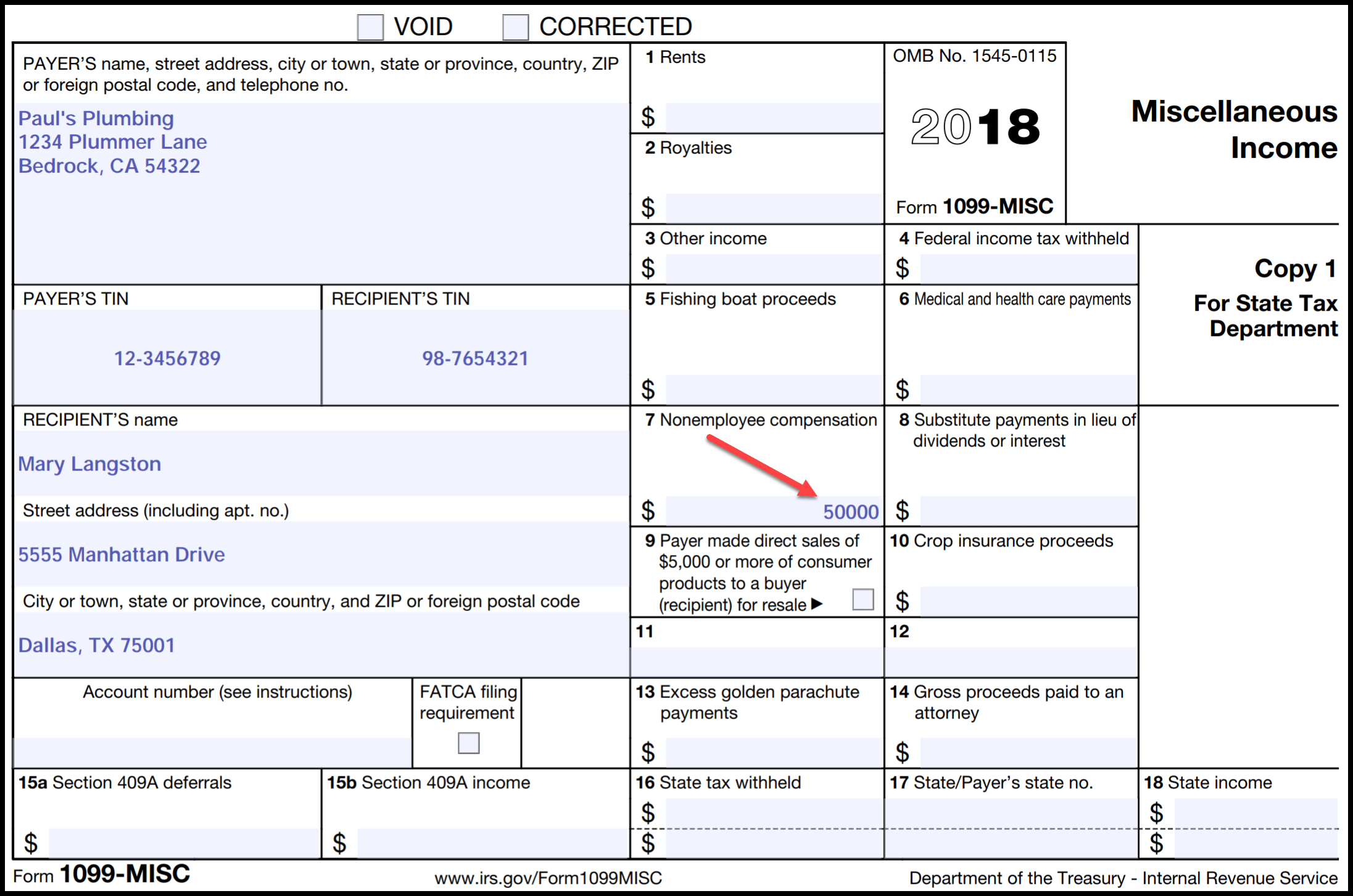

W9 Tax Form 2021 Irs Paperspanda In this video, i'm sharing how a w9 tax form could lead to a 1099. a 1099 is a tax form that's filed by businesses that have received payments from a person. A w 9 is sent by a client to a contractor to collect their contact information and tax number. then, the client uses that info to fill out a form 1099. it’s the client’s duty, as someone who is contracting work, to send the contractor form w 9 before the end of the financial year. the contractor’s job is to fill it out with tax info for.

Editable W9 Form 2024 Independent contractors receive 1099 forms rather than w 2s as a record of income earned. you will be issued a 1099 form at the end of the year with the information that was provided on your w 9. Make w 9 vs.1099 compliance easy with remote’s contractor management. w 9 and 1099 tax forms both regulate aspects of employing independent contractors and freelancers. the difference is that the w 9 collects information that can then be used in 1099 income reporting forms. A 1099 form is a collection of tax forms used for individuals or businesses to report nonemployee income to the irs. the irs also calls 1099 forms “information returns.”. Form w 9. if you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete form w 9, request for taxpayer identification number and certification. this form can be used to request the correct name and taxpayer identification number, or tin, of the payee.

2020 W 9 Form Printable Example Calendar Printable A 1099 form is a collection of tax forms used for individuals or businesses to report nonemployee income to the irs. the irs also calls 1099 forms “information returns.”. Form w 9. if you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete form w 9, request for taxpayer identification number and certification. this form can be used to request the correct name and taxpayer identification number, or tin, of the payee. Jennifer soper. the difference between irs forms w 9 vs 1099 is that the former is given to contractors for the purpose of collecting personal information, while the latter is for reporting wages to the irs. form w 9 is used to gather information about a contractor (like name, address, and tax id ss number) so their earnings can be reported at. The primary difference between these two forms is that form w 9 is used to request information from the individual being paid, while form 1099 is used to report income to the irs. form w 9 requests the taxpayer’s information, such as name, address, and social security number. the taxpayer must then sign the form for them to be issued a 1099 form.

пёџ How A W9 Tax Form Could Lead To A 1099 Youtube Jennifer soper. the difference between irs forms w 9 vs 1099 is that the former is given to contractors for the purpose of collecting personal information, while the latter is for reporting wages to the irs. form w 9 is used to gather information about a contractor (like name, address, and tax id ss number) so their earnings can be reported at. The primary difference between these two forms is that form w 9 is used to request information from the individual being paid, while form 1099 is used to report income to the irs. form w 9 requests the taxpayer’s information, such as name, address, and social security number. the taxpayer must then sign the form for them to be issued a 1099 form.

Comments are closed.